NFTs Soar 12% While ETH Jumps 45% – What’s Next? 🚀

//media.crypto.news/2025/12/Screenshot-2025-12-20-at-09.26.17.webp”/>

//media.crypto.news/2025/12/Screenshot-2025-12-20-at-09.26.17.webp”/>

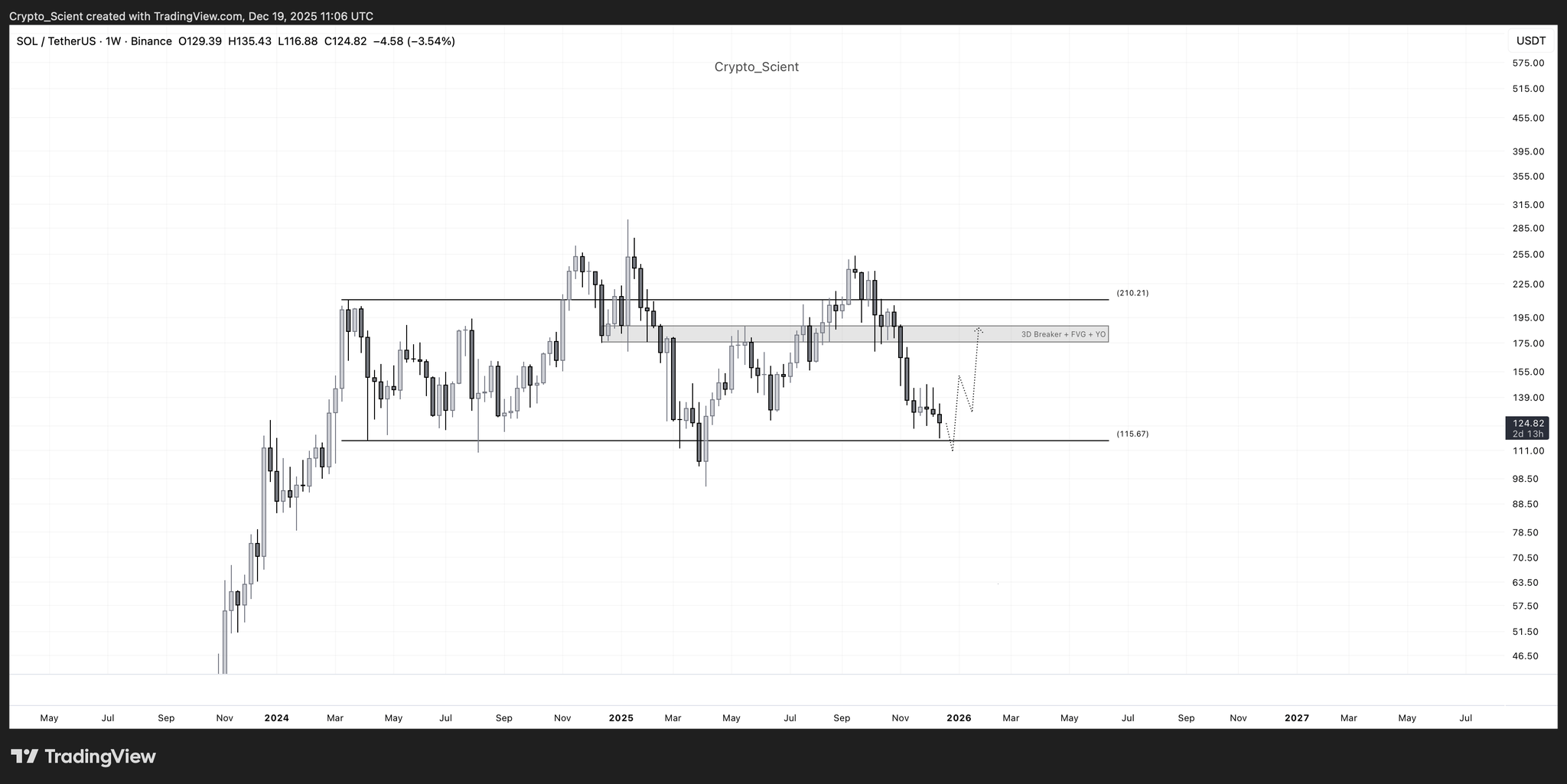

On Friday, Solana clawed its way back from the brink, surging 7.7% towards the $125 mark. Yet, this fleeting victory was preceded by a brutal fall of nearly 9% on Thursday, plunging its value to $116-a nadir not witnessed since April. Breaching the once-mighty $120 support, Solana now teeters on the edge, its future uncertain.

A recent CryptoQuant chart, more alchemical than analytical, presents the NVT Golden Cross-a mystical artifact smoothed by a 100-day moving average. It offers a mirror to Bitcoin’s soul, reflecting the absurd dance between network valuation and the mechanical squishing of transactions. 🪄

Thus, BlackRock Inc.-that colossus of asset management, that shepherd of trillions, that vampire squid with a LinkedIn profile-has deigned to grace the world with a noble quest: the recruitment of digital asset high priests across the civilized world (and a few places still arguing about whether they’re civilized).

For those living under a rock (or just new to the party), Bollinger Bands are a fancy way of saying, “Here’s your price range, try not to fall out of it.” Developed by John Bollinger, this indicator uses a 23-day moving average plus two deviations on either side to give the market a mood ring. Currently, XRP is barely nudging the bottom of the range near $1.82-like a teenager trying to sneak into the fridge without getting caught. Not panic, but also not control-more like, “Meh, we’ll see.”

The Plain Truth, As I See It

Strategy executive chairman Michael Saylor, whose company has been buying Bitcoin aggressively for nearly five years since adopting a Bitcoin (BTC) treasury strategy, presented what many described as plans for a “Bitcoin central bank” during his keynote speech at Bitcoin MENA. Because nothing says “financial innovation” like a central bank… but with crypto. 🏦💸

Earlier in the year, they basked in glory like Gatsby at one of his legendary parties, but now they’re more like the guest who’s taken a wrong turn and ended up in the kitchen-huffed and puffed but with less to show for it. We, the curious and mildly cynical, decided to consult the so-called “brightest minds”-or at least the most verbose chatbots-to see who’s got the best shot at dazzling the future. Spoiler: it’s a toss-up between chaos, cleverness, and a bit of the old unpredictable wild card. 🎩🤡

Table of Contents

Short-term whispers of hope flutter near support, but the grand tapestry reveals a grim truth: this altcoin is but a pawn in the game of consolidation-to-distribution. No revolution here, comrades-only the slow grind of uncertainty. 🌀😏