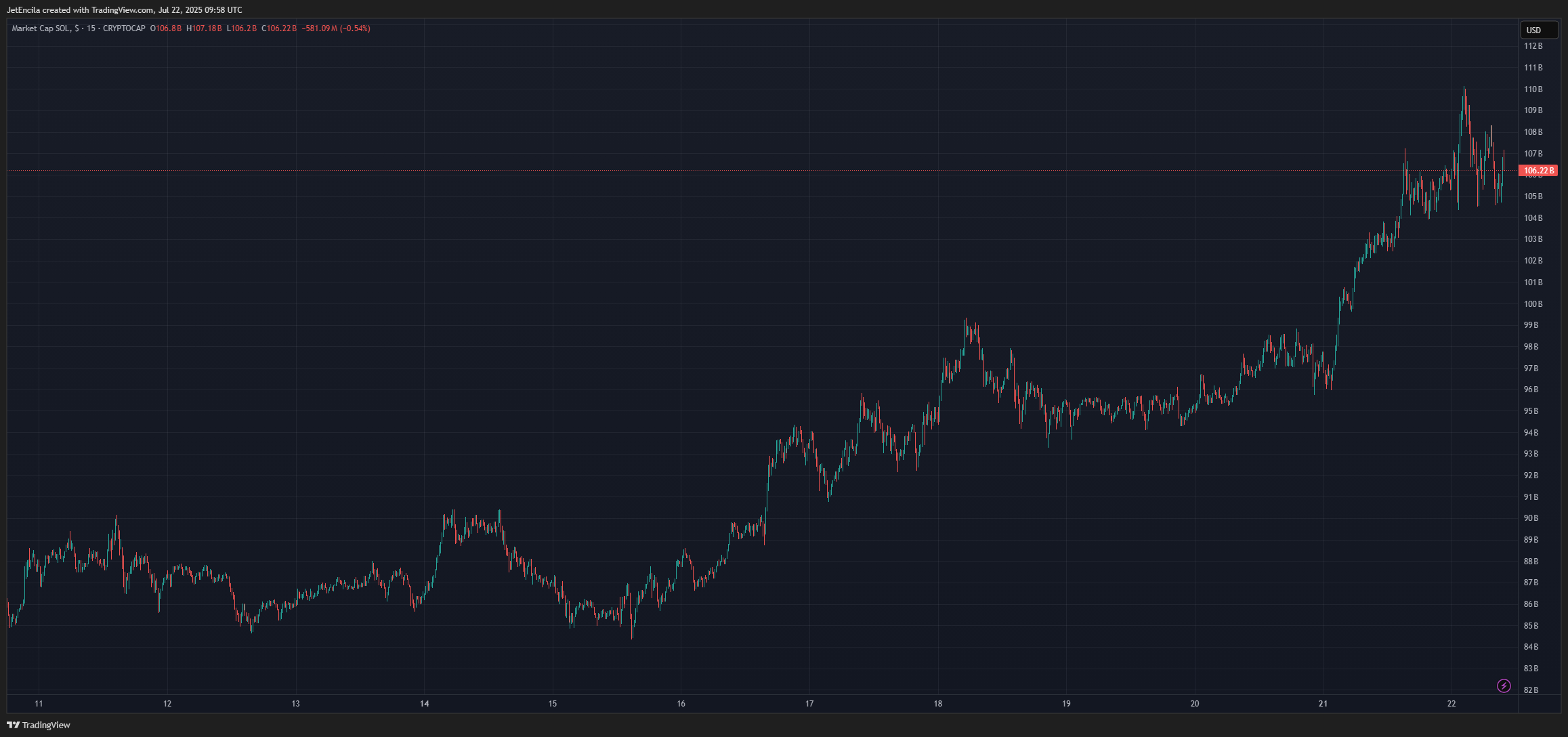

So, Solana decided to throw a party for itself on Monday. You know, the kind of party where SOL tokens show up wearing price tags that say $195.50 each. This little shindig pushed its total valuation over $105 billion—for the first time since January 25th, which feels like three blockchain epochs ago. But hey, who’s counting? 😎

Of course, this surge has everyone feeling optimistic—or at least pretending to be. Short-term gains are impressive, but let’s not kid ourselves: optimism in crypto is often just another word for “hoping we’re not wrong.” Questions linger about whether this recovery runs deeper than a puddle after a light drizzle. 🌧️

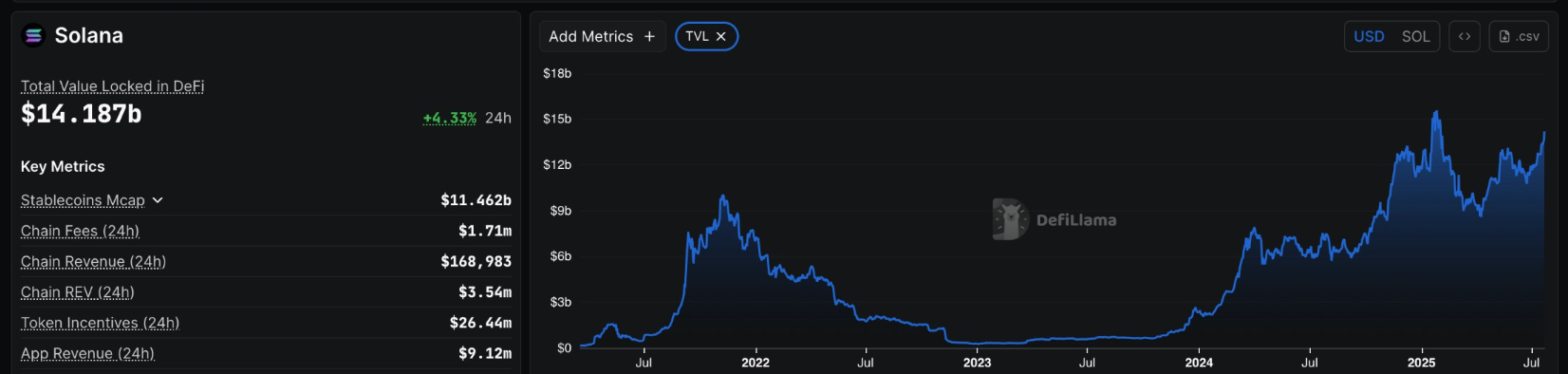

Meanwhile, something called Total Value Locked (TVL) in Solana’s DeFi ecosystem hit $14.18 billion. Yes, you heard me right—billions. Apparently, this is the highest it’s been in six months, back when SOL was busy setting all-time highs and probably bragging about them to Bitcoin at the bar. 🍻

But here’s the kicker: most of that increase isn’t because people suddenly started dumping their life savings into Solana’s lending pools and vaults. Nope. It’s because when SOL goes up, everything already locked inside magically becomes worth more. So technically, users haven’t had to do much besides sit there looking smug while their balances inflate. Truly inspiring stuff. 🎈

Experts, being the buzzkills they are, are keeping an eye on actual new deposits. Because as we all know, token value and real-world demand sometimes have the relationship dynamics of two cats forced to share a cardboard box. One might climb higher, but the other could care less. 🐱🐉

DEX Trading Volume: More Action Than Last Week

Between July 14th and July 20th, Solana’s decentralized exchanges handled over $22 billion in trading volume. Not too shabby compared to the $19 billion from the week before. Raydium led the pack with $8.4 billion, followed by Orca ($6 billion) and Meteora ($5.3 billion). Clearly, these platforms are pulling out all the stops to make sure no one accuses them of slacking off. 💪

Still, even with this uptick, weekly volumes remain laughably far from the $98 billion peak set back in mid-January. So yes, things are warming up—but if you’re expecting boiling lava levels of activity, you might want to grab some popcorn and wait a bit longer. 🍿

Staking: The Unsung Hero of Network Security

Let’s talk staking, shall we? According to on-chain figures, around 355 million SOL tokens are currently staked with validators. That amounts to roughly $69 billion—or about 65% of all circulating tokens. These coins aren’t hanging out in DeFi pools or swapping hands on DEXes; they’re busy doing what they were born to do: securing the network and validating transactions. Very noble of them. 🛡️

And oh, did I mention? Someone somewhere predicts SOL will rise another 3.50% and hit $210 by August 21st, 2025. Predictions in crypto are about as reliable as weather forecasts on Tatooine, but sure, why not? Sentiment is currently bullish, and the Fear & Greed Index sits at 71 (Greed), which basically means everyone’s walking around like Gordon Gekko reincarnated. 📈

In the past 30 days, SOL saw 19 green days out of 30, along with 8.61% price fluctuations. Strength? Volatility? Who can tell anymore? All we know is that CoinCodex data confirms what we already suspected: markets are chaotic, unpredictable beasts. Much like your cat when you accidentally step on its tail. 😺

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD ILS PREDICTION

- Brent Oil Forecast

- USD THB PREDICTION

- Solana Staking Soars! Is $60 Billion the Secret Sauce for Success?

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Silent Whales: Bitcoin’s Shadow War on Binance

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

- EUR NZD PREDICTION

2025-07-22 19:36