Ah, dear reader! Recent chart antics reveal that our beloved asset is in a delightful reaccumulation phase, much like a cat preparing to pounce after a brief nap from its lofty perch at $10.87. The volume data and RSI indicators are whispering sweet nothings of bullish continuation, but alas! The true spectacle depends on how UNI frolics with its short-term support base. 🎭

Uniswap’s Price Pullback: A Comedy of Demand Zones

According to the sage analyst Crypto Chiefs (@cryptochiefss), the UNI/USDT 1-hour chart displays a structured retracement, akin to a well-rehearsed play, after reaching its zenith at $10.87. The price has taken a downward stroll, marked by lower highs and lower lows, heading towards a shaded grey demand zone, that charming little nook between $10.10 and $10.30. This area, once a bastion of bullish momentum, could serve as a key reversal level if our gallant buyers come to its rescue! 🦸♂️

The chart, a veritable tapestry of projected stair-step declines, aligns with the common liquidity sweep patterns, where price dips just enough to tease the short-term lows before bouncing back like a mischievous child. Should the price enter this demand area and find support with a delightful uptick in volume, we might just witness a potential reversal toward the $10.60 level. Traders, those ever-watchful hawks, are on the lookout for confirmation signals, such as bullish candlestick patterns or sustained volume increases, to validate their long setups. 🦅

Bullish Volume and Price Structure: A Match Made in Heaven

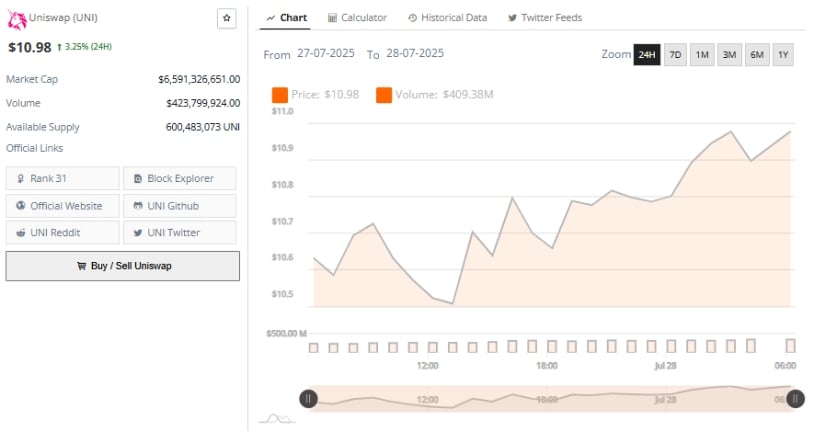

In the past 24 hours, Uniswap has gallantly climbed 3.25%, reaching a splendid $10.98, much to the delight of eager buyers. The session opened near $10.50 and advanced steadily, like a well-oiled machine, through a series of higher highs and higher lows, peaking just shy of the $11.00 psychological threshold. This consistent upward slope is a testament to the strengthening market sentiment, with momentum building incrementally, as if the market were preparing for a grand ball! 💃

Uniswap’s trading volume during this joyous session reached a staggering $423.8 million, supporting the price movement with active participation. Unlike those fleeting spikes that vanish like a puff of smoke, the volume remained steady during each leg of the climb, suggesting that this rally is not merely a flash in the pan but rather a broader market accumulation. The steady flow of buy orders, particularly near the upper price bands, indicates buyer confidence and validates the support of current price levels. Bravo! 👏

UNI’s market cap stands at a princely $6.59 billion, with a circulating supply of over 600 million tokens, contributing to deep liquidity. The next technical hurdle is securing a daily close above $11.00. A successful break could open pathways toward resistance levels near $11.25 and $11.60, aligned with past swing highs. However, should our brave warriors fail to maintain momentum, a short-term pullback to the previously discussed demand zone may be in the cards. 🎲

Momentum Indicators: The Stage is Set for Extension

As we pen these words, Uniswap is trading at $11.014. The daily chart reveals candles forming in the upper Bollinger Band range, with the upper band at $11.632 and the basis line near $9.730. This suggests that bullish control remains intact, as price stays elevated within the channel, much like a king upon his throne. The ongoing uptrend is marked by well-defined higher highs and higher lows, and the price remains above dynamic support. 👑

The Relative Strength Index (RSI) currently reads 71.19, slightly above the RSI-based moving average of 69.26. This positioning places UNI in mild overbought territory, often a sign of continued bullish strength rather than an immediate reversal. The RSI’s alignment with upward price movement suggests healthy momentum. Traders will be observing whether RSI can climb further or diverge, which could indicate either extension or fatigue in the trend. 🏋️♂️

Immediate resistance lies at $11.71, with a break above potentially confirming a new leg upward toward $12. Conversely, a rejection from this level could bring the price back to the baseline at $9.73. The current indicators, volume structure, and price action collectively suggest a possible continuation, contingent upon buyer activity around the key support and resistance zones. Let the games begin! 🎉

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

2025-07-28 20:22