As reported by the discerning citizens of the local press, the central bank is contemplating the possibility of issuing a new ruleset to allow banks to enter the cryptocurrency business. Local analysts, ever eager to speculate, say this would open the door for more people to use crypto and stablecoins, though one might question whether such a measure is a step toward progress or a leap into the unknown.

The Facts

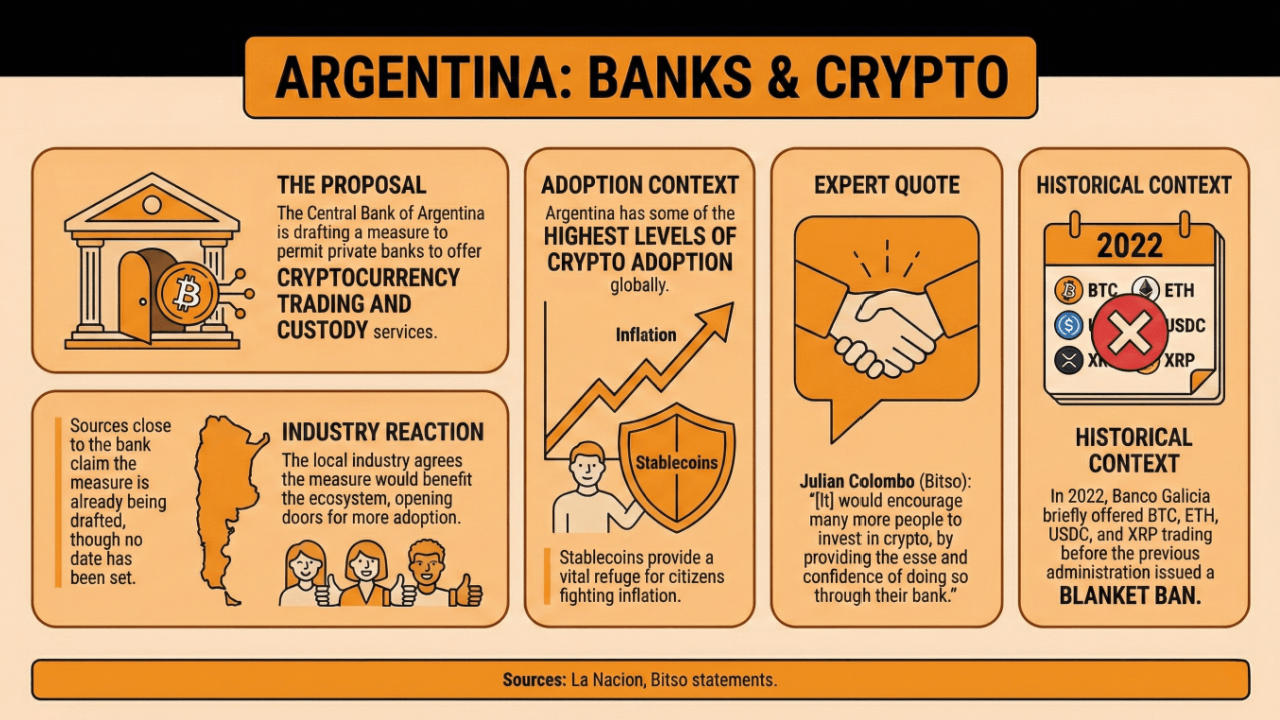

The Central Bank of Argentina is contemplating a measure that would permit banks to offer cryptocurrency trading and custody as part of their service offerings, a proposition as thrilling as a ballroom dance in the 18th century. 🎩💰

According to La Nacion, a local newspaper, sources close to the bank claimed that it is already drafting a measure to open this possibility for private banks. Neither a date nor details on the subject were offered, a mystery as profound as the origins of the universe. 🕵️♀️

Members of the Argentine cryptocurrency industry agreed that such a measure would benefit the national crypto ecosystem, opening the doors for more people to test and use alternatives such as bitcoin as stablecoins, though one wonders if they are more interested in the coins or the attention. 🤔

Argentina is one of the countries with the highest levels of crypto adoption, as stablecoins provide a refuge for citizens to fight inflation and devaluation. Julian Colombo, Bitso’s manager for South America, stated that the measure “would encourage many more people to invest in crypto, by providing the ease and confidence of doing so through their bank,” a sentiment as sincere as a politician’s promise. 🎯

In 2022, Banco Galicia, a local institution, started offering these services, allowing its customers to trade BTC, ETH, USDC, and XRP on its platform. Nonetheless, the central bank, under a different administration, quickly issued a blanket ban on banks offering these services, a decision as fickle as a summer romance. 💔

Why It Is Relevant

If such a decision is taken, it would turn Argentina into a crypto pioneer in Latam, given that other countries like Bolivia and Venezuela have hinted at taking similar measures but have not implemented them, a testament to their remarkable patience. 🚀

As experts state, this move would give the crypto system a new push as a supported alternative to traditional rails, allowing everyday citizens to access crypto savings methods from their banks, a development as exciting as a new season of a beloved drama. 🎬

Nonetheless, the central bank should examine the effects of introducing these assets in the context of the Argentine economy, a task as daunting as deciphering a love letter written in code. 🔍

Looking Forward

While no date was given, industry insiders expect this measure to be effective by April 2026, per La Nacion’s report, a timeline as precise as a clockwork mechanism. ⏳

FAQ

- What measure is the Central Bank of Argentina considering?

The bank is drafting a proposal to allow private banks to offer cryptocurrency trading and custody services, a step as bold as a ballroom dance. 💃 - What impact could this have on crypto adoption in Argentina?

This measure could enhance the national crypto ecosystem, encouraging more citizens to invest in cryptocurrencies like bitcoin and stablecoins, though one might question if they are investing or simply following the crowd. 🧑🤝🧑 - How have local banks previously engaged in crypto services?

In 2022, Banco Galicia began offering trading in cryptocurrencies like BTC, ETH, USDC, and XRP, but a prior administration banned these services, a decision as capricious as a child’s whim. 🍬 - What are the expectations for the implementation of this measure?

Industry insiders predict that the new measure could be effective by April 2026, positioning Argentina as a leading crypto pioneer in Latin America, a title as coveted as a royal title. 👑

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD HKD PREDICTION

- EUR HKD PREDICTION

- ARB PREDICTION. ARB cryptocurrency

- XRP Stands at $2.96-Is it the Final Battle or Just a Whimper? 🚨

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- ETF Mania: Bitcoin And Ethereum Funds Hit Record $40 Billion Week

2025-12-07 13:04