etc.

I’ll produce final answer accordingly.

Bitcoin’s price has, in a rather dramatic display, corrected by roughly 2.4% over the past day—just managing to cling above the $115,000 mark. The market’s ever-cautious traders now hang on the precipice, awaiting a single bullish formation that might vault this digital darling toward the storied $150,000… or, heaven forbid, send it spiraling into a meltdown. (Ah, the joys of crypto!)

Let us now dissect the array of signals purportedly steering this pivotal moment—lest we forget that nothing in this modern financial theatre is ever as straightforward as it seems. (And remember, dear reader, to take all technical wizardry with a healthy dose of skepticism… or perhaps a spot of afternoon tea.)

Fund Flow Ratio Points to Lower Selling Pressure

The Fund Flow Ratio—a metric that, like a genteel butler, keeps tabs on how many coins are shuttled between exchanges and the wider on-chain estate—tells us that a higher ratio often signals frenetic exchange activity and, by extension, selling. Conversely, a drop suggests that fewer coins are eager to abandon ship, hinting at reduced immediate sell pressure. (A veritable supply squeeze may be brewing, if only the big players would stop hoarding their digital gold.)

Over the past fortnight, this ratio has been anything but complacent:

- Earlier in July it reached a lofty 0.15—mirroring Bitcoin’s recent peak near $120,000 and flagging a possible surge in selling fervour.

- By July 28, it had tumbled to 0.11, marking a lower high (the first such occurrence since early July, when prices gallantly surged).

At press time, it has retreated further to 0.07. This downtrend implies that the major players are now content to squirrel away their coins rather than offload them—a development that could very well lead to a supply squeeze and, with any luck, ignite a breakout. (Or perhaps it’s simply another twist in the grand saga of crypto. Only time will tell!)

For token TA and market updates: If you relish these token insights, consider signing up for Editor Harsh Notariya’s Daily Crypto Newsletter here. (Because who wouldn’t want a front-row seat to the ever-so-subtle machinations of the market?)

CMF Divergence Shows Quiet Accumulation

The Chaikin Money Flow (CMF)—that subtle arbiter of market mood—assesses buying and selling pressure by weighing both price and volume. A rising CMF signals robust capital inflows, while a falling one betrays outflows.

On the 3-day chart, a bullish divergence has emerged:

- Price has been fashioning lower highs since mid-July.

- Meanwhile, the CMF has been crafting higher highs—a subtle yet telling sign that money is stealthily accumulating even as prices dip. (Ah, the art of accumulation as practiced by the crypto cognoscenti!)

This divergence is crucial; it whispers that capital is flowing into Bitcoin despite the modest price retractions. The deliberate choice of a 3-day chart is no accident—it filters out the daily noise and illusory breakouts, affording us a clearer view of where the big money is hiding. And when higher timeframe divergences like this rear their head, they often presage a decisive directional move once resistance is vanquished.

Currently, the CMF hovers around the 0.11 mark, and should it ascend further—forming yet another higher high—we might soon receive the bullish confirmation needed for a breakout. (Fingers crossed, one hopes!)

Bullish Pennant Pattern Holds the Key to a $150,000 Bitcoin Price

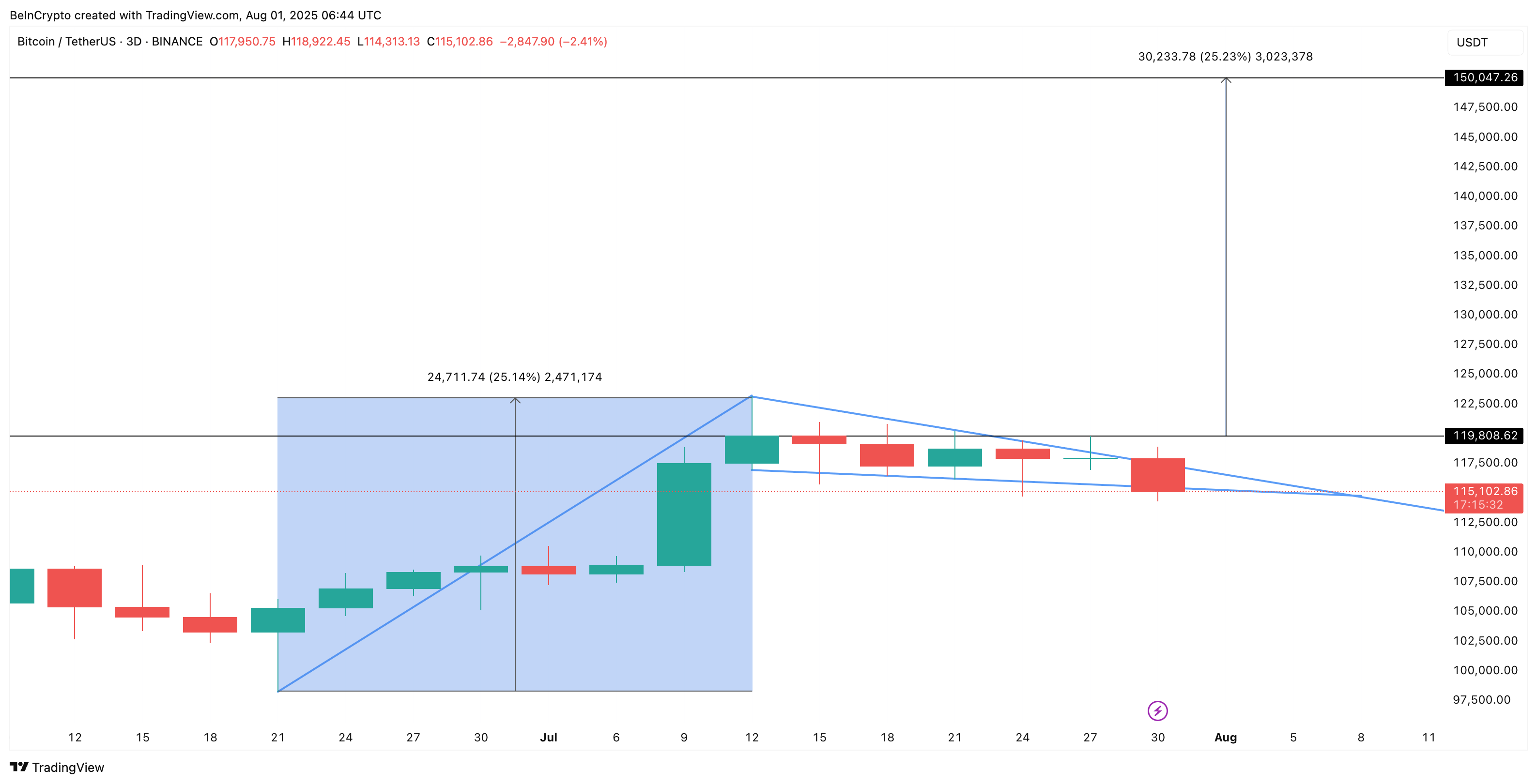

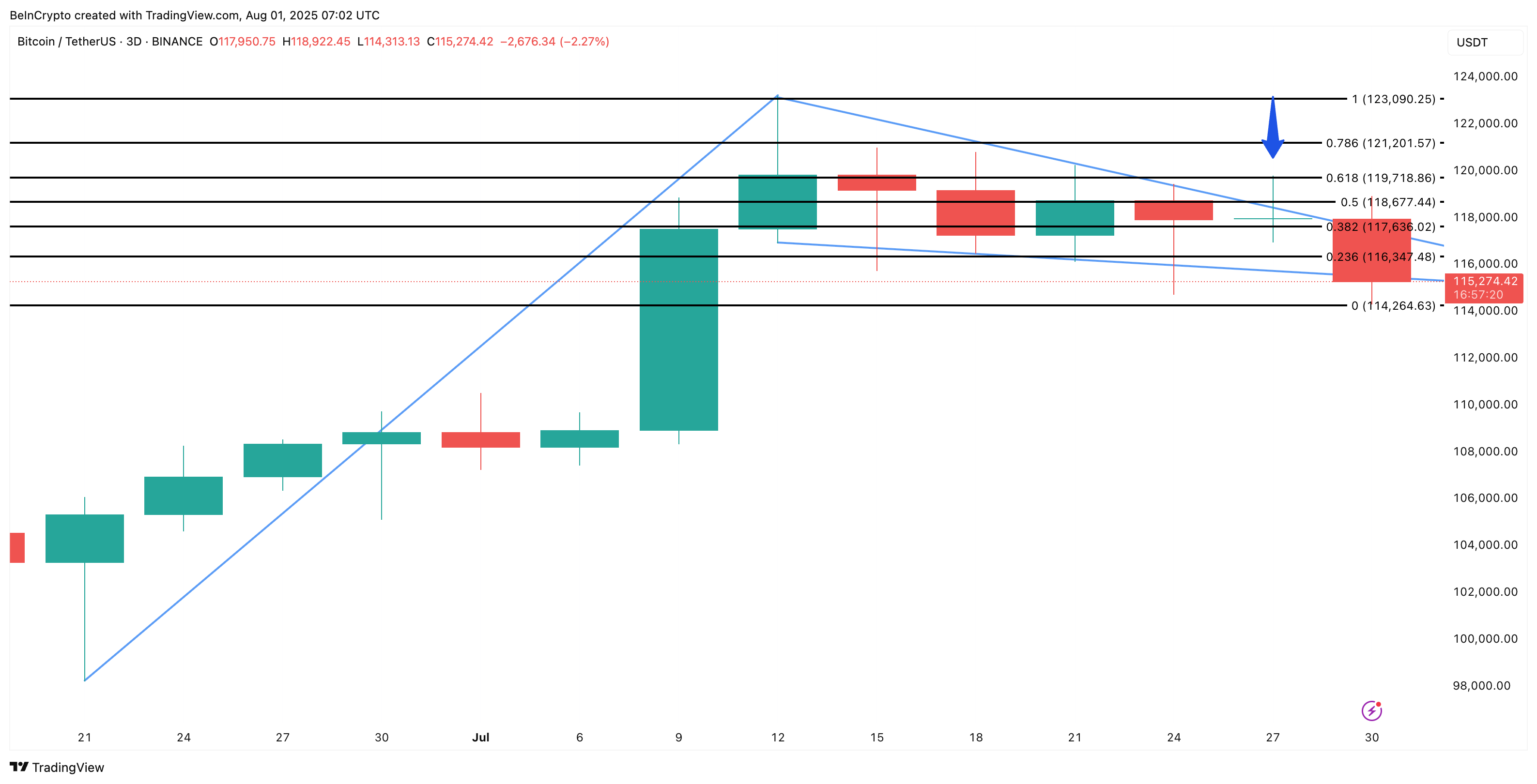

The 3-day chart reveals a classic pole and pennant structure:

- The pole: A vigorous 25% rally earlier this month.

- The pennant: A subsequent period of converging consolidation, as if the market were taking a well-deserved breather. (After all, even the most bullish of trends need to pause for tea and biscuits.)

This formation is typically interpreted as a harbinger of a continuing uptrend, provided the resistance is shattered. Bitcoin has made several attempts at breaking out, with long wicks flaring above and below trendlines—only to be reined in by the market’s characteristic volatility. (The caprices of crypto are indeed a thing of beauty!)

Note: While conventional structures and patterns might crumble after a couple of false breakouts, pole-based formations tend to be more resilient. In most cases, the bullish setup collapses if the price falls to near 50% of the pole’s height. Therefore, the pennant remains valid for the nonce, so long as the $114,000 support holds fast. (Let us pray that the market’s fickleness spares us another disappointment.)

A confirmed full-candle close above $119,000 on the 3-day chart—a level that has seen its fair share of failed breakouts—would likely trigger the next upward leg. Based on the measured pole move, a 25% breakout from this level could propel Bitcoin to the lofty realm of $150,000, aligning with those long-held bullish prophecies. (If only market forecasts were as reliable as a spot of afternoon tea!)

Ultimately, Bitcoin’s next grand move hinges on this singular technical formation. The bullish pennant—bolstered by diminishing exchange outflows and increasingly robust capital inflows on the 3-day CMF—paints an optimistic picture for the bulls. But as ever, it all comes down to the whims of price action:

- Above $119,700: The gateway to a potential surge toward $150,000. (Let the celebrations commence! 😏)

- Below $114,000: The bullish narrative falls apart, and the spectre of downside risk looms large. (Alas, such is the capricious nature of our digital darling.)

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- XRP’s Little Dip: Oh, the Drama! 🎭

2025-08-01 12:11