In a curious twist of fate, the tides of cryptocurrency have flowed in favor of Ethereum, extending the streak of avaricious inflows to the tune of $11.2 billion, while Bitcoin appears a rather sullen figure in the background.

It is Ethereum (ETH) that takes center stage in this grand theater of digital riches, illuminating the path as altcoins flourish, leaving Bitcoin (BTC) gasping for relevance, burdened by significant outflows.

The Rise of Ethereum Amidst ETF Whispers: A Comedy or a Tragedy?

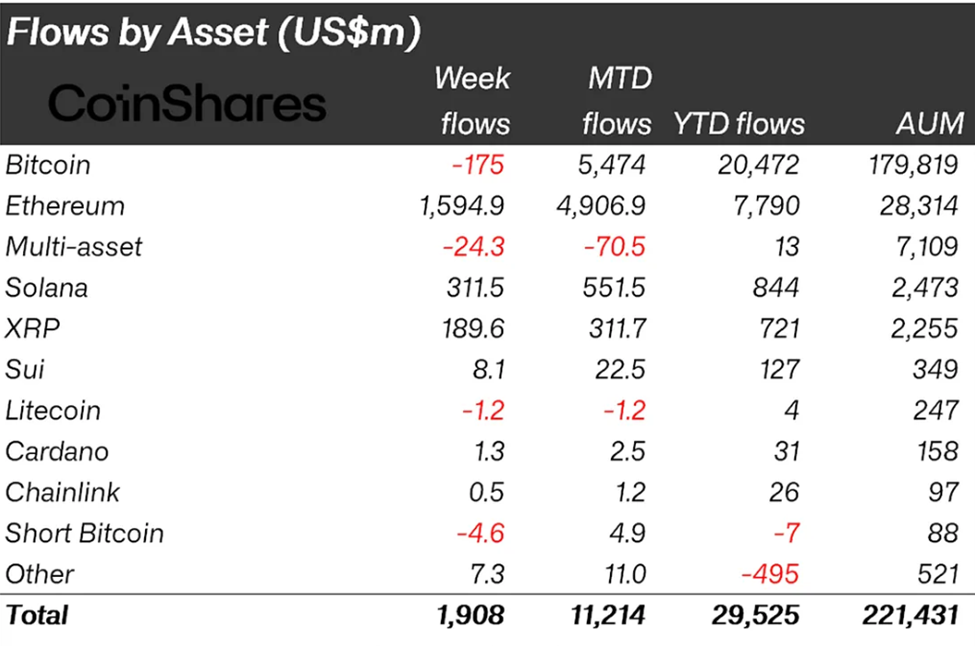

The latest report from our ever-watchful friends at CoinShares reveals that crypto inflows surged to $1.908 billion last week—an impressive leap from the $1.049 billion recorded by the weary July 19. One wonders, did the Bitcoin camp forget to bring their wallets?

In a twist that would make Dostoevsky weep, Bitcoin has chosen to swim against this buoyant current, with a meager $175 million in negative flows. Meanwhile, Ethereum gleefully sprints ahead, boasting a staggering $1.594 billion in inflows last week.

“Ethereum stood out, unusually leading with US$1.59bn in inflows last week, its second-strongest week on record. Year-to-date inflows into Ethereum have now reached US$7.79bn, surpassing the total for all of last year,” said the report, as if it were singing an opera of triumph.

The CoinShares oracle seizes the opportunity to call out Bitcoin for its conspicuous divergence from this ebullient altcoin fiesta, where Solana and XRP enjoy a swell of enthusiastic inflows. Is it anticipation of ETFs that drives these ponies or just a mirage in the crypto desert?

“This has raised the question of whether we are entering an altcoin season…These altcoin inflows may be driven less by broad-based enthusiasm and more by anticipation surrounding potential US ETF launches,” came the declaration like a cryptic fortune.

As Ethereum struts proudly towards its 10th anniversary like a peacock before a flock of pigeons, one might say its recent performance was written in the stars. Institutional interest has surged, with Bit Digital eyeing a billion-dollar pivot to Ethereum, while BlackRock’s digital asset guru has found greener pastures at SharpLink Gaming—a tale that could make even Uncle Vanya envious.

Ethereum: The Darling of Institutional Investors in a Swirling Market

This week, as the fog of market rotation thickens, BlackRock’s Ethereum ETF inflows have outblazed its Bitcoin counterpart. Is this foresight or folly in the high-stakes game of finance?

In a revealing address to BeInCrypto, Andreas Brekken, the enlightened CEO of SideShift.ai, attributes Ethereum’s glittering performance to a veritable flood of institutional conviction flooding in from all sides.

Echoing this sentiment, MEXC Research’s Chief Analyst, Shawn Young, highlights Ethereum’s relentless momentum as it approaches the $4,000 mark like a determined marathon runner, fending off the tired exploits of Bitcoin.

The past two weeks have witnessed over $5 billion pouring into US spot ETH ETFs—16 consecutive days of unabashed admiration from the markets. Ethereum, it seems, is not just a character in this play; it’s emerging as the very stage on which the drama unfolds.

“This growth reflects the increased conviction in Ethereum’s utility, sustainability, and long-term staying power, particularly due to its use in tokenization, stablecoins, and on-chain settlement,” Young shared, offering insight more profound than the enlightened philosophizing of your neighborhood barista.

He lauds ETH’s resilience amid recent market turmoil, advances in market cap dominance, and an ever-stronger role in the ballet of capital rotating from Bitcoin to altcoins. Mathematics meets art!

Technically speaking, Ethereum has held key support levels while flexing its relative strength like a seasoned bodybuilder. According to Young, the improving depth across altcoins reveals a broader shift in market sentiment, hinting at a possible breakout toward $4,500—if the forthcoming GDP and FOMC data encourage a risk-on rally. Who could have guessed that numbers could elicit such passionate dreams?

“Softer inflation data or dovish language from the Fed may reinforce the view that the rate hike cycle is nearing its end, potentially triggering a broader risk-on shift across the markets—a trend that typically benefits the crypto sector significantly,” chimed Young, sounding more like a wise sage warning of a looming storm.

As we embrace this moment in time, Ethereum’s prices flirt with $3,886, boasting a 3% rise in the last 24 hours—a glint of hope for weary investors.

With the relentless rise of ETF adoption and ETH edging its way into the good graces of institutional portfolios, Ethereum stands poised to lead the next act in the ever-evolving play of crypto market expansion. Bravo, Ethereum, bravo! 🎭💰

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-07-28 13:37