Ah, Arbitrum! That elusive little token that’s been playing a game of “keep away” at the $0.50 mark—like an overly-ambitious kid blocking the cookie jar, preventing the bulls from crashing through. For weeks, this stubborn resistance has kept ARB moping just below its sweet spot, each rallying attempt slapped back like a bad joke. But don’t toss out the popcorn just yet—pressure’s mounting like a kettle on the verge of boiling over. If the brave buyers manage to turn that resistance into support, we might see an exhilarating rollercoaster ride towards $0.74, possibly even a dollar, in the not-so-distant future. 🎢

Arbitrum’s Short-Term Mood: Cool, but Not Cold

After flashing some recovery signs like a teenager’s first crush, ARB now seems to be catching a cold shoulder from the market—turns out, the bubble risk indicator from Into The Cryptoverse is nudging back into the “oversold” zone. No need to panic; it’s more like a minor cold rather than a plague. The trend is slowing, maybe just catching its breath, but the blue zones—those lovely undervaluation areas—suggest there’s still room for a comeback. If the structure holds, this dip might just be a chance for buyers to jump in and do their dance. 🕺💃

Range Anxiety: The Make-or-Break Zone

Right now, ARB is cozying up just under the $0.50 resistance—like a cat plotting a pounce. Historically, that level has been a magnet for breakouts. The latest chart from Crypto Foysal shows ARB wedged in a tight little coiling structure, ready to spring. If those bullish bulls can crank up the volume and smash through, we’re heading towards $0.74 or even $1.22—like a missile on a mission. But until then, it’s stuck in a boring range, with the bottom at around $0.28—yep, just hanging there, like a forgotten sock behind the sofa. 🧦

And bonus irony: that same bubble risk indicator isn’t flashing “fire danger,” indicating ARB isn’t overheating just yet. So, expect more sideways passing—not a moonshot just yet, but more like a slow burn until a volume surge spurs a decisive move.

The Liquidity Pool: Not All Doom and Gloom?

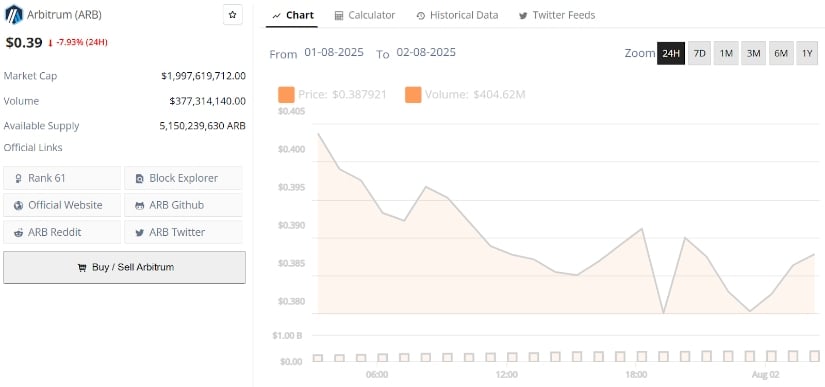

The recent insight from SMcapitalclub looks at a gloomy 6-hour chart, hinting at a rising wedge that resembles a pre-breakdown version of a holiday turkey just before deflating. Should that trendline give way, ARB could slip into the sub-$0.36 abyss, where a giant liquidity magnet sits munching on the market’s fate. Think of it as a “Come hither” sign for traders—an easy target during corrections. But don’t despair! This liquidity chasm might just be the setup for a heroic rebound, a classic “grab the liquidity, then go vertical” move. 🏦⚡

Charting the Big Breakout: Will ARB Rewrite Its Own Script?

Mahdi’s detailed chart paints a tantalizing picture: if ARB can stay above the higher lows around $0.32–$0.42 and reclaim the sacred $0.50 line, we’re talking about a breakout from the long hibernation—a fresh start after months of mental limbo. That could flip the script from stagnant sideways snooze to a bullish party, signaling that the trend is finally shaking off its sleep and waking up with a vengeance. The hype train might just be warming up—so grab your popcorn again. 🍿🚀

Short-term volatility? Sure. But structurally, ARB still has a shot at a comeback. If the volume kicks in and momentum surges, the Fibonacci levels on Mahdi’s chart could serve as the next stop on our whimsical ride upward. So stay tuned, amigos—this tale isn’t over yet.

The $1 Dream: A 2025 Fantasy or Within Reach?

ARBitrum’s current setup isn’t exactly painted in gold, more like a modest sketch on a napkin. Long-term, it’s all about building a sturdy foundation—healthy liquidity pockets, no bubble-induced fireworks, just a slow grind up the ladder. Reclaim $0.50, create a higher low, and suddenly that $1 goal in 2025 doesn’t seem so far-fetched—more like a calm, promising journey into the sunset. Or at least, that’s the fantasy people keep whispering in the crypto shadows. 🌅

Read More

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2025-08-02 11:06