Dogecoin’s 5% Meltdown: Will It Recover? 🐕💸

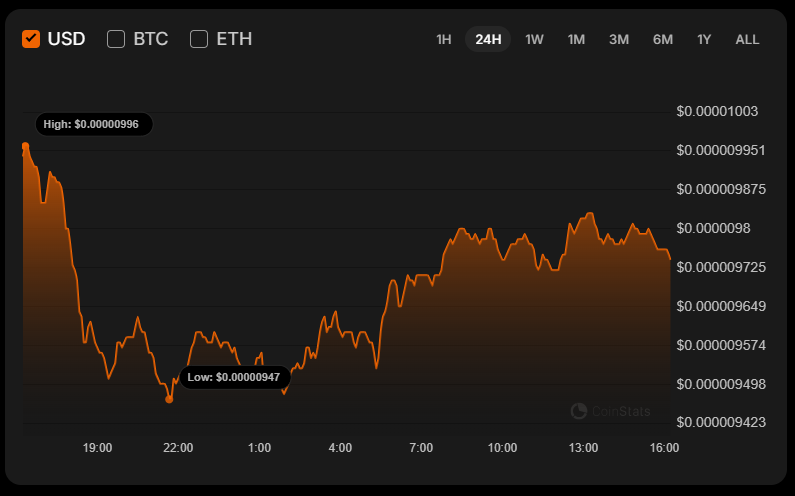

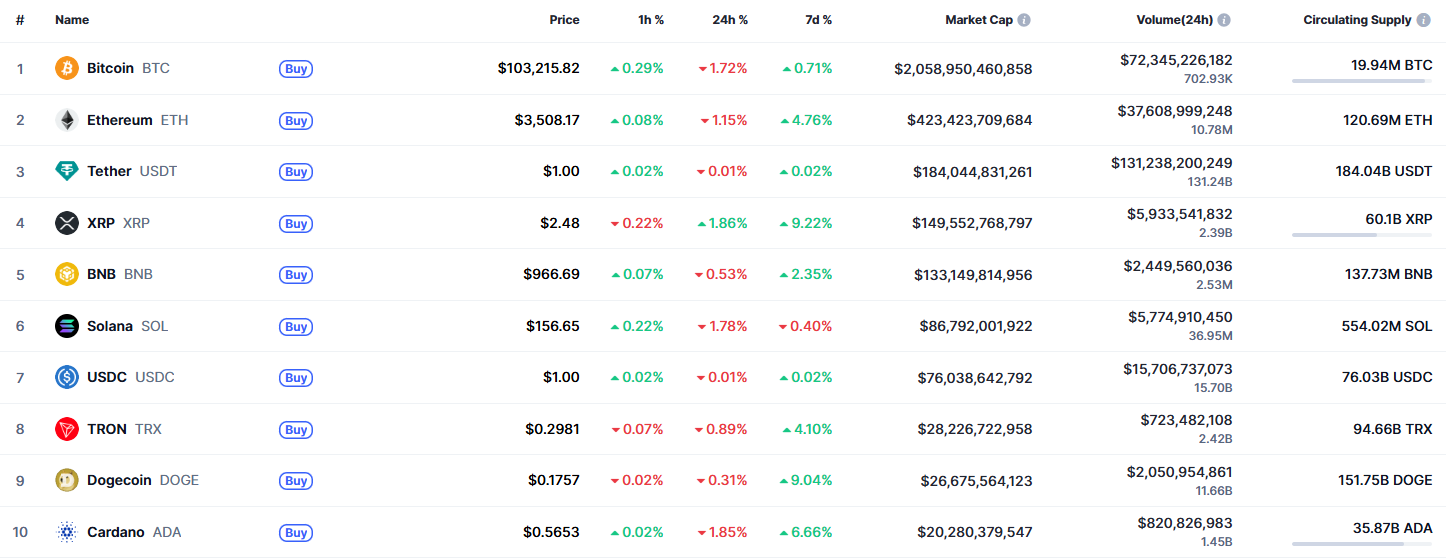

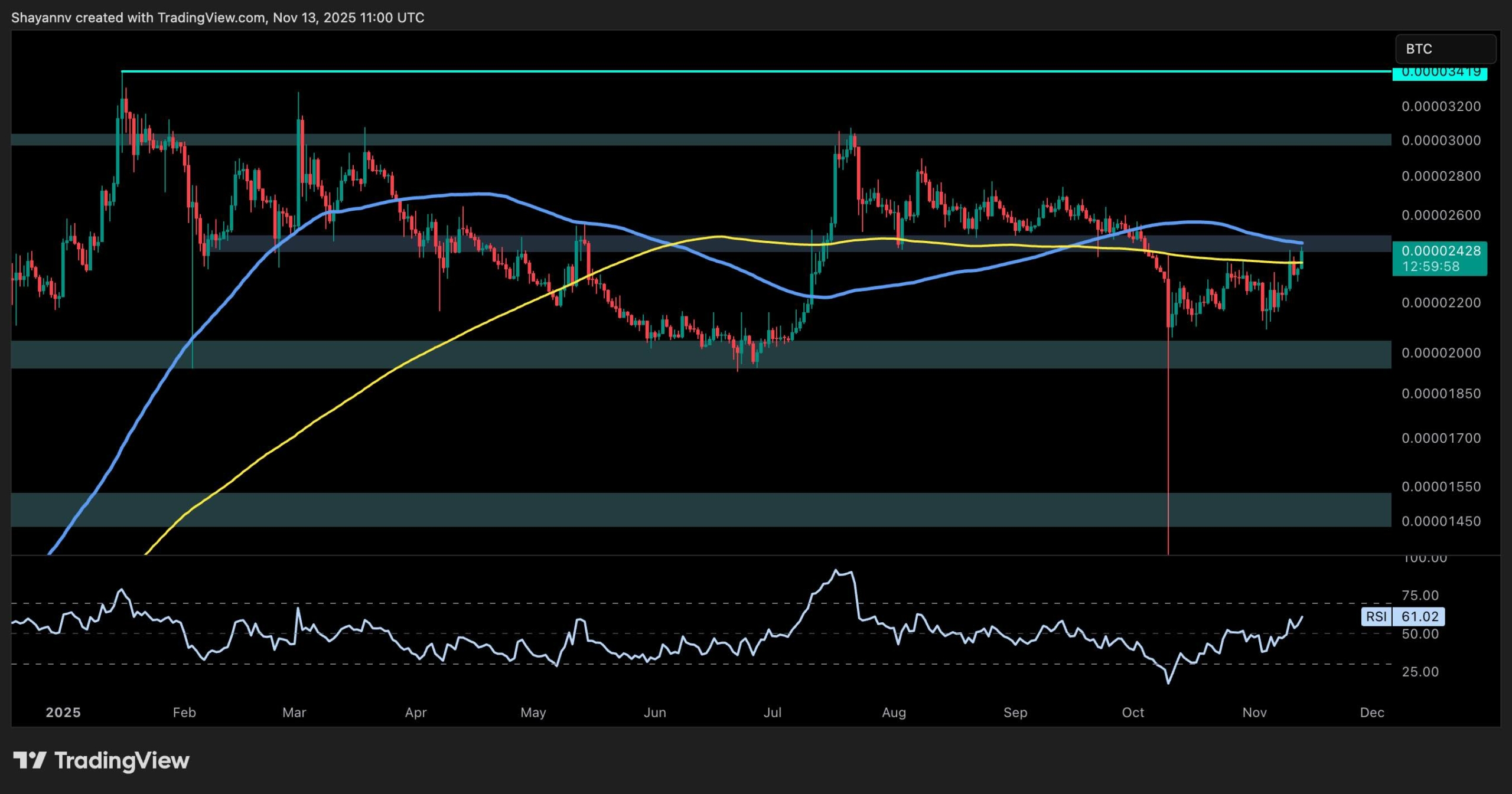

Dogecoin suffered a sharp 5.5% decline on Tuesday, declining between $0.1831 and $0.1730 in European trading. The fall closed under the crucial support of 0.1720 on rising volume, with a volume of 500.6 million tokens, -77 percent above the daily average. 📉