Ah, Ethereum. The digital darling that keeps regulators scratching their heads and investors clutching their wallets. According to CNBC, SEC Chair Paul Atkins—a man who likely dreams in compliance codes—has declared that Ethereum is not a security. 🎉 Informal, you say? How delightfully bureaucratic! Until a formal rule-making concludes, Ethereum remains in that awkward limbo where it’s not quite a security but not *not* a security either. Schrödinger’s coin, perhaps?

“Similar to Bitcoin,” Atkins said, “the SEC has stated informally more than formally that ether is not a security.” Ah, yes, the sweet scent of regulatory ambiguity. Investors, ever eager to pivot on a pin, breathed a sigh of relief and promptly dove back into the Ether pool. 🏊♂️

Paul Atkins: ETH Is Not a Security, Digital Assets Are Being Embraced by the Market

Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (@SECGov), stated that the SEC “informally” considers Ethereum (ETH) not to be a security. He noted that, like Bitcoin,…

— MetaEra (@MetaEraHK) July 21, 2025

Agencies Seek Clarity (And Perhaps a Stronger Coffee)

The SEC’s Crypto Task Force, undoubtedly fueled by endless cups of lukewarm coffee, has held roundtable talks this year. Industry leaders gathered to discuss which federal laws apply to crypto. Spoiler: no one knows. But under Gary Gensler’s watchful eye, the agency has been probing tokens for possible securities status—except Ethereum. Now, Atkins has thrown Ether into the commodity basket, right next to Bitcoin. 🌽

The Commodity Futures Trading Commission has long treated Ether and Bitcoin as commodities. But the real question—do staking rewards count as income or tokens?—remains as unanswered as the eternal riddle of why office coffee always tastes terrible.

Institutional Appetite For ETH Up (Because Who Doesn’t Love a Good Stack?)

Major companies are stacking Ether like squirrels preparing for winter. BTCS, SharpLink Gaming, and Gamesquare lead the charge, adding millions of dollars’ worth of ETH in recent weeks. 💰 One startup, Ether Machine, plans a public debut backed by $1.6 billion in Ethereum capital. Confidence? Or sheer audacity? Either way, it’s a spectacle.

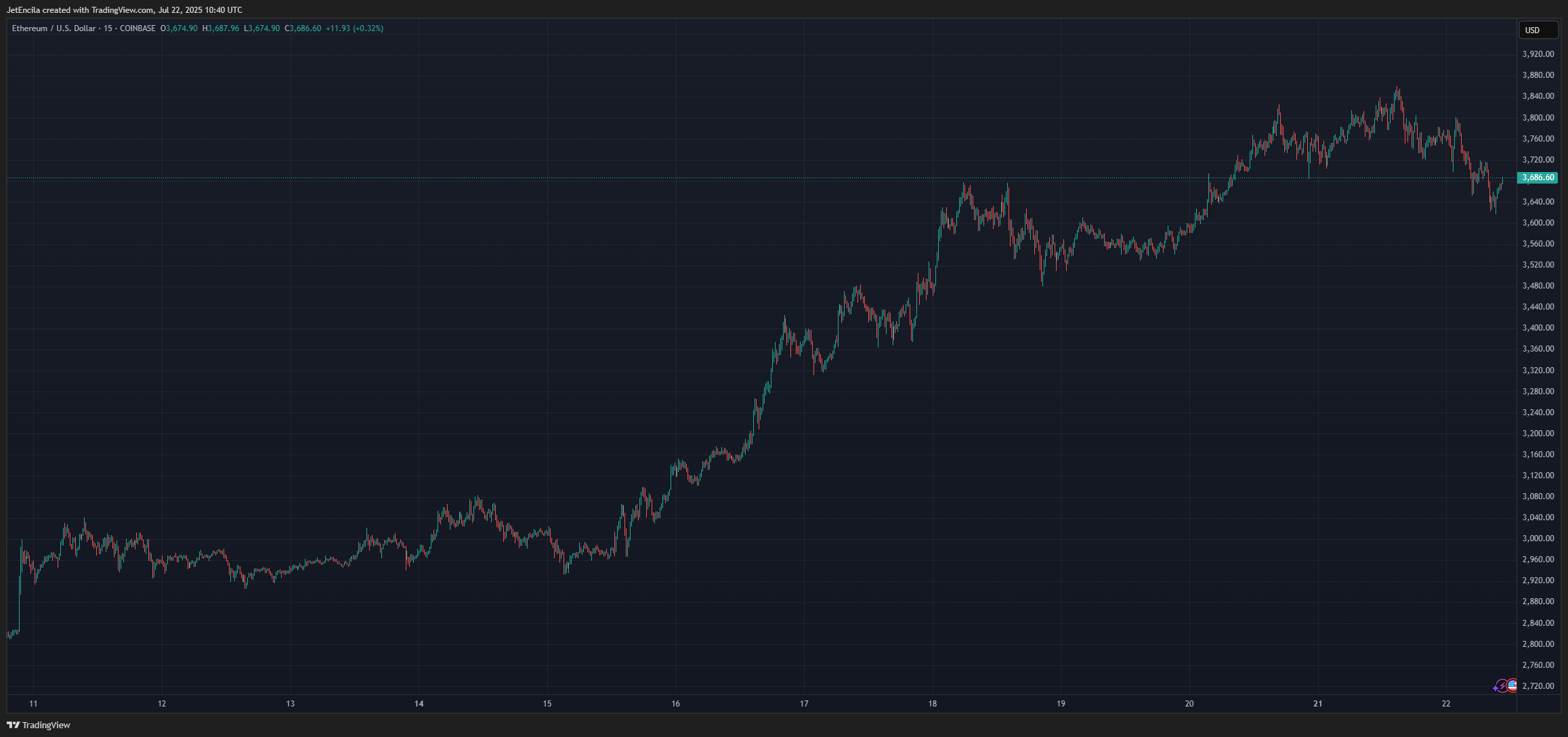

ETH-focused funds have shattered daily inflow records. ETF data shows new money pouring into Ethereum products at an all-time high this month. Prices have followed suit, with Ether climbing to $3,639—up over 24% in the last seven days. Traders, ever optimistic, see room for more growth if regulators stick to Atkins’ remarks. 🚀

Staking Rules Still In Limbo (Just Like Your Weekend Plans)

Applications for Ethereum staking ETFs remain on hold. BlackRock filed its proposal months ago, but the SEC has yet to give a green light. Some companies worry that staking payouts could be deemed securities or income under tax laws. CFTC head Rostin Behnam backs the view of Ether as a commodity. But without clear SEC guidance, DeFi and staking pool players are left pondering like philosophers: to stake or not to stake? 🤔

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- EUR NZD PREDICTION

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- USD THB PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Ethereum’s Circus: $10B Reserve, Whales, and the Quest for $6K – Or Not

- Dogecoin Sparks Meme Coin Surge as $SOL Passes $200 – Could Maxi Doge Ride the Wave?

- Thailand’s Cryptic Cure for Tourist Blues 🌴💰

2025-07-23 05:13