Greetings, dear reader, to the Asia Pacific Morning Brief—your indispensable dose of crypto gossip, market musings, and regulatory theatrics, all served with a side of sarcasm. Pour yourself a green tea and prepare to be amused—or bewildered. Watch closely—and by watch, I mean scroll, sip, and smirk.

Apparently, DeFi’s summer holiday is over—TVL back to its pre-terraform glory, so grab your sunglasses. Meanwhile, the IMF, in a shocking display of technological enlightenment, now considers crypto as worthy of a place on the accounting ledger. Who knew economists had a sense of humor?

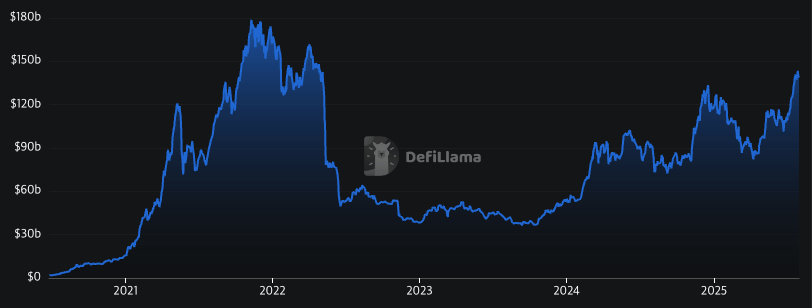

DeFi Summer Back? TVL Leaps From Its Crypt to the Stars

DeFi’s total value locked (TVL) has rebounded to a staggering $138 billion—about the same as an overexcited rollercoaster. It even flirted with $140 billion during a brief July love affair. Who needs summer romances when you’ve got liquid staking and lending? 🤑

AAVE is the belle of the ball, holding a proud $34.405 billion in assets. Lido isn’t far behind with $33.619 billion—it’s the new party buddy. EigenLayer, with $18 billion, is just glad to be in the top three, though the market ponders if this is just a temporary flirtation or the real deal.

Will this spectacular revival surpass 2020’s summer of ‘oh, what a lovely bubble’? Only time will tell, or perhaps an oracle—if you believe in that sort of thing.

IMF Welcomes Crypto—Finally Turning Its Love From Hiding to Hailing

In an unprecedented act of modernity, the IMF has decided that Bitcoin and its friends deserve a spot in the golden ledger. Now, they’re officially called “non-produced nonfinancial assets.” Fancy talk for “We’re finally including your shiny coins.”

Starting 2029–30, countries will showcase their crypto holdings—if they remember where they put them. These assets won’t count towards GDP, but at least they’ll be there, like that mysterious sock in your dryer.

El Salvador, that brave little nation, will proudly display its 6,000+ bitcoins—proof that sometimes, the skeptics are the ones with the coolest assets. This is crypto’s passport to the big league—no more hiding under the bed.

Meanwhile, the rules of the global economic fiesta are getting a digital makeover—artificial intelligence, cloud services, and digital platforms all get a seat at the table. Because what’s better than modernizing data? Making it slightly less terrifying.

Visa, the Gatekeeper, Unlocks Stablecoin Pandora’s Box

Visa, ever the trendsetter, now supports PayPal’s PYUSD, euro-backed EURC, and the ever-glamorous Global Dollar. They’re playing nice with Stellar and Avalanche—because nothing screams “serious business” like blockchain support.

Since supporting USDC across Ethereum and Solana, Visa’s processed over $225 million in stablecoins—clearly the new way to buy unicorns online. The passage of the GENIUS stablecoin bill has sparked even more institutional flirtation, making traditional banks look like last season’s fashion.

Mastercard reports a whopping 30% of transactions are already fancy enough to be tokenized—think of it as digital jewelry for your money. JPMorgan and Bank of America are working on similar magic, while Amazon and Walmart are contemplating their own stablecoin schemes, because who doesn’t want to pay for toilet paper with digital dollar bills?

With stablecoins worth a staggering $256 billion, the old financial world is sweating like a sugar addict in a candy store. Visa’s investment in BVNK hints that the future is now, and it’s just a little bit more virtual than we expected. Cross-border payments are still painfully slow—legacy systems need a coffee break, apparently.

Read More

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-08-01 04:36