Ethereum’s 2026 Upgrade: Hegota or Bust? 🚀

Hegota is like a blockchain multivitamin, designed to keep Ethereum healthy and efficient. It’s part of a new upgrade schedule that’s less “chaotic sprint” and more “well-organized marathon.” 🏃♂️💨

Hegota is like a blockchain multivitamin, designed to keep Ethereum healthy and efficient. It’s part of a new upgrade schedule that’s less “chaotic sprint” and more “well-organized marathon.” 🏃♂️💨

And if you thought that was enough to get the party started, think again! The selling pressure is hanging around like an unwanted holiday guest, making it clear that ETH isn’t exactly ready for a comeback tour just yet.

Young Ki, the whimsical wizard at the helm of CryptoQuant, has made a startling meatball drop: Cryptoblobby Cramer is as bearish on Bitcoin as a grumpy grandma on Christmas morning.

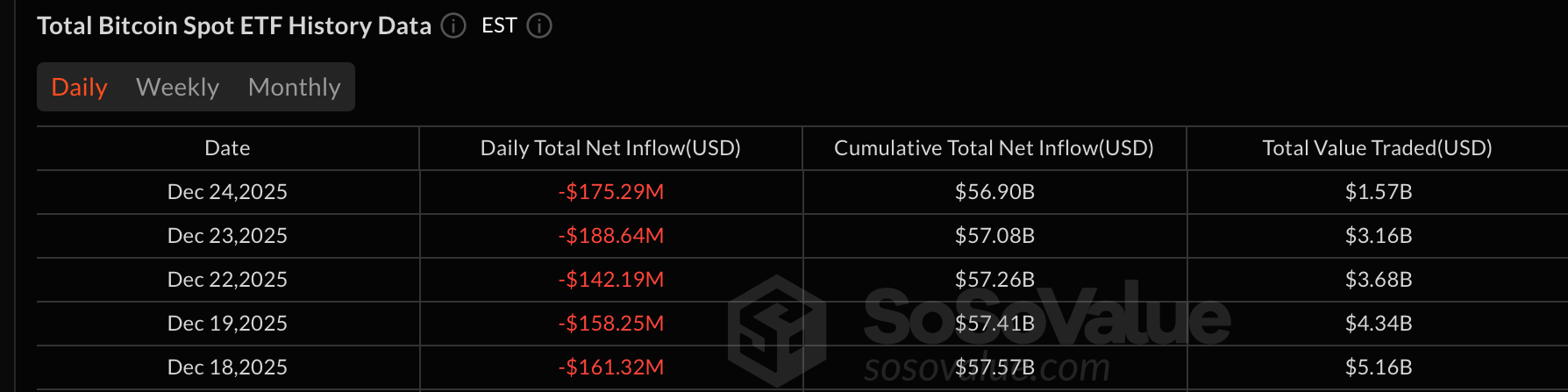

The holiday season, a time for joy and reflection, has instead become a carnival of financial reckoning. The crypto exchange-traded funds (ETFs) lie exposed, their wounds bared for all to see. Investors, those fickle souls, flee Bitcoin and Ether like rats from a sinking ship, while XRP and Solana bask in their modest, yet defiant, inflows. Ah, the irony! 🎪🐀

While this bit of spectacle unfolded, the saga of XRP unfurls into murkier territories. A specter known as the “death cross” draws nearer, hinting ominously at a precipice from $1.858 towards the austere chasm marked at $1.3762-a journey of almost quarter-and-a-half its former grace.

Perusing the parchment of a VanEck scroll (dated c. 2023), Matthew Sigel and Patrick Bush, oracle of digital assets and analyst of the calorie-packed kind, declare: when the hash rate-BTC’s digital heartbeat-falters, the coins rise, guided by spectral hands from 2014. Ever wondered? Now you may wonder less!

Over at Binance, the MOVE/USDT pair was practically hosting a rave, with Spot trading volume doing a six-fold jitterbug compared to its usual sedate 20-day average. One imagines the traders there were either celebrating or drowning their sorrows-hard to tell which.

Grayscale Investments, ever the diligent bureaucrat, has officially filed a second amendment to its S-1 registration statement with the SEC, refining the mechanics for converting its existing Avalanche Trust into a flagship spot ETF. 📄

As of right now? Oy, the schpilkes! HYPE is hanging around $23.942. Down! Down I tell ye! 1.39% today, and a whopping 11.9% this week. It’s a fire sale, folks! A fire sale!