In the latest chapter of the crypto circus, the hapless Chainlink and Uniswap have found themselves in a predicament most unbecoming of their erstwhile grandeur. The former, once a darling of the decentralized oracle set, has tumbled below its pivotal support zone like a tipsy debutante at a society ball. Uniswap, not to be outdone in this farce, has been clinging to a descending trendline with the desperation of a second-rate climber on a crumbling precipice. Both tokens, it seems, have been subjected to the whims of the market’s fickle fancy, their prices oscillating with all the predictability of a Waugh novel’s plot.

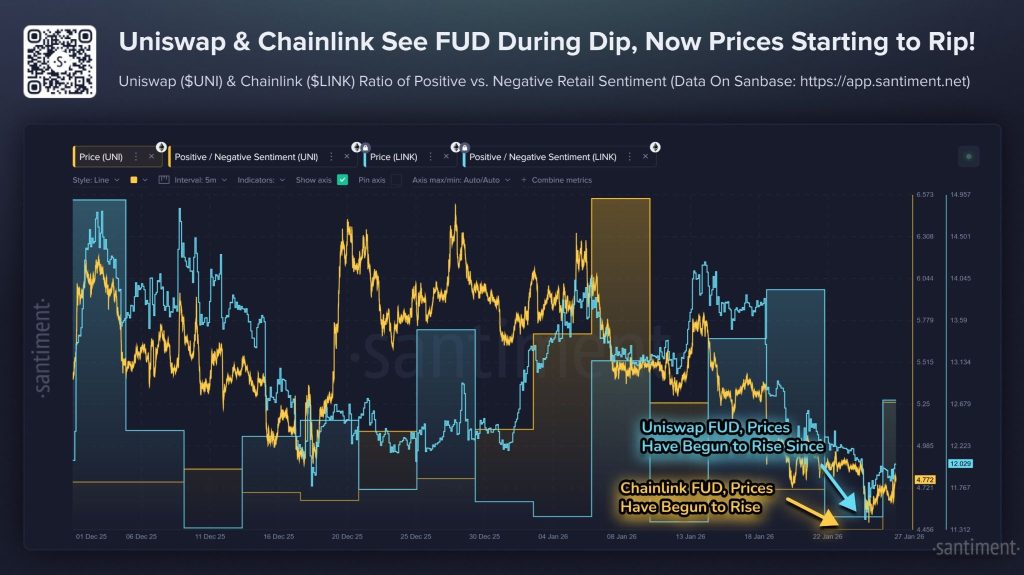

Santiment, that purveyor of market sentiment, reveals a tableau of woe: traders, it appears, have been nursing a collective case of the vapors, their negative commentary dragging prices lower with all the subtlety of a brass band at a funeral. Yet, in this morass of despair, the bulls-ever the optimists-have rallied, preventing a complete rout. With retail investors having fled like rats from a sinking ship, the stage may be set for a dramatic resurgence, though one suspects the gods of finance are merely toying with these poor tokens for their amusement.

Chainlink: A 20% Recovery, or Mere Wishful Thinking?

After months of consolidating within a range so predictable it could bore a clock, LINK’s price finally broke out-alas, in the wrong direction. The bears, those brutish creatures, have dragged it below its support zone, leaving the bulls weak and dispirited. Currently, LINK hovers near $11.85, clinging to a support band like a socialite to her last shred of dignity. The RSI, that fickle indicator, sits below 40, suggesting momentum as weak as a tepid cup of tea. The MACD, meanwhile, remains bearish, though one detects a hint of fatigue in its downward march. Should LINK stabilize, a rebound to $12.50 or even $14.00 is conceivable. But let us not forget: a breakdown below $11.70 would be as disastrous as a scandal in the drawing room.

Uniswap: $6 or Bust? One Can But Dream.

Uniswap, poor soul, trades near $4.82, its price chart a lamentable descent from August’s giddy heights. Lower highs and rebuffed attempts at resistance have left it languishing near $4.70, consolidating like a guest trapped in an interminable dinner party. Momentum indicators, though weak, hint at stabilization-the RSI hovers near 38-40, and the MACD’s histogram bars are flattening, suggesting the worst may be over. If UNI holds above $4.70, a rebound to $5.60 is possible, and from there, the fanciful $6.60-$8.60. But should $4.70 fail, a drop to $4.20 looms like a looming cloud on a picnic day.

The Bottom Line: A Farce or a Recovery?

In this tragicomedy of tokens, both LINK and UNI find themselves in a similar predicament: prolonged consolidation near support zones, weakening downside momentum, and sentiment rising from the depths of despair. The setup, one must admit, is ripe for a short-term recovery-provided, of course, that key supports hold and the market does not decide to throw another spanner in the works. But let us not be too hasty in our optimism; after all, in the world of crypto, as in the pages of Waugh, nothing is ever quite as it seems.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- A Gentleman’s Guide to Dogecoin’s Imminent Gallop-Or Perhaps a Tumble

2026-01-28 21:36