What to know:

- NEAR is trading at $2.52, maintaining support above $2.50; a drop below $2.48 could trigger further downside toward $2.34.

- A bullish breakout above Monday’s high of $2.70 could target $2.91 and $3.12 levels.

- Strong support zones at $2.48-$2.52 and resistance at $2.57-$2.60 coincide with increased institutional activity and elevated trading volumes.

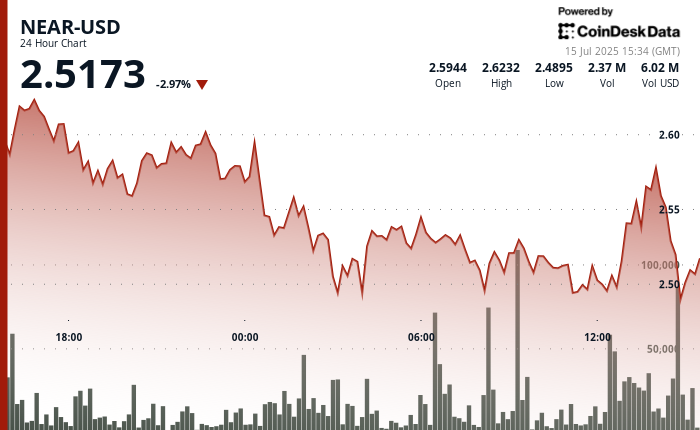

NEAR lost 3% of its value on Tuesday after demonstrating an impressive recovery at 13:00 UTC, rising from $2.54 to $2.56 in a move that nullified the previous drawdown.

The AI token is currently trading at $2.52 as it continues to hold above the $2.50 level of support. A drop below $2.48 would pave the way for downside extension all the way down to $2.34, which was the base of last Thursday’s rally.

A bullish breakout would occur if prices surpass Monday’s high of $2.70, which was incidentally also the high in June before a major correction. Upside targets above there would be $2.91 and $3.12.

Technical Indicators

- NEAR established formidable support mechanisms around $2.48-$2.52 with multiple technical rebounds occurring throughout volatile trading sessions.

- Resistance thresholds materialised near $2.57-$2.60 whereupon distributors maintained active positioning throughout the trading period.

- Volume acceleration to 3.68 million during the 03:00-04:00 session surpassed the twenty-four-hour average of 2.32 million, indicating heightened institutional participation.

- Final hour recuperation successfully breached resistance at $2.57 with exceptional turnover of 217,573 units at 13:55.

- Aggregate trading range of $0.15 represented 5.70% of the period’s zenith, demonstrating considerable intraday volatility characteristics.

Read More

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- CRV PREDICTION. CRV cryptocurrency

- Bitcoin’s Wild Ride: $79B Futures & Sky-High Options-Brace for Impact! 🚀💥

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

- Crypto’s Big Bet on FOMC: Will It Pay Off? 🚀💥

- Grayscale’s Crypto ETF: 42% Growth or Just Another Digital Mirage?

2025-07-15 19:43