Bitcoin’s Balancing Act: A Farce of Bearish Manners

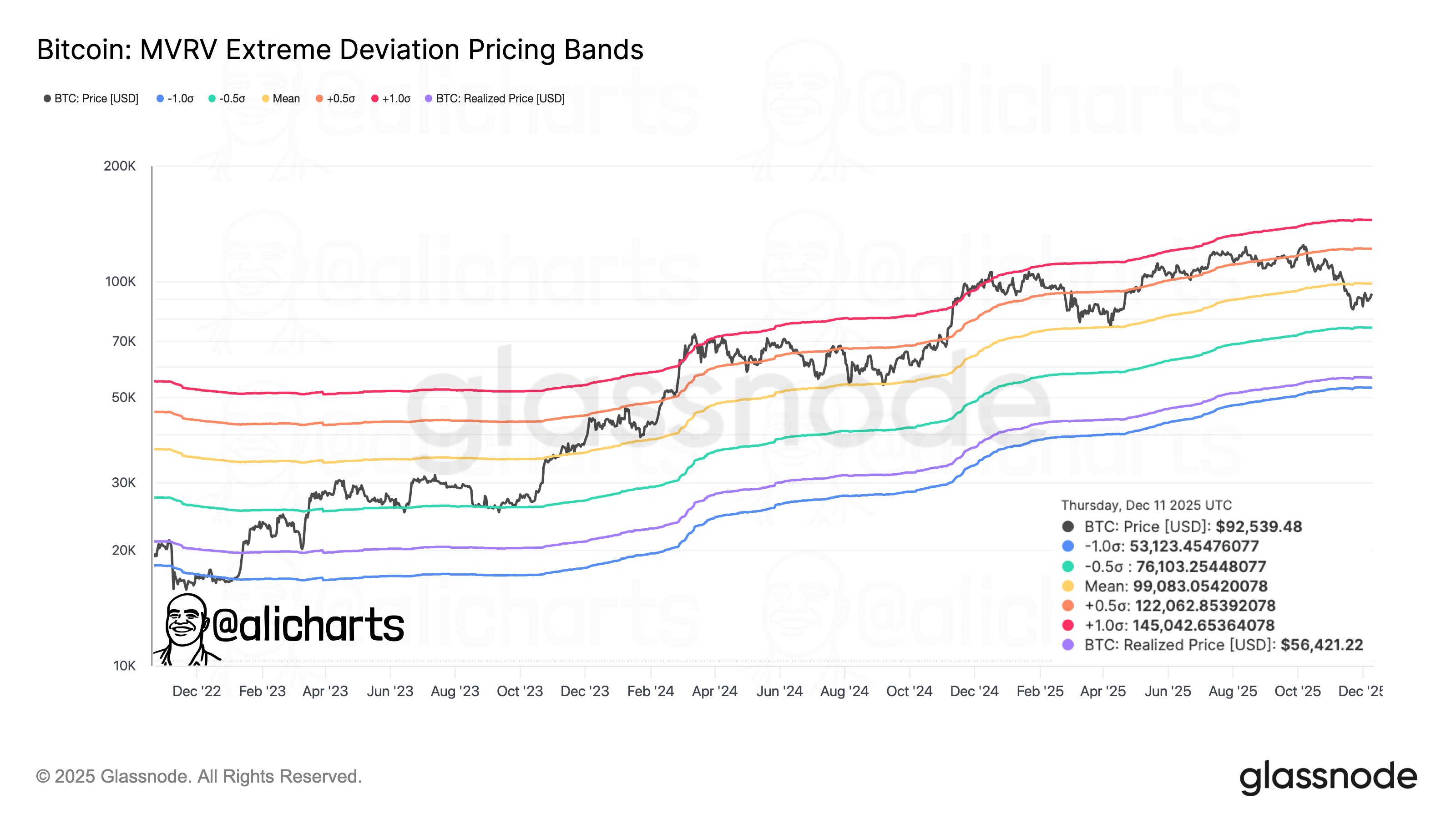

Price action, darling, is performing a precarious ballet just beneath $90,000 after a breakdown so dramatic it could rival a Shakespearean tragedy. The hourly chart reveals a plunge from $90,600 to $88,500-a descent reminiscent of a debutante fainting at a garden party, complete with volume spikes that whisper of panic, or perhaps the more common spectacle of liquidation-fueled surrender 🎭.