Crypto Boom: Hong Kong Dives into Tokenized Funds!

Franklin Templeton launches its tokenized U.S. Government Money Fund for professional investors, marking the first project under the HKMA’s new Fintech 2030 plan 🤯

Franklin Templeton launches its tokenized U.S. Government Money Fund for professional investors, marking the first project under the HKMA’s new Fintech 2030 plan 🤯

Market analysts, bless their optimistic hearts, concede that although the sellers have thrown a grand tantrum, the underlying trend remains as stubborn as a village dog refusing to come inside. They dare to insist that ETH can saunter its way back to the lofty heights of $5,000 by year’s end, like a dreamer chasing butterflies in a field of wildflowers.

During a recent chat with Fox Business, Suarez acted like he’s a crypto wizard, waving away price swings with the grace of a man who’s never had to sell a coin. “I’m not worried,” he said. “I’m just here for the long game… and the 300% gains. You know, the real money.”

But then-a miracle!-up from the depths sprang HYPE, like Prince Myshkin returning from his faint, hair disheveled but soul unbroken. A 7% surge! A rally! Now hovering near $40, as if to say: “Dear comrades, I have not perished. The people still believe.”

Everyone’s walking on eggshells, tiptoeing around the broader market’s melodramatic pullback like it’s a soap opera. Suspense, tears, and maybe some popcorn. 🍿

According to data from Growthepie (because who doesn’t trust a pie-themed data company?), there was a glorious moment where Ethereum processed 24,192 transactions in just ONE SECOND. Can you say “speed demon”? I mean, sure, that sounds like something out of a sci-fi movie, but it’s real, baby!

“We’ve luxuriated in contemplation, dear reader,” confessed Shiv Verma, the venerable vice president of finance and strategy, during the florid oration that comprised their third-quarter earnings conference on a dreary Wednesday. “To align with our community, we must not only flirt with their passions but consummate them!” he declared, a twinkle of mischief in his eye.

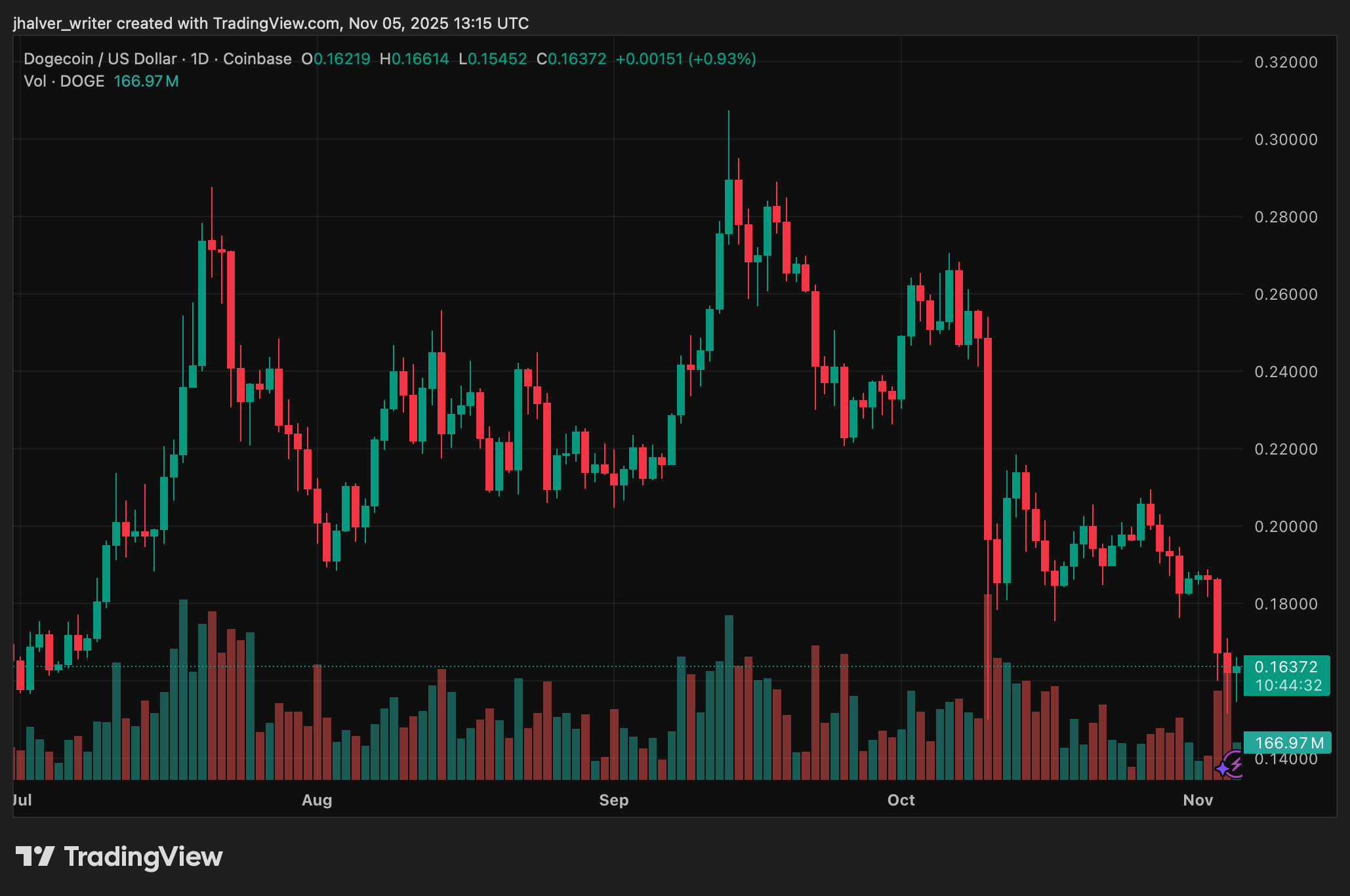

Currently clinging to $0.163 like a socialite to her last shred of dignity, DOGE nosedived 5% on Tuesday. Institutional sellers, those paragons of fiscal responsibility, ensured it breached critical support levels. Meanwhile, on-chain data reveals whales offloading 1 billion DOGE-roughly $440 million of pure, unadulterated disappointment. 🐳💸

The Deribit bitcoin options market is now a battleground, where traders are preparing for the worst: a drop to $80,000 as spot prices show clear signs of weakness. 😱

There’s hope, dear reader! Strong retail accumulation on Coinbase and bullish Puell Multiple readings point to renewed upside potential near long-term support. So, don’t write off Bitcoin just yet, even though it’s hanging on by a thread.