Ah, Arbitrum! A blockchain that’s not just riding the stablecoin wave, it’s surfing it like a pro! 🏄♂️ As of Monday, July 7, the total stablecoin market cap on this snazzy network has skyrocketed to a jaw-dropping $6.8 billion. Yes, you heard that right—$6.8 billion, which, in case you’re wondering, is quite the hefty chunk of crypto cheddar. This includes both stablecoins minted right there in Arbitrum’s backyard and those that just breezed in through bridges. Talk about an open door policy!

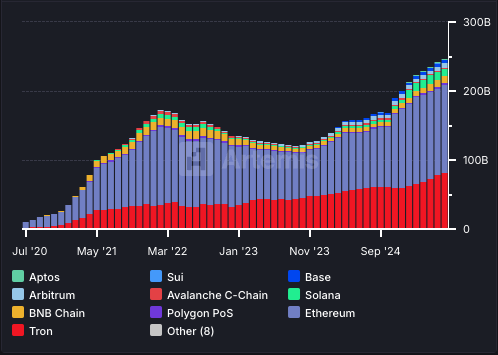

Now, in the great blockchain race, Arbitrum has waddled its way up to fifth place. Ethereum, the granddaddy of them all, is sitting pretty at the top with a cool $127 billion. And then there’s Tron, all shiny at $81 billion, looking like it’s preparing for a space launch. BNB Chain and Solana are trailing behind, somewhere near $10 billion. It’s like a crypto party and everyone’s showing up with their fancy wallets. 🤑

Oh, but wait, here’s the real kicker! Arbitrum has been snatching up stablecoins like a kid in a candy store. For the week ending June 2, Arbitrum raked in a whopping $381 million in stablecoin inflows, outshining every other blockchain out there. Meanwhile, Ethereum was busy watching $374 million in stablecoin outflows, probably wondering where it all went. 🍬

Arbitrum’s Stablecoin Wallets: Over a Million and Counting! 🎉

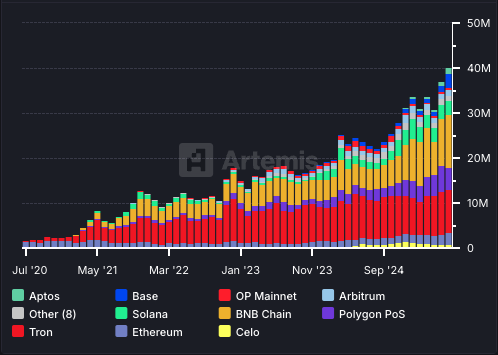

And guess what? Arbitrum now has over 1.3 million active addresses holding stablecoins. That’s right, 1.3 million! To put this in perspective, BNB Chain’s got a little more at 11.8 million, and Tron, with its always-shiny shoes, is rocking 9.6 million. It’s like the ‘cool kids’ club of stablecoin wallets, and Arbitrum’s got a VIP pass. 😎

Before you go thinking Arbitrum’s about to throw a party in the crypto world, let’s throw in a little reality check. Sure, it’s scooping up stablecoins, but its token, ARB, has been on a bit of a downhill slope. Over the past 30 days, ARB’s value has slid from $0.4255 to $0.3284, which is like watching a movie where the plot twist is a tad disappointing. Maybe it’s all part of the “buy the rumor, sell the news” trend, especially after its flashy partnership with Robinhood. 💸

Read More

- Gold Rate Forecast

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD HKD PREDICTION

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Dogecoin’s Crypto Comedy: A Meme Coin’s Misadventures

2025-07-07 18:38