You Won’t Believe How Bitcoin and Gold Stack Up-Spoiler: It’s Not Pretty!

Singapore-based QCP is one of Asia’s largest trading desks, with over $60 billion in annual volume. That’s right, billion with a ‘B.’ They’re not just playing around!

Singapore-based QCP is one of Asia’s largest trading desks, with over $60 billion in annual volume. That’s right, billion with a ‘B.’ They’re not just playing around!

One simply cannot fathom the audacity of these public crypto treasury firms, none of whom hold assets above their average cost basis. The market, my dear, has turned into a veritable minefield of losses, liquidity woes, and existential crises. How utterly gauche.

Some fella named Brett, who fancies himself a crypto sage, reckons buyin’ Bitcoin below the 100-week Simple Movin’ Average is about as reliable as a hound dog’s loyalty. He says this zone’s where pessimism’s thicker than molasses in January, and the risk-to-reward ratio’s sweeter than a pecan pie. Brett ain’t tryin’ to time the bottom – no sir, he’s scatterin’ his buy orders like a farmer sowin’ seeds, hopin’ somethin’ takes root between $55,000 and $75,000.

Bitcoin finds itself ensnared in a web of technical structures, each one vying for attention like a troupe of actors in a tragicomedy. Horizontal support zones beckon at $60,176 and $47,824, while the recently trespassed $77,086 level looms ominously, confirming that the once-mighty bullish highs are now under siege. Ah, but near $72K to $74K, buyers emerge valiantly during intraday dips, crafting long lower wicks and moderate volume spikes that suggest a bit of hopeful accumulation-like a sprightly flower pushing through cracks in concrete.

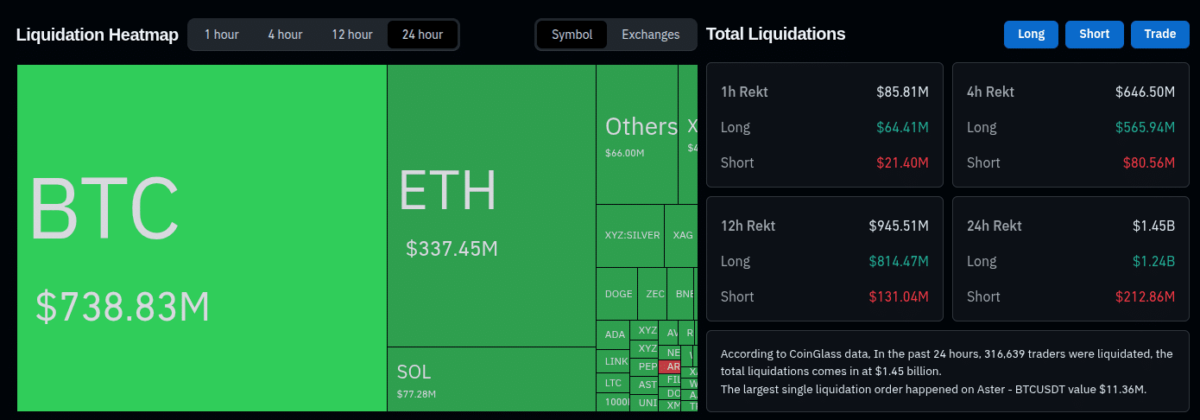

As fate would have it, more than 311,000 traders found themselves rudely awakened from their dreams of wealth, as their positions were unceremoniously flushed away. The pièce de résistance of this calamity was a single liquidation from the BTC/USDT pair, which rolled forth from Hyperliquid’s competitor, Aster, to the tune of $11.36 million. Oh, the sweet music of despair! CoinGlass, the ever-watchful chronicler of our times, unearthed this data at precisely 5:30 p.m. UTC on February 5.

In his latest yarn, Soloway reckons Bitcoin’s sittin’ pretty on a price perch, showin’ more backbone than a mule in a mud pit, while them U.S. stocks are wobblier than a three-legged stool. He figures the stocks’ll keep their pants in a twist for months, but some of that fancy capital might just mosey on over to Bitcoin, keepin’ it from takin’ a nosedive in the short haul.

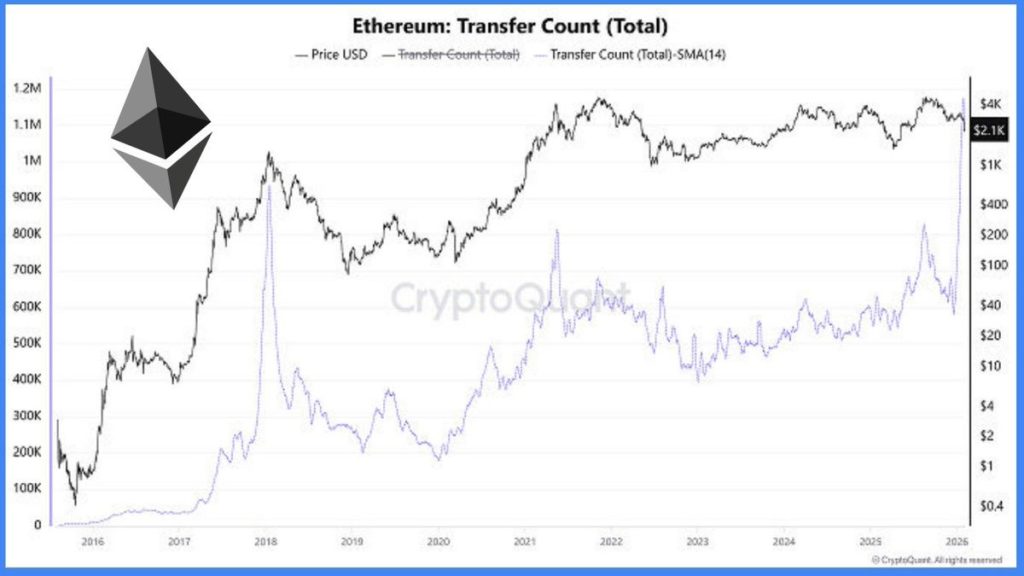

Historical patterns suggest that such folly cannot be dismissed lightly. Indeed, a certain key factor has weakened further since our last theatrical performance, lending credence to CryptoQuant’s rather gloomy prediction that we might just be rehearsing for an encore.

Tether, the architect behind the world’s most voluminous stablecoin, USDT, has declared its investment of $100 million in Anchorage Digital, a federally regulated digital asset bank. A marriage of convenience, or perhaps, of ambition?

Behold, the on-chain data doth reveal a spectacle most curious: Ethereum’s transfer count hath surged to 1.17 million, a number as grandiose as a Victorian ball. Yet, history, that wily raconteur, reminds us that such peaks were last seen in the halcyon days of 2018 and 2021-epochs that preceded financial tempests and prolonged periods of existential ennui. High network activity, they say, is bullish-but pray, when did a crowded ballroom ever guarantee a harmonious waltz?

Beyond the cold symmetry of charts, the pulse of the network tells a tale of quiet resilience. On-chain metrics, those cryptic oracles, murmur of a basing phase, as if the very essence of SOL is gathering strength, biding its time, like a poet sharpening his quill before the storm of creation.