In the grand theater of finance, where titans clash and ink-stained villains plot in shadowed boardrooms, a tempest brews between JPMorgan and the crypto realm. 🌪️

The Spark That Lit the Powder Keg

On a day when the sun dared not shine too brightly (July 11, to be precise), Bloomberg delivered a tale of monstrous fees: JPMorgan, that noble house of finance, declared war on fintechs by charging them a princely sum—up to 1,000% per transaction!—for the privilege of accessing customer data. A financial guillotine, one might say. 💸

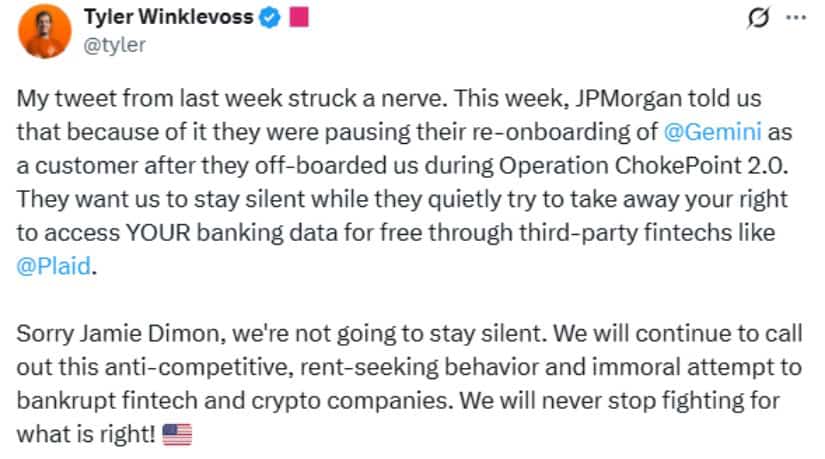

Cue the Winklevoss twins, those digital knights in shining armor, who took to X to denounce the move as “anti-competitive” and “bankrupting.” They even singled out Jamie Dimon, CEO and self-proclaimed titan, for his role in this capitalist ballet. “Dimon’s dance card is full of consumers’ tears,” they declared, with the fervor of a prophet in a marketplace. 🙌

A Tale of Retaliation and Rancor

Six days later, the plot thickened. Winklevoss, now the bard of crypto’s woes, claimed JPMorgan had paused Gemini’s re-onboarding process—a move he attributed to his “insufferable” tweets. “My words struck a nerve,” he wrote, “like a dagger to the ego of a man who forgot how to smile.” 🤡

Gemini, that phoenix of crypto, had previously lost its banking relationship during the infamous “Operation Choke Point 2.0,” a period when banks, under regulatory pressure, turned their backs on crypto like it was last season’s hat. 🎩

JPMorgan’s Fee Policy: A Masterclass in Bureaucracy

JPMorgan’s new fee structure, a labyrinthine tangle of charges, targets data aggregators like Plaid. These companies, the unsung heroes of fintech, help customers transfer funds from JPMorgan to crypto exchanges or apps like Venmo. But now, JPMorgan demands payment for its “secure systems,” as if data were a rare spice and not a digital necessity. 🤯

The bank claims it receives 2 billion monthly data requests—90% of which are “unrelated to actual customer activity.” One can only imagine the chaos of such a deluge. “A bureaucratic nightmare,” one fintech executive sighed, “but at least the fees will fund my next coffee habit.” ☕

Operation Choke Point 2.0: A Dark Chapter

The crypto industry, ever the underdog, has long bemoaned the banking restrictions. Documents reveal the FDIC once asked banks to “pause all crypto asset-related activity”—a directive that reads like a modern-day Inquisition. 🔥

This echoes the original Operation Choke Point, a shadowy campaign from the Obama era that targeted payday lenders and gun dealers. “Progressive justice, or just progress phobia?” one might ask. 🕵️♂️

Gemini’s Gambit: IPO Dreams and Regulatory Drama

Gemini, now a phoenix rising from the ashes, filed for an IPO in June. The company, having settled with the CFTC and survived the SEC’s gaze, now seeks to soar under Trump’s pro-crypto banner. “A crypto IPO in a Trump era? More likely a crypto IPO in a Trump tweet,” one observer quipped. 🐦

Industry Outcry: A Symphony of Indignation

Fintech groups, their voices shrill with righteous fury, decried JPMorgan’s fees as “anti-competitive.” Winklevoss, ever the orator, claimed the policy violated the “Open Banking Rule,” a federal law that grants consumers the right to access their data. “JPMorgan wants to take your data and charge you for it,” he wrote, “like a landlord who also owns the air you breathe.” 🏡

The Grand Finale: What Lies Ahead?

This clash, a dance of progress and resistance, will shape the future of finance. As crypto gains political favor under Trump, the battle for data—and the soul of banking—will only intensify. “A farcical opera,” one analyst mused, “with JPMorgan as the villain, Winklevoss as the hero, and the public as the confused chorus.” 🎭

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD ILS PREDICTION

- Brent Oil Forecast

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- USD THB PREDICTION

- Fed’s $55B Injection: Will XRP Hit $3? 🚀

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Solana Staking Soars! Is $60 Billion the Secret Sauce for Success?

- EUR NZD PREDICTION

2025-07-28 00:34