Well, well, well! Look who’s suddenly having a moment in the crypto limelight. It’s DOGE—up a whopping 25% in just seven days! I can practically hear the sound of Dogecoin holders checking their wallets like a kid peeking at their birthday presents. Will this be the golden opportunity to lighten their load from when they jumped in at that extravagant $0.45 back in January? 🤑

But hold your horses! That hopefulness is colliding head-on with a reality that must feel like trying to get a cat to take a bath. Dogecoin’s investment landscape in 2025 is a delightful mess: think of it as an awkward reunion of institutional investors and meme aficionados discussing the fine line between ‘real’ and ‘just a joke.’ 💸 This piece attempts to unpack why your traditional price calls might just be as reliable as a weather forecast in April.

The Community vs. Institution Divide: What Really Drives Dogecoin?

The real drama here isn’t found in the numbers—oh no—it’s in the emotional rollercoaster of the ever-growing rift between the grassroots community who made this pup famous and the formally-suited investors suddenly showing up to the party. Some on-chain data suggests that the wild speculative trading of DOGE is taking a back seat, making way for something a bit more, dare I say, mature? 😏 Meanwhile, whale wallets—yes, actual whales—are feasting on those 1M–100M DOGE tokens like it’s an all-you-can-eat buffet.

We’re not talking simple window dressing here. I mean, did you know Dogecoin’s average daily trading volume reached a staggering $950 million in Q1 2025? That’s like my cousin’s post-binge drinking confession level of substantial. Yet, surprisingly, the correlation between Bitcoin and Dogecoin prices has dipped. It’s like a couple that still loves each other but just can’t seem to make anything work. How poetic! 🥲

And let’s talk businesses! Over 3,000 of them now accept Dogecoin. Sure, that’s a significant leap from just under 1,800 in early 2023, but let’s not kid ourselves—most of that adoption feels like a fashion statement rather than actual financial utility.

Technical Realities Behind the Meme: Infrastructure Challenges Ahead

Don’t you just love that warm, fuzzy feeling of optimism that accompanies a price prediction? Well, let’s pop that balloon with the cold, hard truth that lurking under the surface is a mountain of technical challenges. While some are seeing DOGE sailing past $0.50 this year, it feels like they might be glossing over a few infrastructure hiccups, don’t you think? 🚧

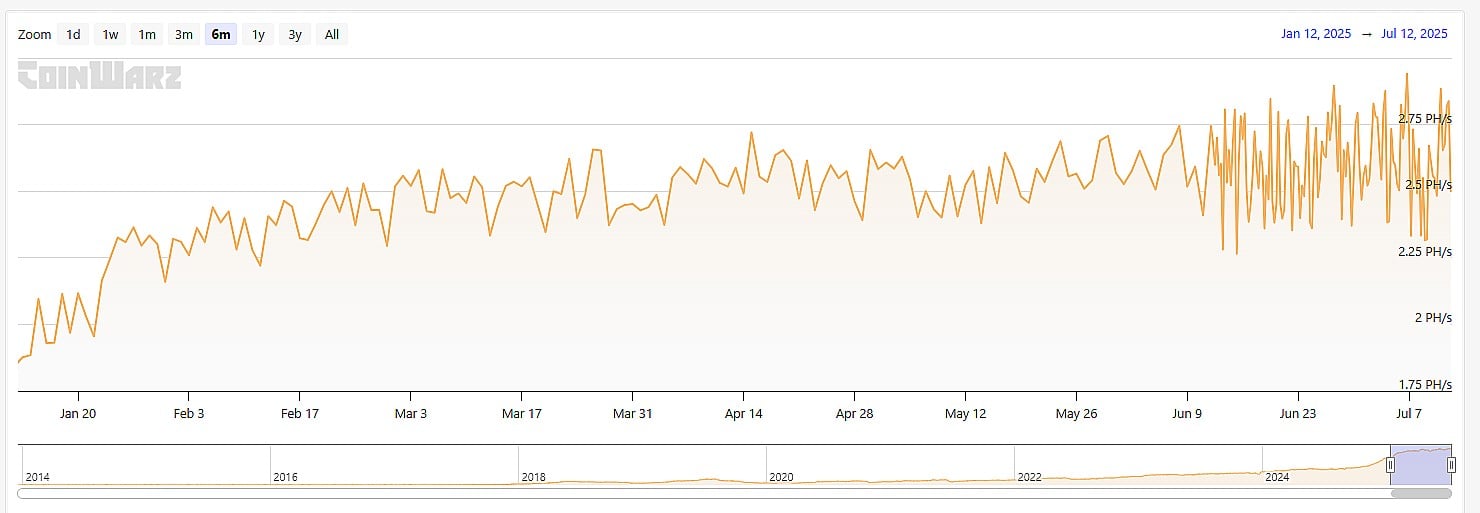

With transaction fees so low you’d think they were conducting a sale at the dollar store (averaging just $0.0021), it’s easy to get caught up in the hype. But let’s not forget—you can’t have a dog without taking it for a walk. Dogecoin’s current hash rate is floating happily around 2.94 PH/s, which sounds impressive until you realize it’s still wrestling with scalability issues and how well it can juggle decentralization while wearing a tuxedo.

And then we have Shiba Inu, the second-largest meme coin, living rent-free in everyone’s heads, sporting a $7.93 billion market cap while doing all those fancy Ethereum tricks. It’s like Dogecoin is the lovable family pet, while Shiba is that trendy neighbor’s new tech-savvy dog that everyone wants to hang out with.

Can Dogecoin keep its crown with sheer community spirit, or will it need a little more than “we love memes” to survive? Friendly neighborhood competition is heating up!

The $1 Question: Why Traditional Analysis Falls Short for Dogecoin

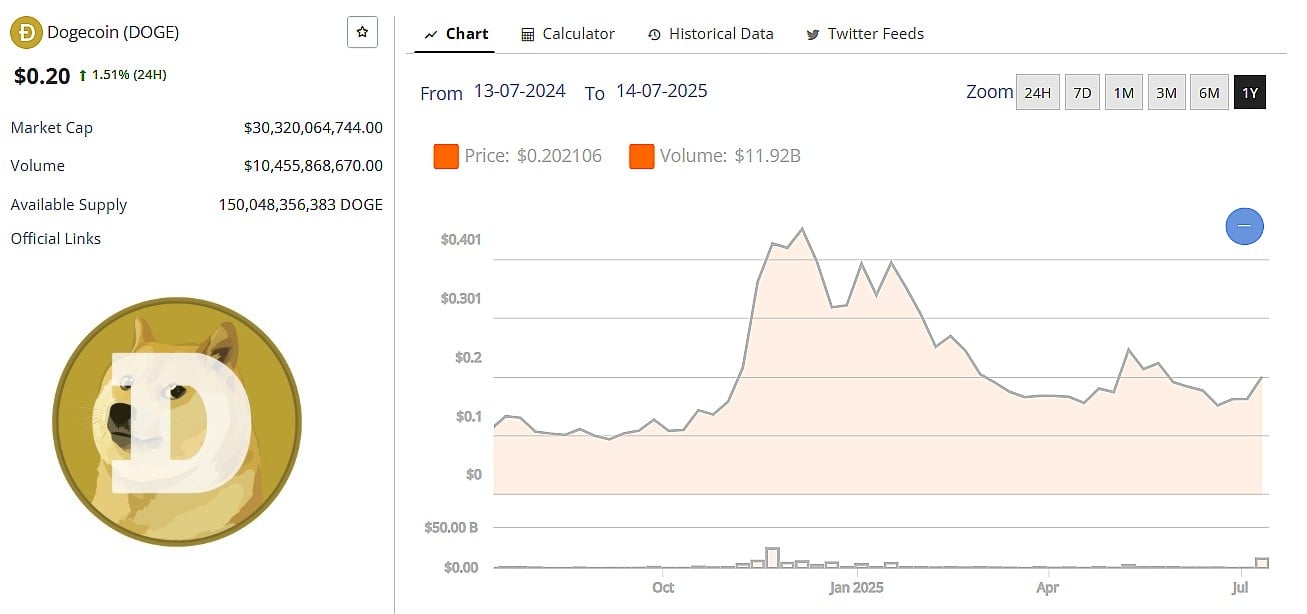

All this chatter about whether Dogecoin will land at the coveted $1 mark is like asking musicians to name their favorite band—everyone has opinions! But let’s dig a little deeper. Currently, to see a $1 DOGE, we need a market cap of $150 billion, which is 5 times its current $30 billion cap. That’s like expecting a junior burger to magically become a gourmet dish. Meanwhile, even the stellar Solana is only at an $87.24 billion cap, serving up all kinds of tasty blockchain goodies.

And don’t forget DOGE is inflationary—like my roommate’s laundry that just keeps piling up. Instead of capping supply, it adds about 5 billion new coins each year, making for an annual inflation rate that’s around 3.6%. That’s 80% higher than the Fed’s own target. Welcome to the party! 🎉

Investment Implications: Beyond Simple Price Targets

The Bull Case: Institutional accumulation is like putting wood on a fire—it’s a game changer, my friends! Unlike the overzealous retail-driven waves of the past, these are savvy investors who might just stabilize the price action. Coupled with upgrades from the Dogecoin Foundation—GigaWallet and RadioDoge—maybe Dogecoin will cross that threshold of “just a meme” to “please take my money.” 💵

The Bear Case: But let’s not ignore the reality check. DOGE took a dive of over 70% from its glorious peak last December. Yikes! If it doesn’t draw the demand it needs, those soaring high valuations may just become a distant memory.

The Reality: Ultimately, whether DOGE ever sniffs that $1 mark is secondary to how it can transition from meme darling to potentially a serious asset class. The merging of ETF buzz, competitive threats, and infrastructure growth creates a tangled web that even an arachnophobe would find daunting.

So, dear investors, let’s not get bogged down in simply asking if Dogecoin will indeed hit that dollar figure. The real question is whether it can foster genuine, lasting value or simply ride the emotional coattails of meme-driven madness. The answer is going to shape not only Dogecoin’s future in 2025 but its overall relevancy in the endless circus that is cryptocurrency. Buckle up—this is going to be a wild ride!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- EUR NZD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- EUR JPY PREDICTION

- USD GEL PREDICTION

- This Whale Left Bitcoin for Ethereum and You Won’t Believe What Happened Next 🐳🚀

- Binance Flushing Out Bitcoin Like There’s No Tomorrow – What’s the Fed Got to Do With It?

2025-07-12 15:01