In the dark corridors of human endeavor, where the soul wrestles with despair, the so-called experts—those pitiable wretches—predicted that the grand puppet master in Washington, the Federal Reserve, would once again cling to its stone-hearted decision to leave rates untouched. Yet, like a rebellious spirit, bitcoin, that symbol of mankind’s fragile hopes, was seen tumbling in defiance when the cold official decree was announced. Ah, the irony! 😅

BTC Smirks at Fed’s Foolishness, Rebounds with a Shake of Its Digital Fist

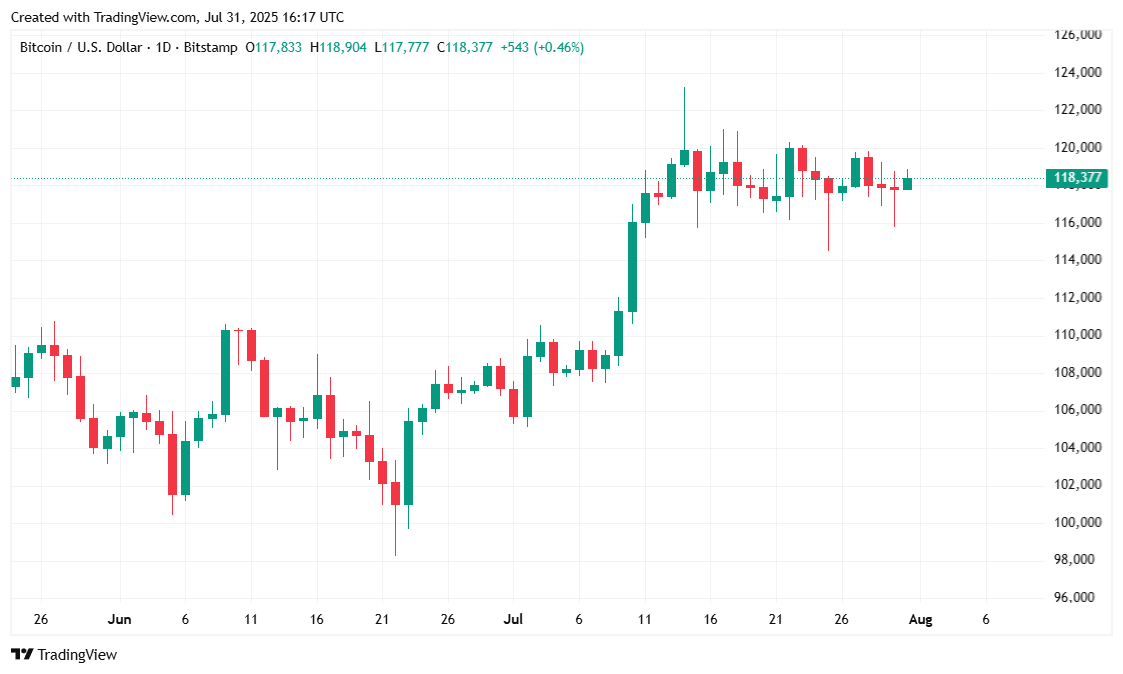

There was little surprise—none, really—at Jerome Powell’s strategic monologue on Wednesday, yet bitcoin, that stubborn creature, plunged approximately 1.7% to just shy of $116K. Like some tragic hero, it fell after Powell’s announcement that rates would remain static. But lo and behold, almost a full day later, it clawed its way back to the mighty $118K threshold, as if to mock the very notion of certainty.

Powell, that ecclesiastical figure of economic authority, faces mounting pressure from the fiery Donald Trump, who, with all the patience of a saint—or perhaps the patience of someone who’s just about had enough—demanded rate cuts. Even within Powell’s clandestine circle, dissent brews. Michelle Bowman and Christopher Waller, like rebellious monks, dared to suggest a quarter-point reduction. It’s been 32 years—since the days of yore—that such a schism fractured the sacred consensus.

Thus, Powell’s proclamation sent bitcoin into a brief, frantic dive—like a ship battered by unseen storms—and now, with a slow, defiant rise, the digital beast has returned to its familiar throne of $118K, snickering at the chaos of human folly. 😏

Market Observations: The Circus Continues

At the moment, bitcoin languishes at $118,404.41—just enough to make a person think about the fleeting nature of certainty. A modest 0.53% increase in 24 hours, yet down 0.43% since last week—an ever-constant reminder of how capricious the gods of finance are. The trading range stretched from $115,800.83 to $118,919.98, the lower bound a gift from Wednesday’s Fed folly.

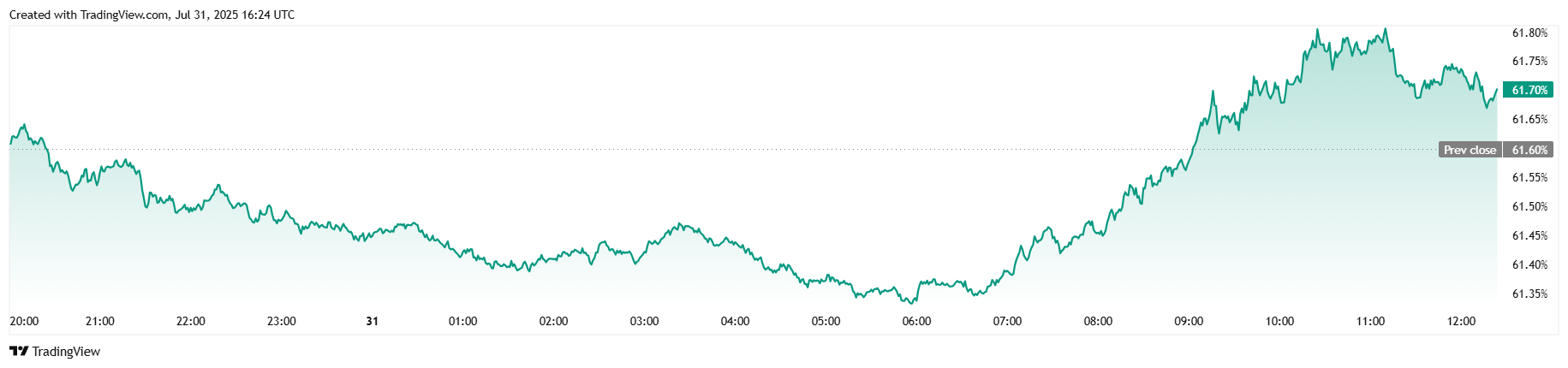

Like a glutton at a feast, trading volume surged 9.64%, reaching $68.96 billion, all while the mountain of market cap crept 0.44% higher to a staggering $2.35 trillion. Bitcoin’s dominion—an empire of scattered pixels—climbed 0.15% since yesteryear, asserting its throne at 61.70%. 🤡

The open futures contracts—those promises made in the shadowed halls of greed—rose 1.16%, reaching $83.94 billion. Meanwhile, the ledger of liquidations claimed $62.60 million since the wicked Wednesday. Most of that—$54.21 million—was lost from long positions, as if the market itself chuckled at the fools who dared to hope. Shorts, the poorer devils, saw a mere $11.39 million wiped out, a humble reminder that gambling is a game of fools and prophets alike. 🎭

Read More

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-07-31 21:08