Ah, the sweet whispers of the Fed, promising a rate cut in September! Everyone’s dreaming of champagne and bull runs, but beware, mes amis, for history has a rather *sharp* sense of humor.

Indeed, it has long been observed (by those who like to watch the tragic comedy) that when the Fed lowers rates, it often prefaces a grand spectacle called recession-a curtain call in the drama of our economy.

A Fed Rate Cut: The Recession’s Curtain Call

Recent whispers from BeInCrypto reveal that the probability of such a charming move in September 2025 has soared above 90%. Clearly, the investors are playing dress-up for a finale they hope will be a hit. Yet, savvy analysts crack a knowing smile and say, “Hold thy horses, dear speculators.”

Lower interest rates, they say, are like giving a fancy key-more borrowing, more investment in risky ventures like cryptocurrencies, the very darlings of the thrill-seekers.

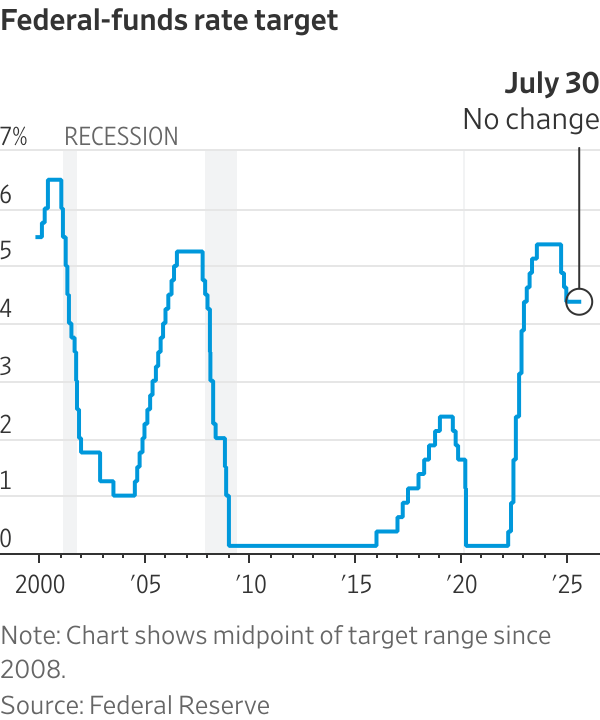

But lo and behold, the historical record (which often enjoys a dark joke or two) shows that major rate cuts are the opening act of a recession-cue the dramatic music: 2001, 2008, 2020-and a few more encore performances.

Yes, the data is quite clear: recessions love to begin with a charming rate cut, just as the curtain rises on tragedy. And many a brave retail investor is starting to question whether the script is playing out entirely as expected.

“If rate cuts supposedly boost lending, then why do the ominous gray bars (recessions) always seem to appear *after* the Fed’s little spa day?” queries John Smith, amateur Sherlock, on X.

John’s question is no mere jest-especially when considering the recent dance of tech stocks, which now moonwalk in a manner reminiscent of the dot-com era’s flamboyant days.

“Tech stocks are shining brighter than the disco ball at a 90’s rave-largest margin since the Dot Com Bubble,” snickers Barchart, our data jesters.

Guilherme Tavares, CEO of i3 Invest, joins the chorus, warning that the S&P 500’s overheating is powered more by AI hype than by actual productivity-yet investors still plan to hold tight, perhaps imagining they’re riding a unicorn into sunset.

Beware the Joy of a Fed Rate Cut-Crypto Might Not Be Smiling

Our wise sage, Henrik Zeberg, steps forth with clarity (and perhaps a glass of truth), dissecting the Fed’s ‘pivot’-that lovely euphemism for panicked reaction.

While markets might toss confetti on a short-term rally, history suggests it’s just an act-a reaction to the battered script of recession already in motion. Zeberg, a connoisseur of macro horrors, tells us plainly:

“The illusion of a strong labor market was shattered faster than a cheap plate by Friday’s NFP report. Time to brace yourselves.”

According to Zeberg’s labyrinth of models and warnings, late 2024 has already been whispering tales of coming economic storm clouds-cracks in the labor market and all.

“This deterioration isn’t some fleeting quirk; it’s a sinister sign that the tide is well underway to turn,” hisses Zeberg, eyes gleaming with your local fortune teller’s glee.

So, a Fed cut? It’s less about putting a band-aid on a wounded economy and more about doing a victory dance on a sinking ship-hoping no one notices the water rising.

And while markets might seem unstoppable, shouting ‘to the moon!’ as Bitcoin hits record highs, Zeberg warns this euphoria might just be the final desperate gasp of an aging bull-like a lavish ego swell before a fall from the pedestal.

“This is a sword with two edges, my friends: while a pivot might buy a few more moments of madness, it only paints a target for the inevitable crash-an encore of chaos far worse than the first act.”

And to make the tale even juicier, Zeberg foresees a potential market crash of historic proportions-perhaps more dramatic than the 1930s, with all the clatter and chaos included. Grab your popcorn. 🍿

Read More

- Gold Rate Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Silver Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Bitcoin’s Christmas Miracle? Analysts Bet Big Bucks Amid Crypto Chaos 🎅💰

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Crypto Chaos: Trump’s CFTC Chair Pick Stalled by Winklevoss Twins’ Whims 😏

2025-08-07 14:54