In the grand theater of financial chaos, Bitcoin derivatives have reached a crescendo-futures open interest exploding across the scene, climbing relentlessly to a staggering $79 billion. Traders, with their characteristic flair for drama, are clearly leaning into the call options, like teenagers chasing a mirage in the desert, convinced the next big wave is just over the horizon. 😂

Market at a Peak: A Circus of Options and Futures

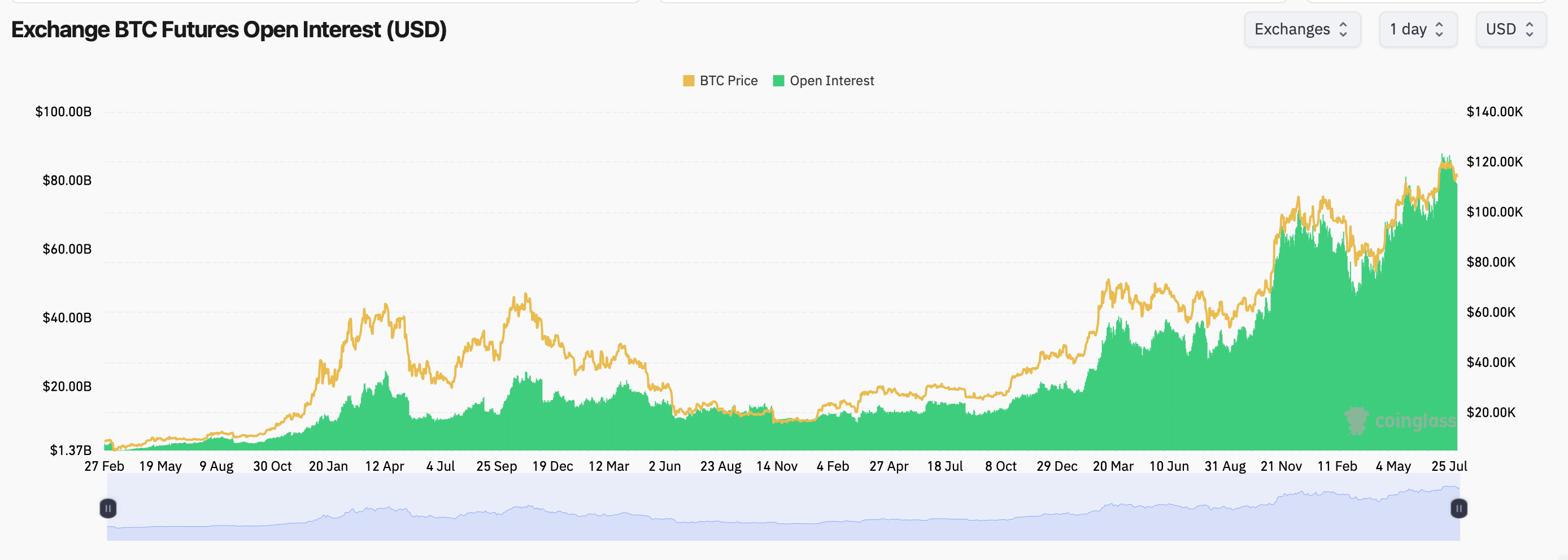

According to Coinglass data, the total BTC futures open interest (OI) is puking at 692,490 BTC, which cynical analysts translate into around $79 billion. CME, always the institution’s pet, leads with 139,350 BTC ($15.88 billion), grabbing just over a fifth of the entire market-a real showstopper! The rest are clinging on: Binance, Bybit, OKX, Gate-all playing their parts in this financial soap opera. 🎭

In 2025, futures OI has been climbing like a cat on a curtain-with prices dancing just shy of the $120,000 mark, as if trying to tease traders into a frenzy. CME and Binance are the main puppeteers, stirring the pot; CME’s OI is flat but upward, while Bybit’s just nudges higher. The market’s like a rollercoaster daring you to scream. 🎢

Meanwhile, options-those darling financial instruments-are equally thrilling. Total OI hovers near $60 billion, with a hefty tilt toward calls (more than 61%), boldly forecasting the tiger to the upside. But don’t let the bullish gloss fool you-inside, traders are hedging like paranoid conspiracy theorists. More than a third are defensive puts, bracing for a short-term downslide-probably wishing they’d stayed in bed. 😜

On Deribit, the star of the show, the big contract is a December 2025 call at $140,000-more hope than sense perhaps, but don’t dismiss it. Meanwhile, the bears have weaponized roughly 6,489 BTC in puts below $110,000, ready to pounce if the market decides to throw a tantrum. Heavy demand for downside hedges signals traders might be more worried than they admit. 🤔

The last 24 hours saw frantic activity: short-dated puts-those cozy bets on falling prices-like the August $112,000 and $115,000 puts-are flying off the shelves faster than hotcakes. The implied volatility? Higher than your cousin’s confidence during a karaoke night-short-term jitters showing up amid the long-term bullish cheer. 🎤

Options expiries? Oh, they cluster around key dates-August 29, September 26, December 26-like holiday dinners with relatives demanding both the main course and dessert in the same breath. Puts dominate, but calls still get their fair share, indicating traders are hedging with one eye on the exit door while pretending to believe in the moon shot.

And if you think this is just a blip, think again. The volume on Deribit is trending up, surging during price roarings, solidifying its dominance in the global BTC options scene-no surprise, given the market’s current penchant for drama. Other exchanges, like Binance, are starting to cough up some competition, probably desperate for their share of the chaos. 😏

Market watchers note: when OI gets sky-high, volatility often follows-like a dog chasing its tail. Bitcoin hovers near its all-time high, splitting traders into those trying to lock in gains and those dreaming of higher caps. But the structure of this market-lots of notional exposure, bullish bets, and some hedging-suggests traders are preparing for a wild ride, possibly with a few bumps ahead. Buckle up! 🎢🚀

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Silver Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- USD HKD PREDICTION

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-06 18:33