And so it was, in the madhouse of modern finance, that the specter known as ARB shook off its lethargy and, with a diabolical grin, vaulted over the ramparts of resistance. A fever seized the masses-from the petty speculator in his Moscow flat to the granite-faced institutionalist in London. Whispers, seductive as Satan’s own, suggested a flight towards the gilded heights of $1.30. A most dubious paradise!

A Base, You Say? More Like a Cemetery of Hopes! 💀

Some bespectacled wizard, no doubt with a crystal ball clouded by cheap tobacco smoke, proclaims the weekly chart has ‘constructed a base.’ I say it resembles nothing so much as a rounded bottom, the kind a well-fed bureaucrat might possess after a lifetime of state banquets. This so-called ‘demand zone’ near $0.50 is where dreams go to be accumulated, my friends, before being launched into the ether on a rocket of pure speculation. The volume dynamics? A chorus of the damned!

One ‘Analyst munky’-a name surely bestowed by a mischievous primate-declares ARB could “easily double.” Easily! As if one might easily sprout wings and fly to the moon. The next resistance, a paltry $1.30, awaits like a mirage in the desert. A most entertaining forecast, if one enjoys fairy tales.

A Torrent of Capital, or a Plumbing Leak? 💸

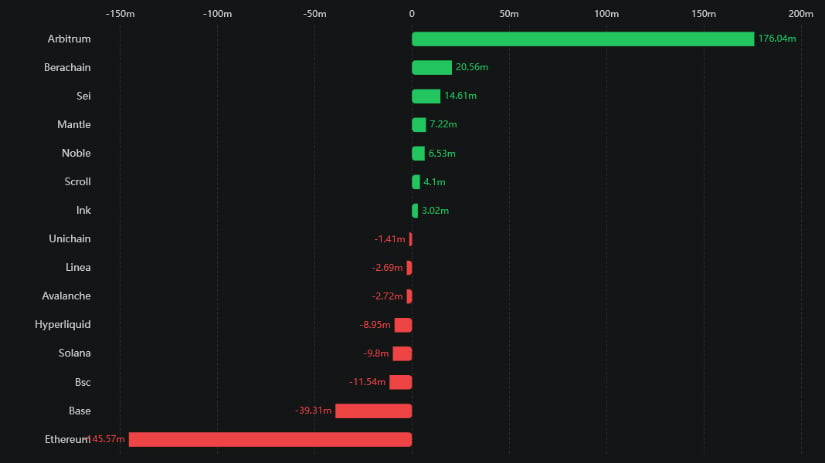

Behold! A miraculous inflow of $176 million! A sum so vast it would make a Soviet minister blush. It has flooded into Arbitrum, leaving rival chains-Berachain, Sei-gasping in the puddles of their pathetic $20M. This is not mere capital rotation; it is a stampede of lunatics, convinced they have found the one true path to salvation. It lends ‘weight’ to the bullish setup, they say. I say it lends weight to the notion that humanity has finally lost its collective mind.

Arbitrum, that glutton, feasts on $176M while others starve.

The Price Outlook: A Tightrope Over the Abyss

The coin has bravely conquered the summit of $0.5200. A heroic feat! Now it eyes $0.5825, then $0.6750, where the ‘overhead supply begins to thin.’ A charmingly optimistic phrase, suggesting the air up there is easier to breathe. A supportive trendline, drawn by some technical necromancer, guides this ascent. One must ask: is it a guide rope, or a hangman’s noose?

Another sage, ‘Tom B,’ warns that failure at $0.5200 invites a swift descent to the catacombs near $0.48. For now, the price consolidates, caught between hope and despair, much like a man deciding whether to jump.

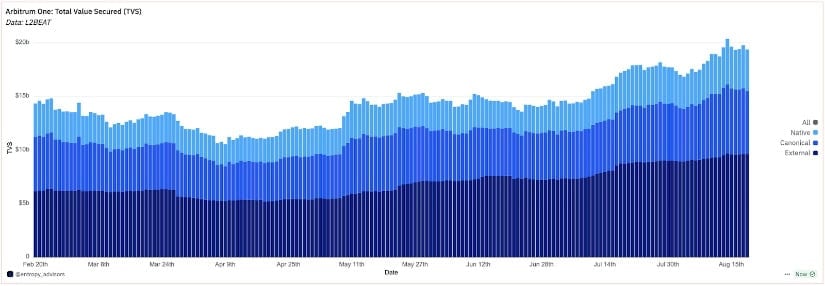

The TVL Milestone: A Pyramid of Paper Gold 🏛️

Arbitrum’s Total Value Locked has swelled to a grotesque $20 billion. A monument to… what, exactly? Sticky demand? User confidence? Or perhaps mass delusion? It now holds nearly half of all L2 value, a terrifying concentration of faith in a digital entity. The growth is described as ‘broad-based,’ which in this context means the madness has infected every stratum of society.

This ‘fundamental,’ they claim, supports the ‘technical.’ A comforting lie, like a warm blanket on a cold night. It suggests stability. I suggest you hold onto your hat.

Final Musings: To the Stars, or the Asylum? 🌌

The setup is compelling, a perfect storm of technicals and inflows. But sustainability hinges on a push through $0.67-a feat requiring not just momentum, but a suspension of the laws of gravity and reason. Success promises a giddy flight to $1.30. Failure, a most humiliating crash.

The true story, however, is the ecosystem itself: $20B locked, dominance assured. It builds a floor, they say. I say even the most solid floor can collapse into the basement if the foundations are built on greed. Can Arbitrum hold its momentum? Ask the chicken before it is counted. Ask the devil, for he is surely brokering these deals.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Silver Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- USD HKD PREDICTION

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-23 01:47