Bitcoin, that capricious and charming chameleon of the digital realm, has once again donned the mantle of the market’s darling, surging to a new all-time high and breaking past the $118,000 price level for the first time in history, a mere two hours ago. 🚀

Unlike the previous episodes of euphoria, which were often fueled by the whims of retail investors and the reckless use of leverage, the current ascent is a more measured and structurally sound affair. 🎩✨

For a while, the momentum was largely driven by whales on US-based exchanges like Coinbase, where the elite of the crypto world would occasionally flex their financial muscles. However, today’s breakout above the previous all-time high was orchestrated by a significant move from a major whale operating through Binance, a platform known for its subtle yet powerful influence. 🐳🌐

Crypto Dan, a sage of the digital realm, suggests that this is not just another surge. It is a carefully choreographed dance, with deep-pocketed players choosing their moment with the precision of a Swiss watchmaker, perhaps aiming to spark the next leg up in a rally that is still gathering steam. 🕰️🔥

Spot-Driven Surge With Minimal Leverage

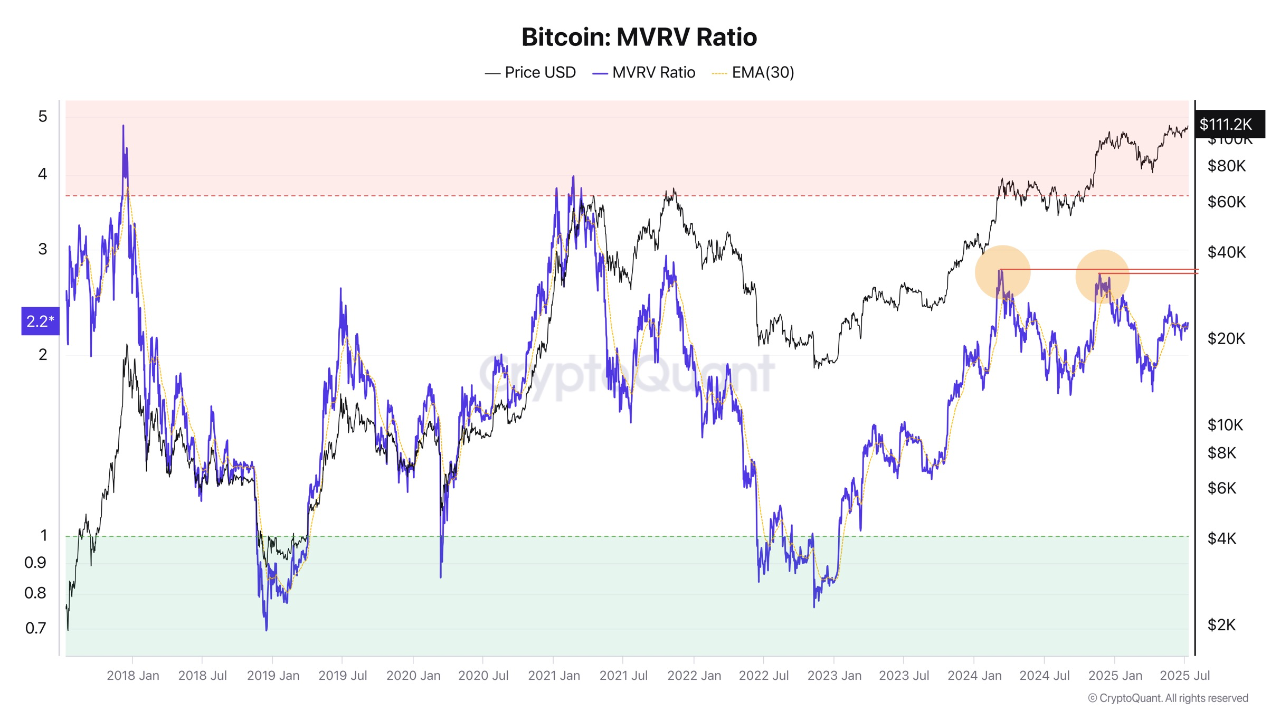

What sets this rally apart is the absence of speculative excess. On-chain metrics, such as the MVRV ratio, currently at a modest 2.2 compared to 2.7 during the March and December 2024 peaks, suggest that the market is not overbought. It’s as if the market is taking a deep breath before the next sprint. 🏃♂️💨

Bitcoin MVRV Ratio | Source: CryptoQuant

Funding rates remain slightly positive, reflecting a restrained use of leverage by traders. Open interest is rising in sync with the price, not because of new leveraged positions, but due to a genuine increase in spot demand. It’s like a slow burn, rather than a flash in the pan. 🔥🔥🔥

ETF inflows continue to act as a powerful engine for price appreciation. Since mid-April, over $49 billion has poured into Bitcoin ETFs, signaling steady institutional appetite. The institutions, it seems, are the tortoises in this race, slow but steady. 🐢🚀

Matrixport analysts note that these inflows, combined with the absence of speculative behavior, make this breakout notably more sustainable than previous cycles. It’s a marathon, not a sprint, and the market is pacing itself. 🏃♂️👟

📃#MatrixOnTarget Report – July 11, 2025 ⬇️

Why This Bitcoin Breakout Feels Different#Matrixport #Bitcoin #BTC #BitcoinETF#CryptoMarket #CryptoRegulation #GENIUSAct#InstitutionalAdoption #DigitalAssets #OnChainFuture#CPI

— Matrixport Official (@Matrixport_EN) July 11, 2025

Retail Missing the Run, but Fundamentals Back the Climb

Retail investors, often quick to flood in during parabolic moves, remain significantly underexposed this time. UTXO analysis shows that only 15% of Bitcoin is held by short-term investors (those who bought in the last month), compared to 30% during the last ATH. It’s as if the retail crowd is taking a nap, while the whales are wide awake. 🐳😴

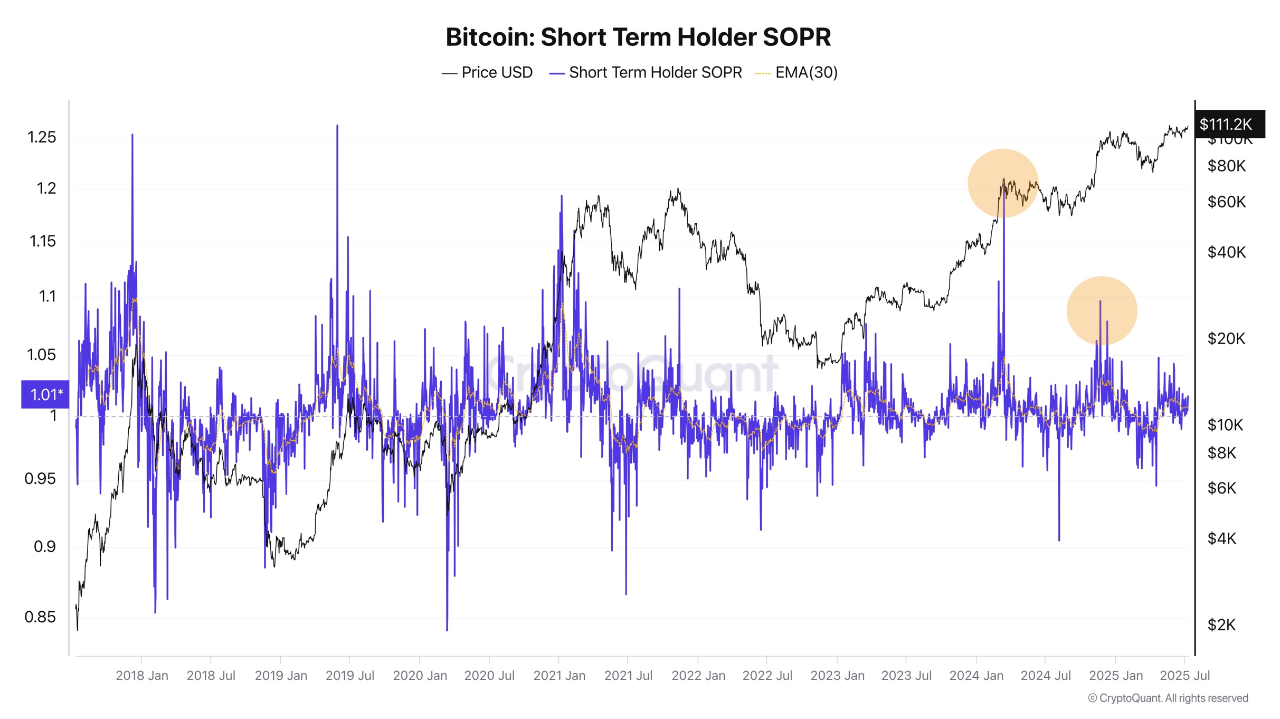

Moreover, Short-Term Holder SOPR indicates little profit-taking pressure, meaning recent buyers aren’t rushing to exit positions. They’re in it for the long haul, like a group of marathon runners who have just started their race. 🏃♂️🏃♀️

Bitcoin SOPR | Source: CryptoQuant

Meanwhile, miners, often a source of sell pressure, are also behaving differently. The Miner Position Index is trending downward, with many mining firms choosing to accumulate Bitcoin rather than liquidate, reducing selling pressure. It’s as if they’re hoarding their treasure, like dragons in a medieval tale. 🐉💎

Political Winds and Monetary Easing Add Fuel

July has historically been a strong month for BTC, and this time, the seasonal strength is bolstered by political tailwinds. A dovish shift at the US Fed is becoming increasingly likely, and the upcoming GENIUS Act is progressing swiftly through Congress. 🏛️💡

The legislation could dramatically reshape crypto regulation in the US, offering legal clarity around stablecoins and paving the way for broader digital asset adoption. It’s as if the political winds are blowing in favor of the crypto world, like a gentle breeze on a warm summer day. 🌞🍃

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-07-11 14:29