Crypto Craze: How Dogecoin and XRP ETFs Raked in $54M Like Magic Beans! 😲

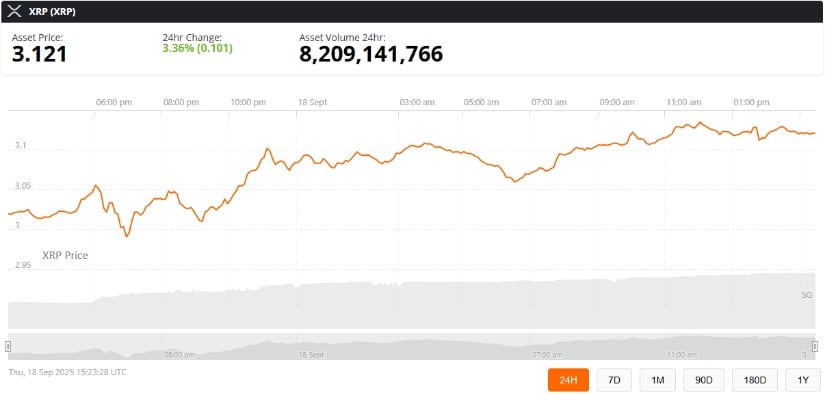

The grandest of the grand was the REX-Osprey XRP ETF (ticker: XRPR), who strutted about with a dazzling $37.7 million in trading volume, according to the oracle Bloomberg’s ETF wizard, Eric Balchunas. He called it the “biggest day one” for any ETF launched in 2025 – a phrase that sounds like a royal proclamation if you ask me.