ETH Chart Flashes Classic Rally Pattern, $4.8K or $7K Next?

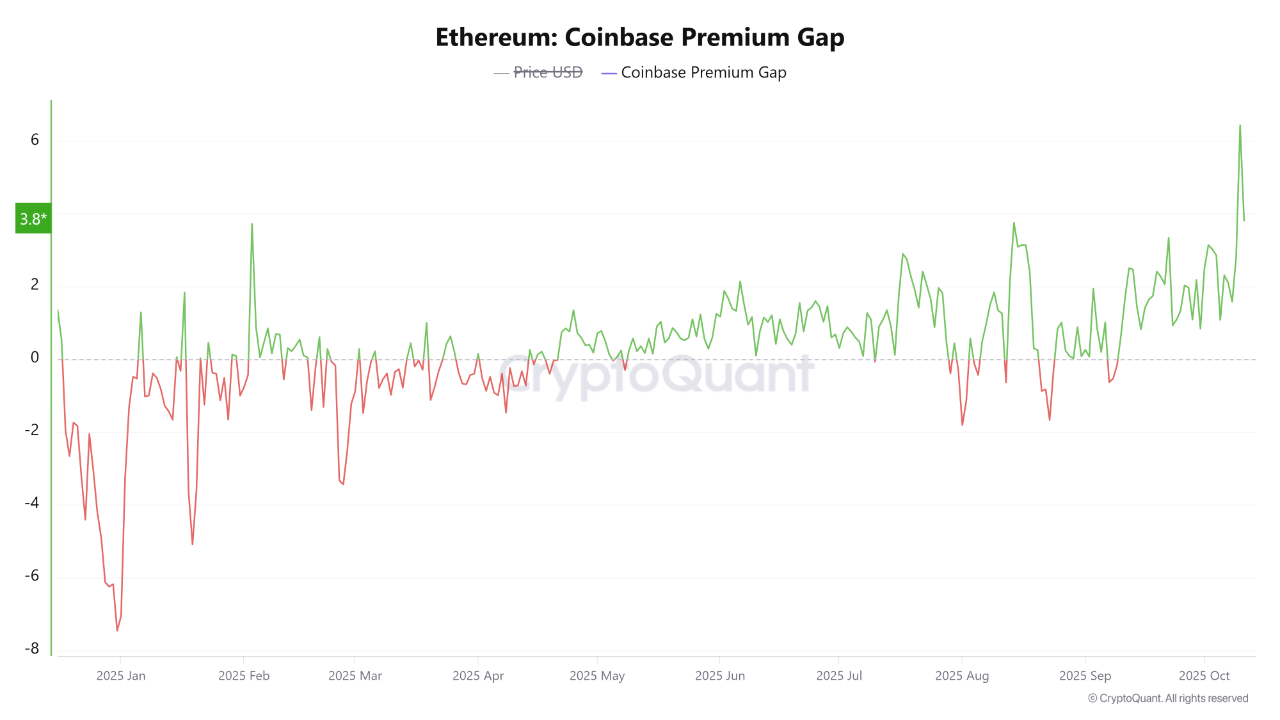

Now, let’s talk about this oh-so-familiar “false breakdown” pattern. Sounds like a bad rom-com, doesn’t it? But don’t worry, Trader Tardigrade has your back. This savvy chart wizard points out that ETH has a habit of faking us out with a breakdown, then suddenly bounces back like it’s got a secret stash of energy drinks. The pattern looks like this: Breakdown, Reclaim, and BOOM – Rally! 🎉