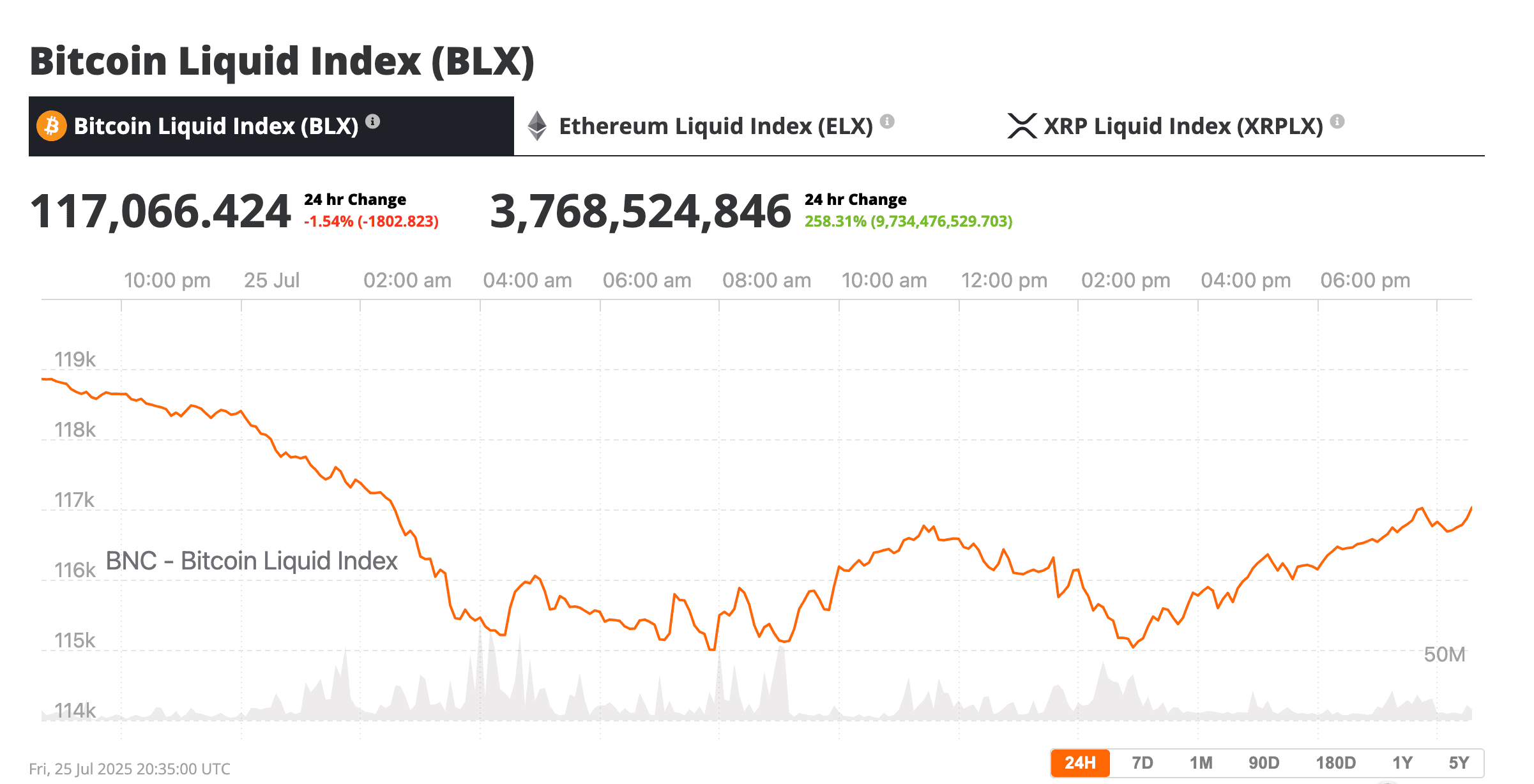

The price of Bitcoin, that darling of the digital age, took a most disagreeable tumble below the $116,000 mark—a calamity so swift and severe it left nearly a quarter million traders in financial disarray. The result? A staggering $700 million in liquidations across the cryptosphere, with longs bearing the brunt of this unfortunate affair. One might say it was a veritable feast for the market makers, though not one to be savored by their victims. 😅

According to CoinGlass, over 213,700 traders found themselves unceremoniously ejected from the game within the last 24 hours. Bitcoin, ever the capricious diva, dropped 2.63% to $115,356, obliterating $140 million worth of long positions. Ethereum, ever the dutiful understudy, followed suit, shedding 1.33% to settle at $3,598, while wiping out $104.76 million in longs. One can only imagine the collective groans echoing through cyberspace. 🎭💸

What Prompted This Unfortunate Bloodbath?

One word: leverage. Oh, dear reader, how predictable we humans are! Crypto trader Ash Crypto succinctly summarized the debacle in a post on X: “This dump is a pure leverage flush.” It seems many an eager speculator, intoxicated by FOMO after witnessing Ethereum’s surge, leapt into altcoin longs, only to be ambushed by market makers who seized the opportunity with glee. Classic whipsaw indeed! The data confirms what we already suspected: long positions bore the brunt of the pain, as traders betting on further gains were instead led to the proverbial woodshed. 🪵🪓

Dogecoin, that whimsical token of internet jest, led the charge among top 10 coins, plummeting 7% to $0.22 and incinerating $26 million in long liquidations, per Nansen. One almost feels sorry for the poor creature, if not for its perpetual air of absurdity. 🐶🔥

Sentiment vs. Reality: A Tale of Two Markets

Even amidst this dramatic flush, sentiment remains curiously buoyant. The Crypto Fear & Greed Index still hovers at 70, firmly entrenched in “Greed” territory. How peculiar, is it not, that optimism persists even as the market exacts its pound of flesh? Bitcoin, you may recall, reached an all-time high of $123,100 less than two weeks ago (on July 14), and many continue to dream of loftier heights. Galaxy Digital CEO Mike Novogratz, ever the optimist, boldly proclaimed ETH is destined for at least $4,000, a roughly 10% upside from current levels. Meanwhile, Bitfinex analysts envision Bitcoin’s next key level at $136,000, assuming the uptrend resumes.

Yet, with so many leveraged traders clinging to bullish setups like shipwrecked sailors to driftwood, any further downturn could unleash another round of cascading liquidations. For instance, a retreat to $119,500 would imperil another $3.07 billion in short positions—thus, the pressure mounts on both sides. One cannot help but marvel at the precariousness of it all. 🌊⚓

Where Do We Go From Here?

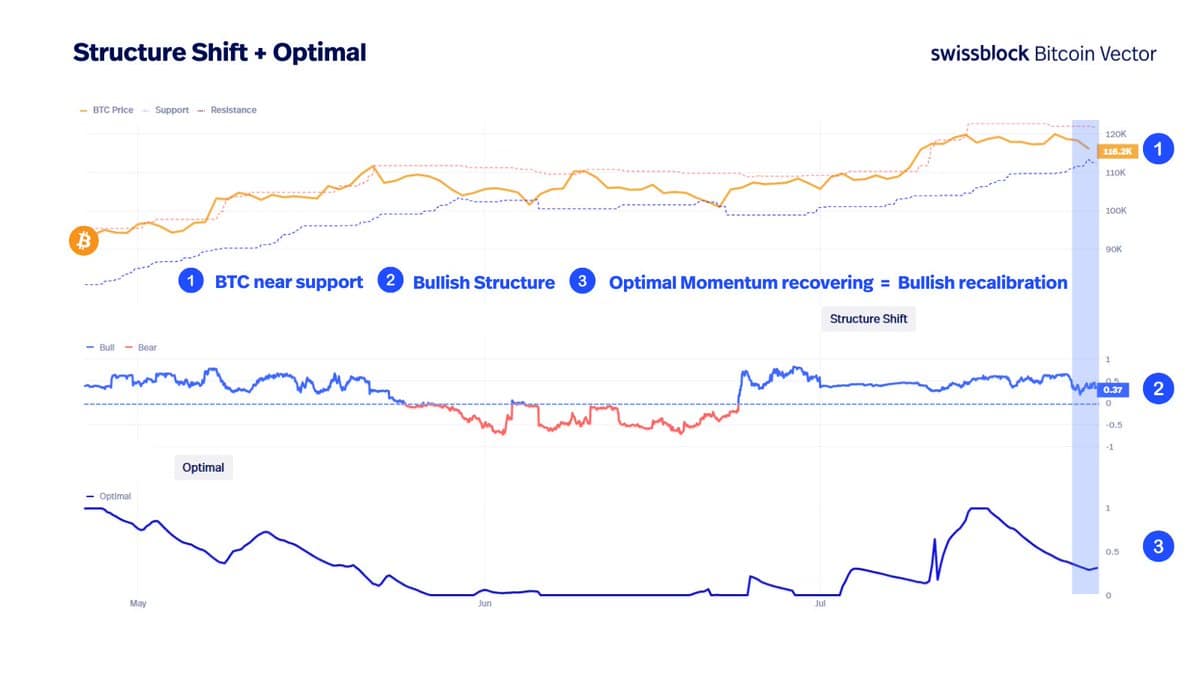

Markets such as these do not falter due to bearish fundamentals; rather, they crumble under the weight of overconfidence and excessive leverage. What transpired on Friday was not a collapse in belief, but rather a cleansing of overextended wagers. Whether this marks the final shakeout before another ascent or the harbinger of a broader reversal remains uncertain. As Bitcoin Vector mused on X, “Bitcoin’s drop isn’t a breakdown, it’s a healthy correction.” Indeed, structure remains bullish, and momentum, though paused, shows signs of recovery. BTC clings precariously above support, though we may yet test $112,500.

Momentum paused, but the trend is intact, source: X

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin, Baby! 🤯 Asia’s Wild Ride into the Crypto-Void 🌪️

- Silent Whales: Bitcoin’s Shadow War on Binance

- EUR NZD PREDICTION

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- USD THB PREDICTION

- USD ILS PREDICTION

2025-07-26 03:51