Silver prices took a nose-dive of over 3% this week, slipping to a soggy $37.20 an ounce, much to the consternation of brolleys and silver bugs alike. Amidst the chorus of accusations, many argue the market’s as rigged as a carnival game—except instead of a duck, they’re aiming at your hard-earned silver.

Silver Bulls See Manipulation in Price Dip

Start the week at roughly $36.98 to $37.20—nothing to write a sonnet about, but enough to get the silver crusaders riled up. The old chestnut about “paper silver” flooding the COMEX stage has been spun more times than a DJ’s vinyl—yet, the plot thickens like grandma’s gravy. The story is as familiar as Jeeves’s bow tie, yet no one’s got the smoking gun. Still, that doesn’t stop the Silver Faithful from murmuring conspiracy over their gin rickey.

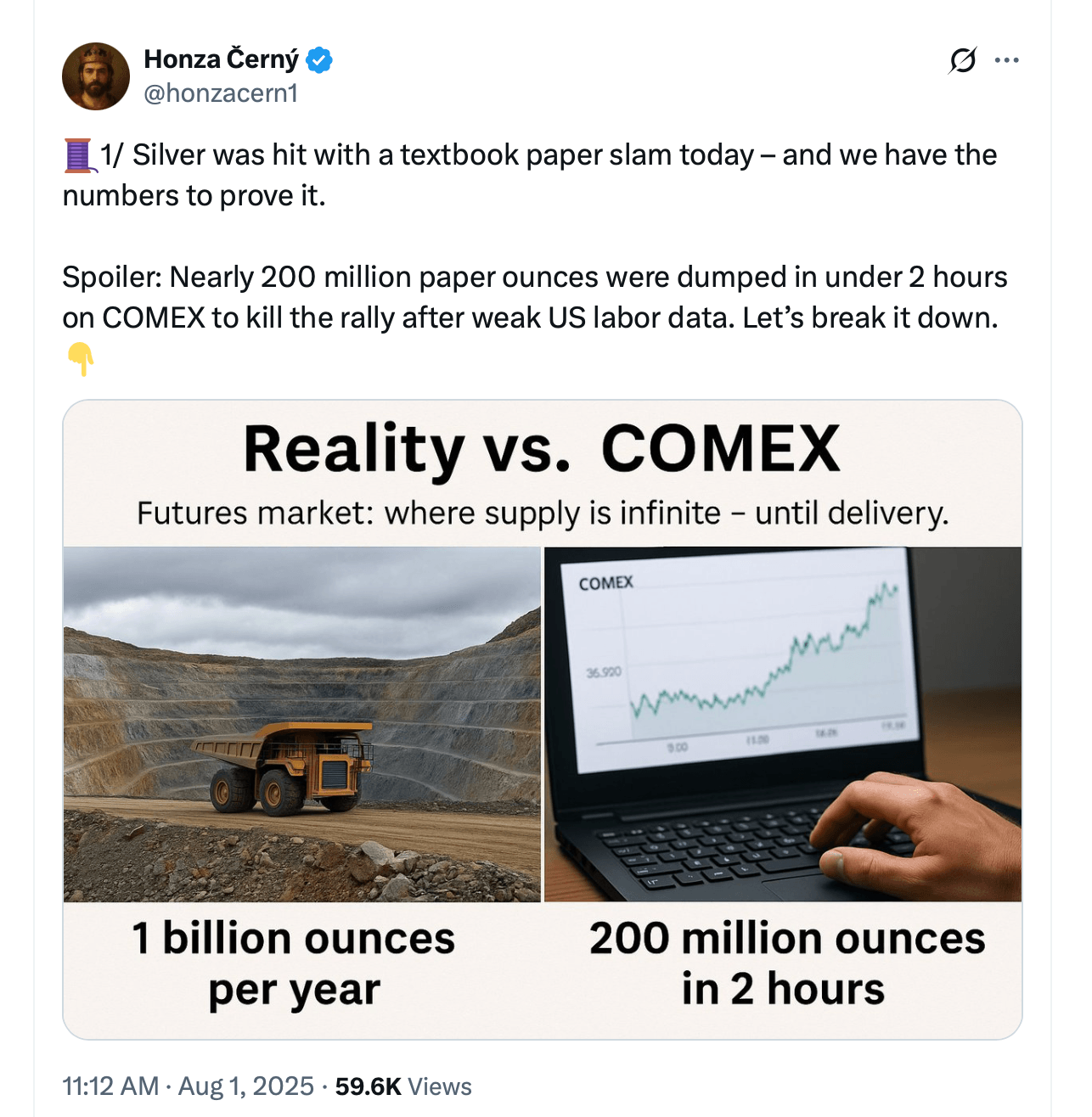

The theory is straightforward: a fat imbalance of paper contracts versus actual shiny stuff. Imagine hundreds of paper ounces trading for every real ounce mined—by some accounts, ratios go as high as 350:1—clever folks call this the “Great Silver Shuffle,” where physical ounces are just the bait while the real action is all on the ledger. It’s like trying to fill a bathtub with a thimble, and somehow dodging the leak.

“Yesterday, 369 million paper ounces were traded to, presumably, keep the price in check,” said The Dude, tipping his fedora. “The COMEX had fewer deliveries than a Sunday roast, yet silver’s price did a tap dance—mostly controlled by options and derivatives,” he added, as if the whole thing was just a game of financial charades.

At the core of it all are those rather rascally financial institutions, the “bullion banks,” who, whispers tell us, are often caught with their fingers in the cookie jar—short positions in futures, sometimes even without any physical metal at all (“naked shorts,” for the uninitiated). These banks apparently sell mountains of paper silver during lean liquidity—just to keep the lid on, and the smiles on their binary faces.

And then there are the “slam” events—short, sharp drops that arrive like uninvited guests at the opening of the New York market—surely a coincidence, or so they say. Critics argue these “tamps” are orchestrated, choreographed dance moves to prevent silver from breaking Free—like a shy debutante at a ball.

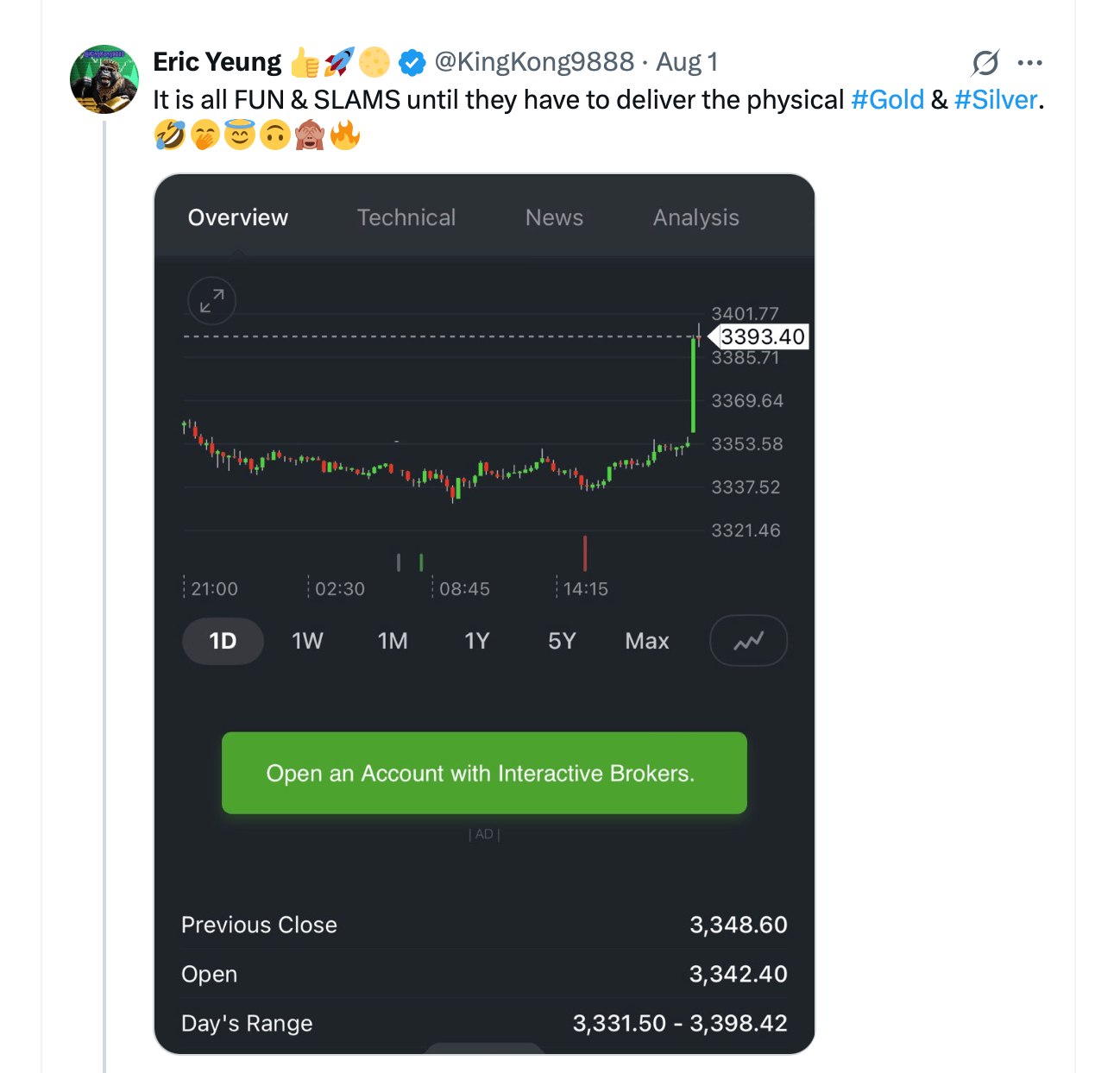

The plot thickens with a side of scandal. Major banks have been caught red-handed—fined plenty of times—manipulating markets with shady tricks like spoof orders and whatnot. Charts show silver prices rising in Asian and European markets but falling in big, bustling New York—a regular stock-market soap opera. Some analysts, like Ronan Manly, swear they’ve seen the long, secret dance of suppression play out over decades—just like an old black-and-white film, only with more zeros at the end.

The motive? The everlasting meddling with fortunes and currencies, especially our good old dollar. Silver as a monetary metal might just be the kryptonite to fiat paper—so, of course, keeping its price low keeps confidence afloat—or so they say, with a wink and a nod.

Counterarguments? Plenty. The CFTC, that watchdog of ours, has conducted investigations, and shockingly, found “no evidence” of manipulation—just the usual market dances. Industry folks, like the CPM Group, shrug it all off as normal hedging, demand cycles, and typical market noise. Meanwhile, COMEX’s inventory pancake—particularly the “registered” category—is shrinking faster than a puddle in the Sahara, hinting that the physical side of the story might be more brittle than a bad soufflé.

And let’s not forget, the fractional reserve system of COMEX is about as stable as a house of cards in a hurricane—where paper claims greatly outnumber actual silver. One wonders how long the music can go on before the chairs give way, leaving some traders flat on their backs.

So, amid all the tales of skullduggery, there’s enough to keep the silver speculators and conspiracy aficionados entertained—if not entirely convinced. After all, in markets as slippery as a greased pig, it’s always possible that the real secrets are hiding just behind the curtain, waiting for someone brave—or foolish—enough to lift it.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD HKD PREDICTION

- EUR HKD PREDICTION

- ARB PREDICTION. ARB cryptocurrency

- XRP Stands at $2.96-Is it the Final Battle or Just a Whimper? 🚨

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- ETF Mania: Bitcoin And Ethereum Funds Hit Record $40 Billion Week

2025-08-04 18:11