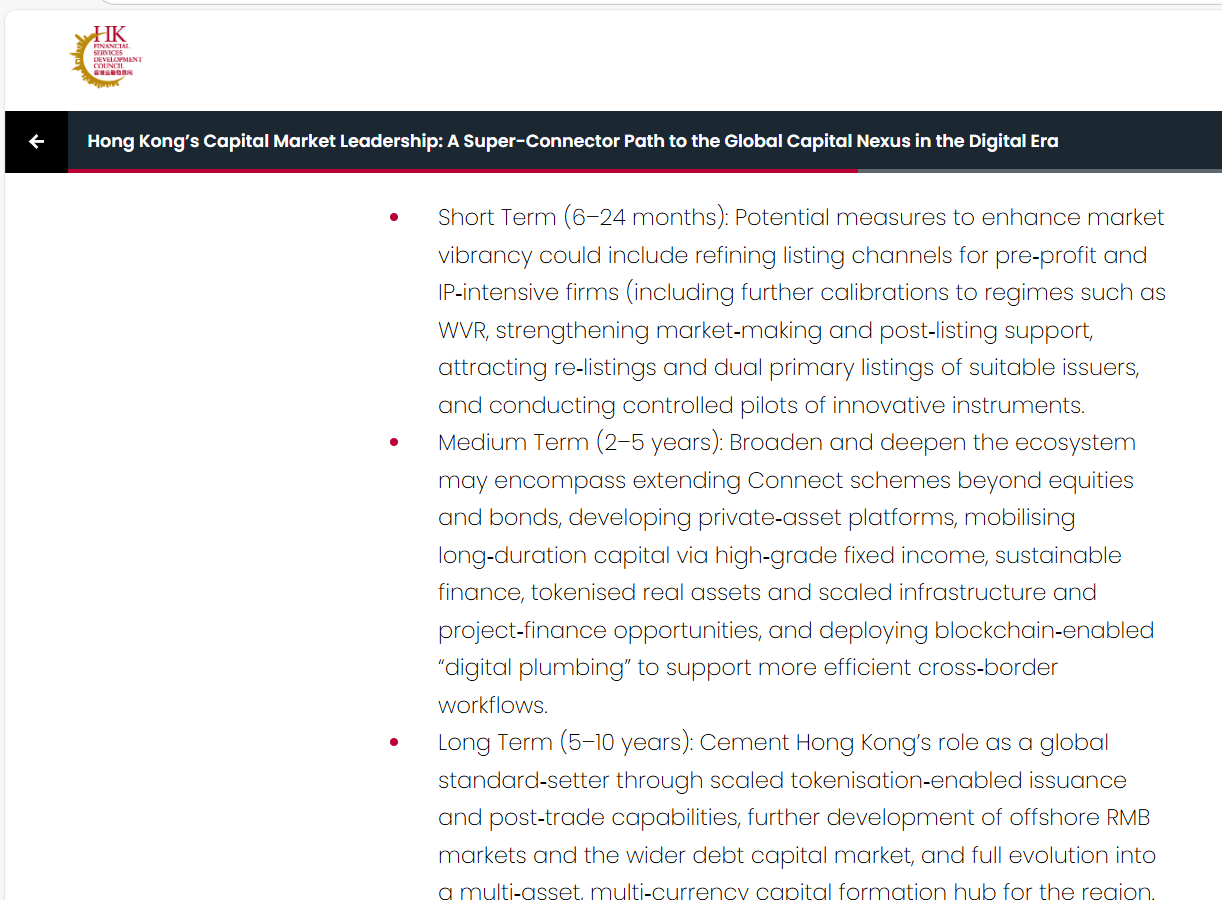

Hong Kong’s Blockchain Bonanza: A 10-Year Plan You Can’t Miss!

The Hong Kong government has officially released a 10-year masterplan that could make even your grandmother want to invest in digital assets. This document is the ultimate guide to building a digital asset market where blockchain technology and traditional finance hold hands and skip through the financial meadows. And yes, they promise to keep investors safe-no guarantees on sanity though.🤹♂️