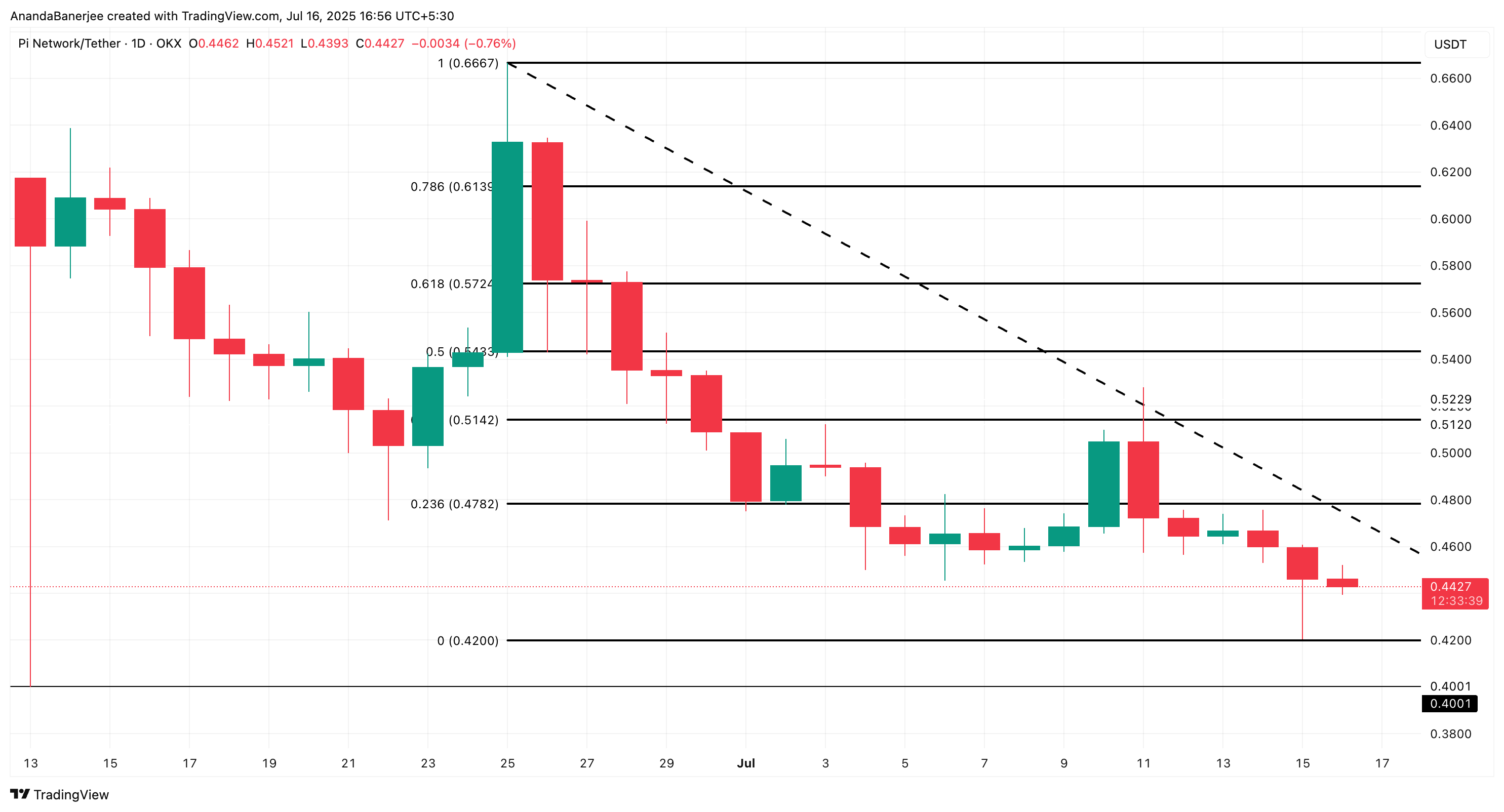

It is a truth universally acknowledged, that a token in possession of a precarious price must be in want of a bullish indicator. Pi Network’s price, currently hovering just above $0.44, finds itself in a most delicate situation, with a 10% drop to the $0.40 zone looming like a storm cloud on the horizon.

Yet, amidst the sea of red signals, one beacon of hope remains. A key indicator suggests that the bulls, though seemingly vanquished, might yet rise to reclaim their throne. Should PI price ascend to the lofty heights of $0.47, the bearish forecast may be rendered as obsolete as a gentleman’s letter of introduction.

The Supertrend: A Red Flag Indeed

The Supertrend, a tool of great repute among market analysts, has been a constant companion to PI’s daily candles since mid-June. When this indicator appears above the price action, cloaked in a crimson hue, it serves as a stern warning to traders: “Beware, for the bears are in control.”

Alas, this red zone has not only persisted but has expanded, much to the chagrin of those who hold dear the hopes of a bullish turn.

At present, the Supertrend’s resistance stands at a formidable $0.5450, a barrier that PI must breach to invalidate the bearish prophecy. Until such a feat is accomplished, the market remains under the shadow of the bear.

The RSI: A Hidden Gem of Bullish Divergence

But fear not, for there is a twist in this tale. Despite the bearish trend, the Relative Strength Index (RSI) reveals a glimmer of hope. While PI’s price has been making lower lows, the RSI, a measure of momentum, has been forming higher lows. This divergence, often a harbinger of change, suggests that beneath the surface, buying pressure is quietly accumulating.

The RSI, a metric that tracks the speed and magnitude of price changes, currently stands at 36, indicating that PI may soon enter oversold territory. Should the market sentiment remain bullish, a reversal of fortune is not out of the question.

Exchange Flows: A Tale of Two Cities

While the momentum may be improving, the story of exchange inflows is less encouraging. In the past 24 hours, over 5.7 million PI tokens have found their way into CEX wallets, a sign that selling pressure is still a formidable force.

PI Price Analysis: A 10% Dip Looms

From a structural perspective, Pi Coin has relinquished its 0.23 Fibonacci level at $0.47 and is now consolidating around the $0.44 mark. The next significant support lies at $0.42, and should this level be breached, a 10% decline from current levels is a distinct possibility.

This Fibonacci retracement pattern, plotted from the last swing high ($0.0067) to the recent swing low ($0.4200), serves to chart the downside risk, or rather, the bearish bias.

Should PI price manage to transform $0.47 into a support level, reclaiming the Fibonacci, the bulls may yet regain control. However, until this transformation occurs, the trend remains decidedly downward. A clear uptrend will only emerge if PI breaches the $0.5142 mark.

Thus, PI price risks a 10% descent toward $0.40 unless the bullish divergence proves to be a faithful ally. For now, the bears hold the upper hand, but the momentum indicators whisper of a potential change in the winds.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Crypto Chaos: Ripple’s Legal Boss Warns of an Endless Puzzle of Regulatory Nonsense

- Solana’s Breakout: Is $200 Just the Beginning? Find Out Now!

- TRON’s Stablecoin Chaos: Whales Wobble, Binance Falls! 🐉💸

- Gold Hits New Heights While Bitcoin Seems to Be Taking a Nap – You Won’t Believe This!

- EUR CHF PREDICTION

2025-07-16 18:41