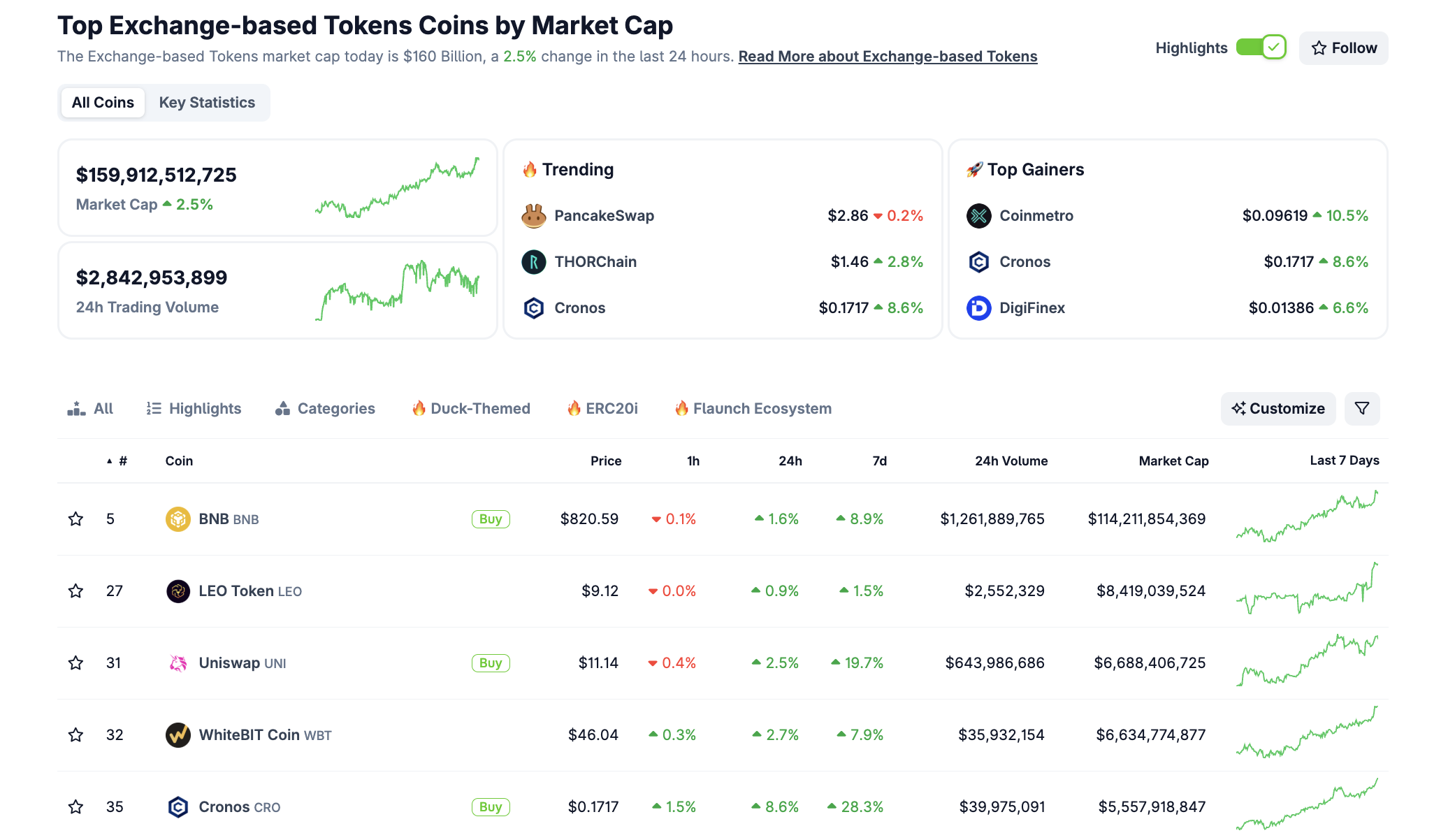

BNB dominates the so-called “exchange token” segment like a plucky upstart at a debutante ball, amassing capital from institutions and community hopefuls who stare at their screens with the fervor of the faithful before a slot machine. 🎰

Unchallenged Monarch Among Exchange Tokens

The Binance Coin (BNB) reached a level of glory at its all-time high (ATH) in July that would make even the Drones Club look on with envy. Though the coin’s price has experienced a slight correction-one imagines a brief swoon before righting itself-it’s still trading at a stately $811 at the time of writing, only slightly less than the price of entry-level sneakers.

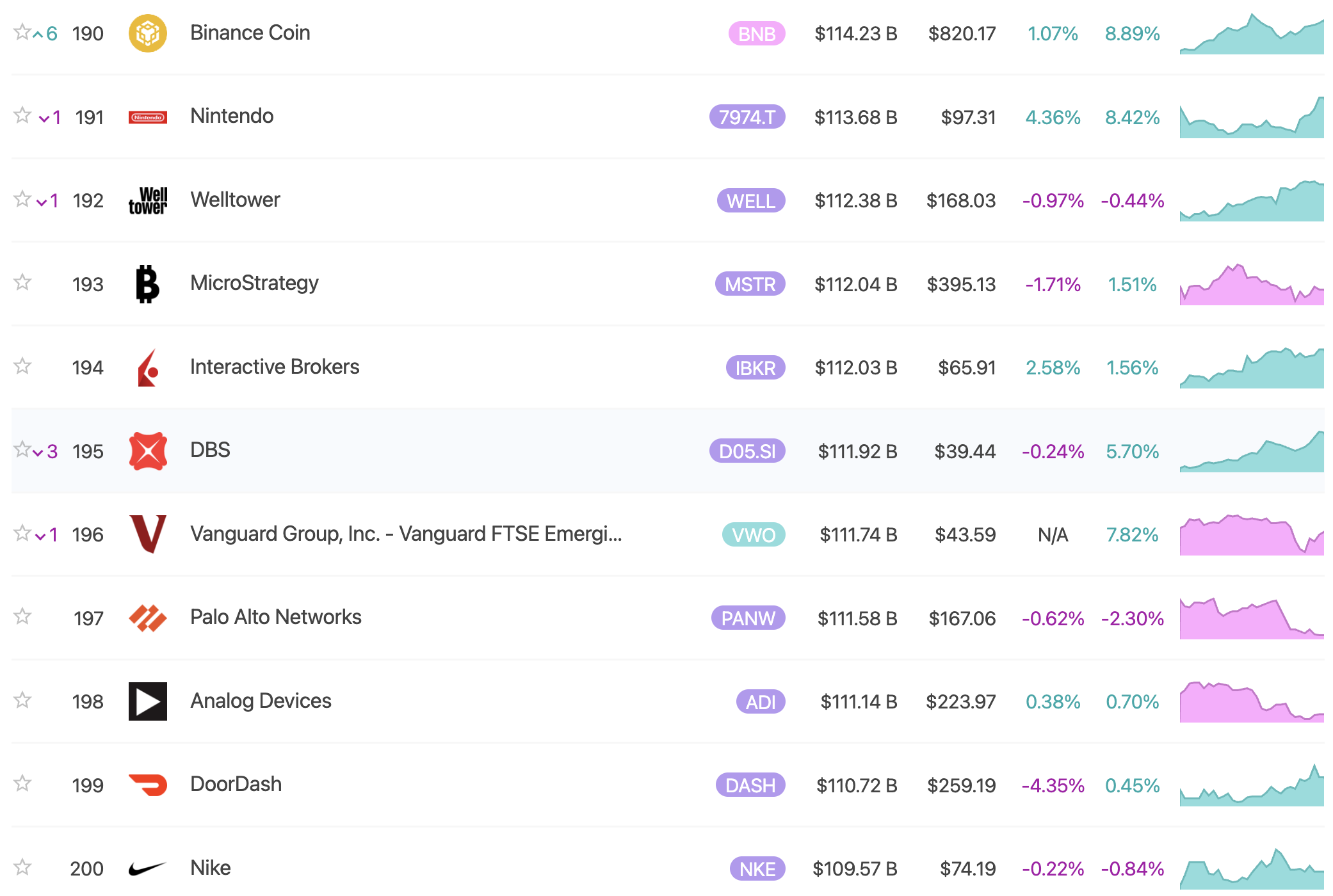

This unbridled rally has propelled BNB’s market capitalization to $114.36 billion, now eclipsing Nike and MicroStrategy. Nike, presumably, is reviewing its corporate strategy, wondering if trainers should come with blockchain integrations. 👟

“That strength isn’t cosmetic – it powers both Binance and BNB Chain, and the ongoing burn tightens supply as on-chain activity grows,” commented X user Daniel Nita, pausing only to check if his WiFi was still functioning.

The growth spurt leaves BNB reigning supreme, now accounting for an outrageous 81% of the market capitalization of exchange-based tokens. Surely, the other tokens are busy typing up their résumés.

This apparent magnetism reflects Binance’s brand (something between myth and marketing miracle), and the charms of the BNB Chain ecosystem within DeFi, NFTs, and those RWAs one hears so much-though rarely sees at cocktail parties.

PancakeSwap, the largest DeFi protocol on the BNB Chain, also finds itself swept up in this froth-like a particularly enthusiastic guest at a champagne reception. BNB’s recent ATH has lured new capital into CAKE, which, contrary to the name, offers precisely zero calories but much liquidity.

Outside the hallowed realms of Bitcoin and Ethereum, BNB now attracts institutions seeking “strategic reserves,” which sounds suspiciously like prepping for a post-apocalyptic scenario where only tokens are accepted (but please, no canned beans). Nasdaq-listed company BNC (formerly Vape-surely the marketing department is exhausted) recently parted with $160 million for 200,000 BNB, making it the largest institutional holder globally. They might start an annual BNB parade soon, trumpets optional.

Meanwhile, Windtree Therapeutics eyed a cool $520 million for its BNB reserve ambitions, heralding what may be the next corporate fad: the “BNB treasury” craze. Don’t worry, there will be mugs and tote bags.

Will BNB Strike That $1,200 Note?

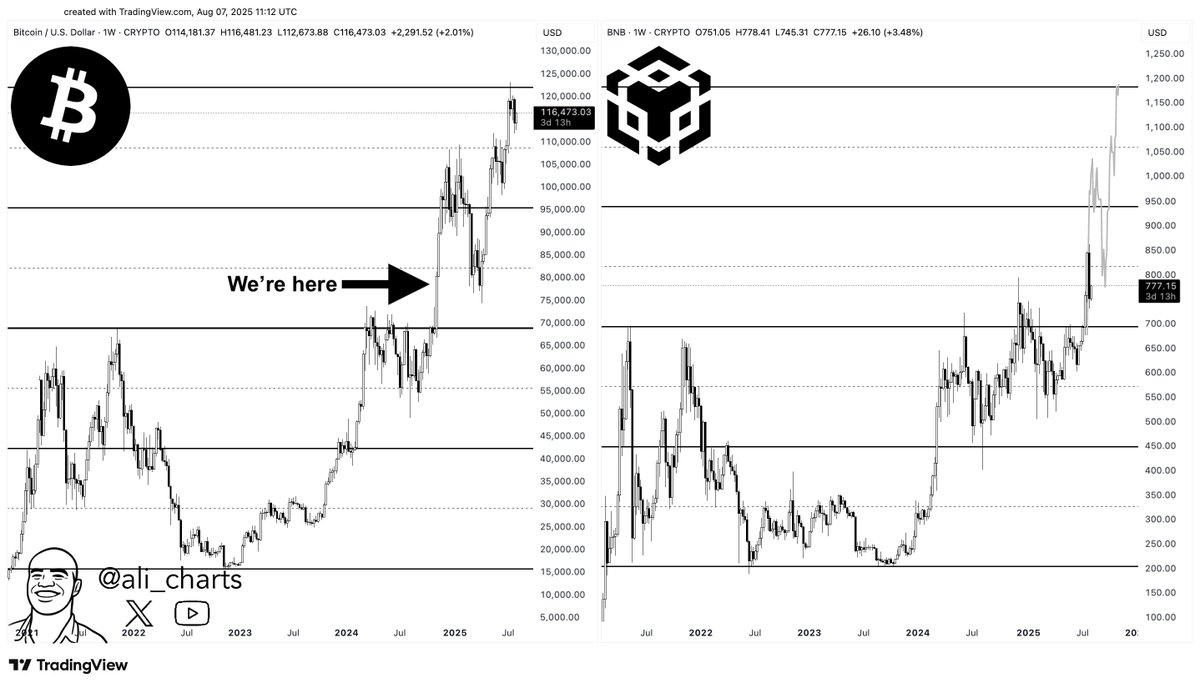

Crypto analyst Ali, who presumably spends more time with trading charts than friends or sunlight, shared on X that BNB’s price structure eerily mirrors Bitcoin’s own ballet. “We’re in the early rally phase!” claims Ali, no doubt clutching his mouse like a rosary.

The outlook-at least when peering through the rose-tinted glasses offered by BeInCrypto-appears bullish, though of course, as soon as BNB hits a new ATH, a flurry of medium-term holders leap like startled cats, selling off tokens and stirring up predictable selling pressure. Leverage, as always, remains the siren call of the reckless-so do keep an umbrella handy. ☔

Read More

- Gold Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD HKD PREDICTION

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

- 🤑 Conservatives Declare War on Digital Dollars: Cash is King! 👑

- When Planes Meet Pixels: The Crypto Revolution Takes Flight ✈️💸

2025-08-11 11:54