Korean Traders Swap Memecoins for Chips: A Wild Ride 🚀🥶

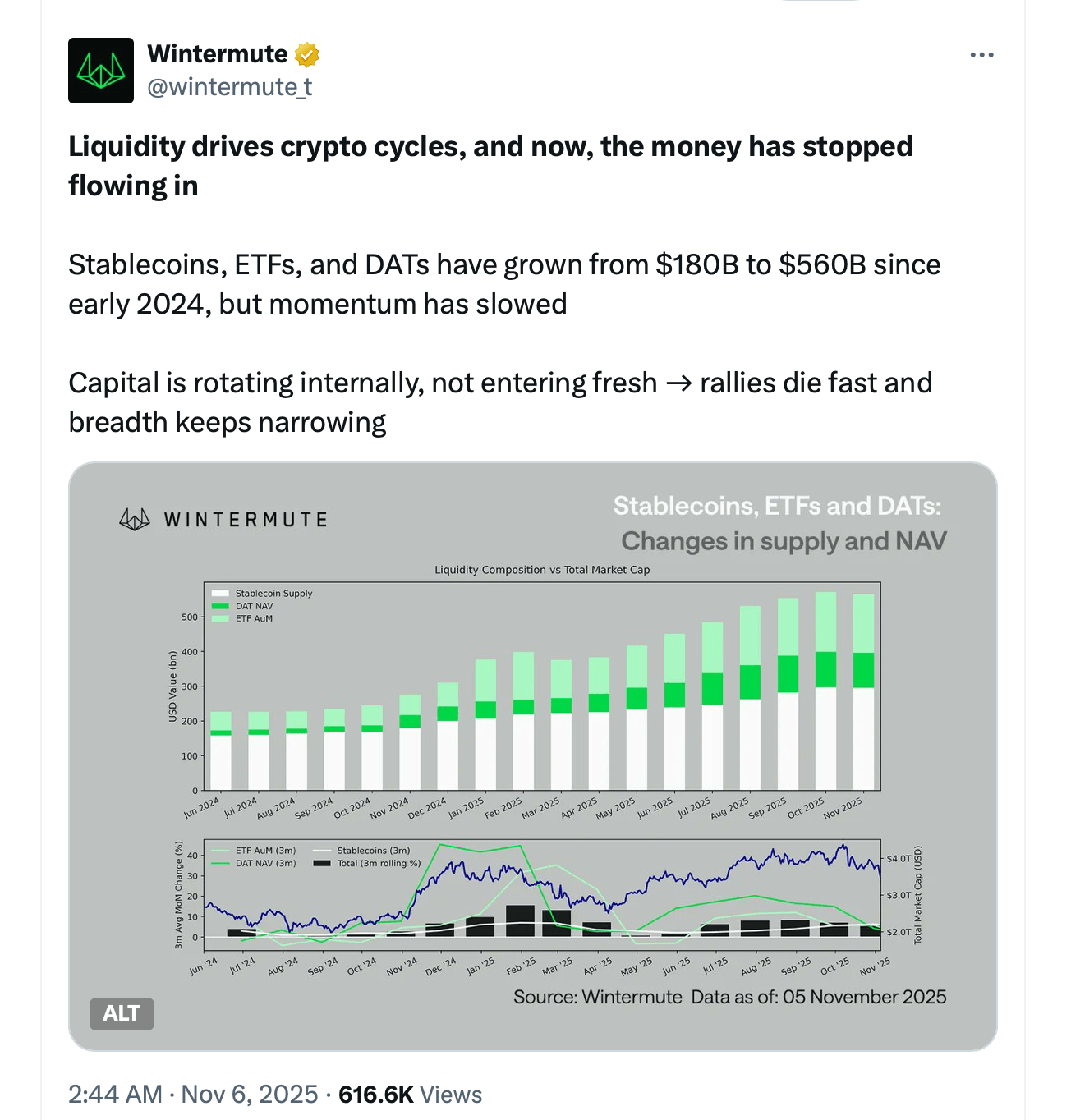

Once upon a time, South Korea was the Vegas of crypto speculation. The “Kimchi Premium” was a thing, and traders moved markets like they were auditioning for “Dancing with the Stars.” 🌟💃 But by late 2025, the crypto party is over, and everyone’s gone home – or, more accurately, to the stock market.