So, Solana just decided to take a little dip below $170. You know, just a casual drop that has some folks sweating bullets while others are like, “Hey, maybe this is the perfect time to buy!” I mean, who doesn’t love a good comeback story? 📉➡️📈

Solana Slips Below $170 Mark

Here we go again! Solana’s price is doing the limbo, dropping below $170 after flirting with $200 just two weeks ago. That’s an 18% decline, folks! And it’s not just a little blip; we’re talking noticeable volumes here. Mario Nawfal posted a chart that looks like a rollercoaster ride gone wrong. So, is this the end or just the beginning of a new chapter? 🎢

Now, if you look at the technical mumbo jumbo, the $168 to $165 range has been a support zone before. If Solana can hold its ground here, it might just be a golden opportunity for those brave enough to buy the dip. But if sellers decide to throw a party below that, we might be eyeing the $150 to $155 zone next. Who doesn’t love a good cliffhanger? 😬

Solana’s Tom DeMark Signal Flashes a Possible Buy Zone

After Solana’s dramatic fall, chartist Ali is waving a flag, pointing to a potential reversal sign from the Tom DeMark Sequential indicator. This tool is like the psychic of the trading world, spotting exhaustion points in trends. It just triggered a buy setup on the 4H chart. So, while SOL is still hanging out near its lows, this signal suggests that maybe, just maybe, the bears are getting tired. 🐻💤

And guess what? This indicator is cozying up to that support zone we talked about earlier. If SOL can keep its act together over the next few sessions, short-term traders might just be eyeing a bounce back to the $180 to $185 range. Fingers crossed! 🤞

Solana ETF Hopes Gain Momentum Amid Market Pullback

Even as Solana dips below $170, the ETF chatter is heating up again. A new Form S-1 Amendment filed by VanEck for a “Solana ETF” is making the rounds. It’s like a glimmer of hope in a sea of uncertainty. Sure, it doesn’t guarantee approval, but it shows they’re serious. And who doesn’t love a little optimism? 🌈

This news comes right on the heels of the Tom DeMark buy signal and a key technical support retest. So, we’ve got a mixed bag here. Some folks are cautious, while others are like, “Let’s go!” It’s like a party where half the guests are dancing and the other half are just standing around awkwardly. 🎉

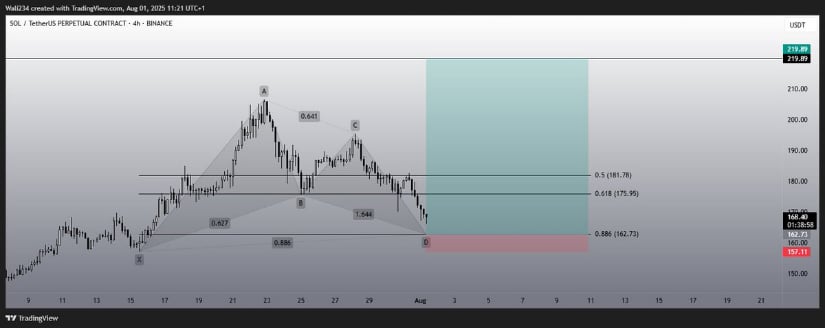

Solana Technical Outlook: Harmonic Pattern Eyeing $220

Analyst Waleed Ahmed is bringing some fresh perspective with a bullish harmonic pattern. The ABCD structure suggests that SOL might be completing a full retracement leg. Key Fibonacci levels are aligning between $162 and $165. It’s like a cosmic alignment for traders! 🌌

If Solana can hold that $162 to $165 region, we might be looking at a potential upside toward $180, $195, and maybe even back to the $210+ range. It all depends on how the broader market feels that day. You know how it is—one day you’re up, the next day you’re down. Classic! 😅

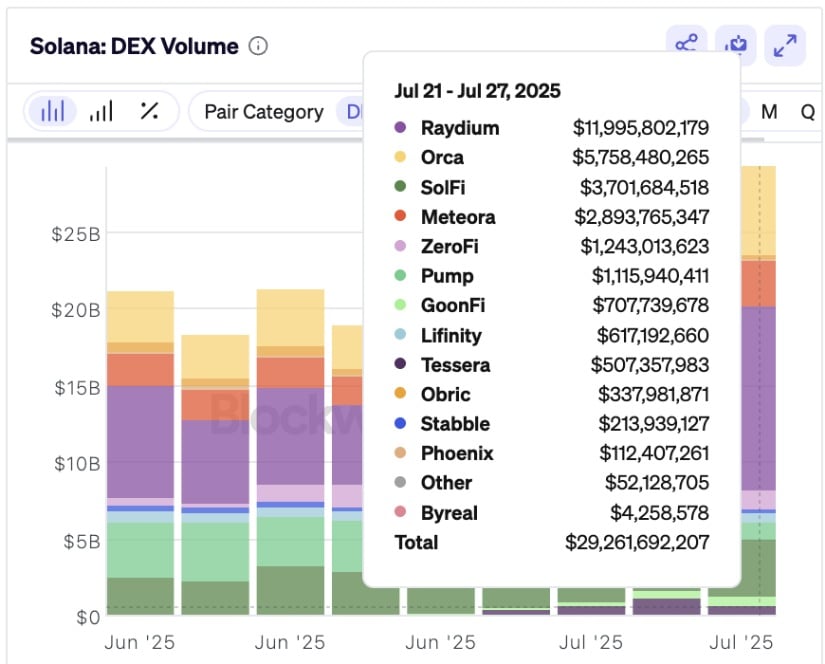

Solana On-Chain Activity Surges Despite Short-Term Price Weakness

While Solana’s price is taking a hit, on-chain data is flexing its muscles. According to SolanaFloor, DEX volume surged to nearly $30 billion for the week ending July 27. That’s the highest level in over eight weeks! So, while the price is sulking, the activity is thriving. It’s like a party where the music is great, but the dance floor is empty. 🎶

This surge in on-chain activity adds some credibility to the bullish Solana price prediction. Who knew a little dip could lead to a big comeback? 🤷♂️

Final Thoughts: Can Solana Bounce Back?

So, Solana’s recent dip below $170 might feel like a disaster, but the technical and on-chain signals are telling a different story. With the Tom DeMark Sequential flashing a buy, a harmonic pattern forming near $165, and ETF speculation back in the headlines, this zone could be more of a springboard than a breakdown. Short-term uncertainty? Sure. But buyers are circling like hawks! 🦅

And let’s not forget the surge in DEX volume. Real user activity hasn’t vanished; it’s growing! That divergence between price and on-chain traction could be exactly what fuels the next leg higher. Or, you know, it could just be another wild ride. Buckle up! 🎢

Read More

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-08-01 18:19