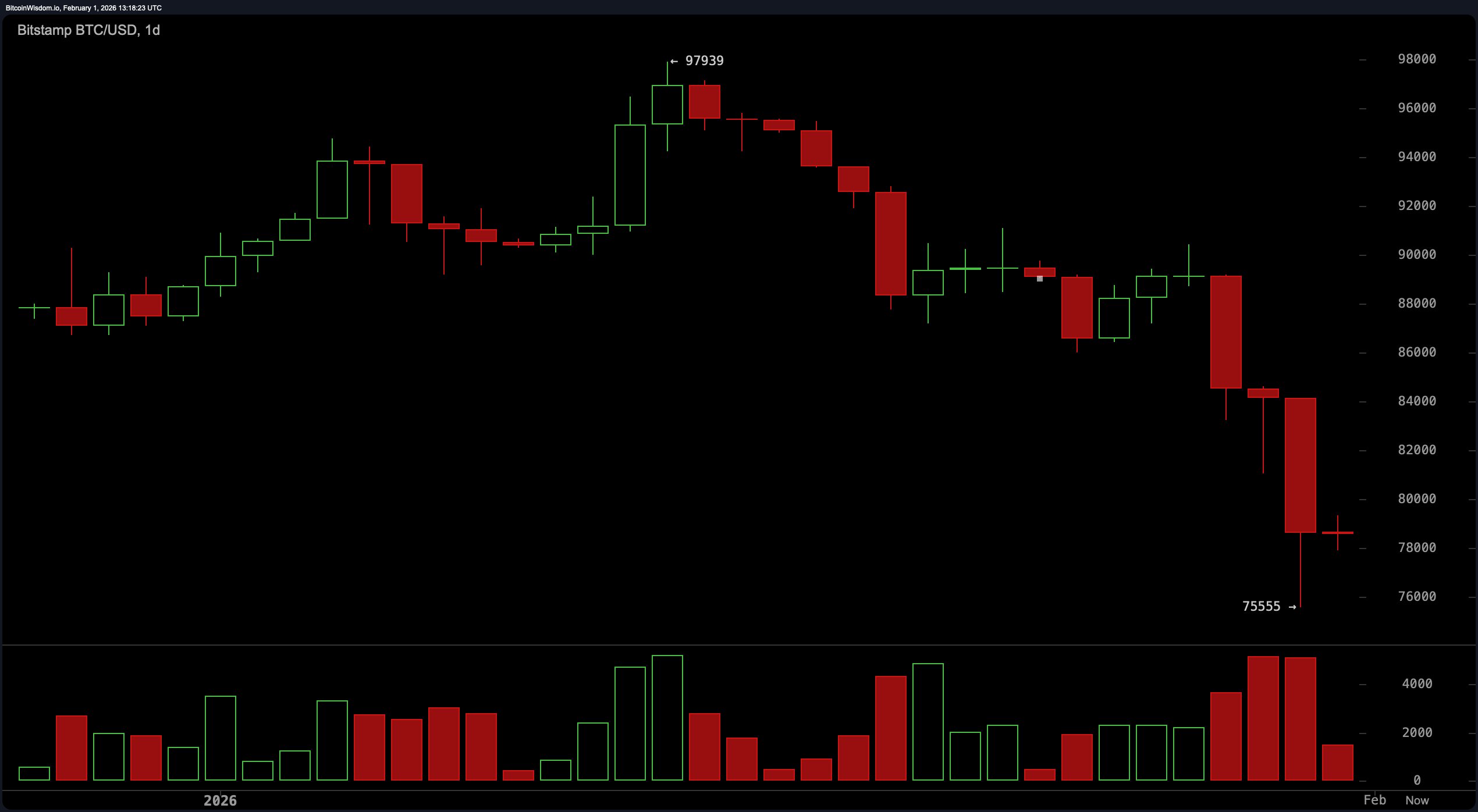

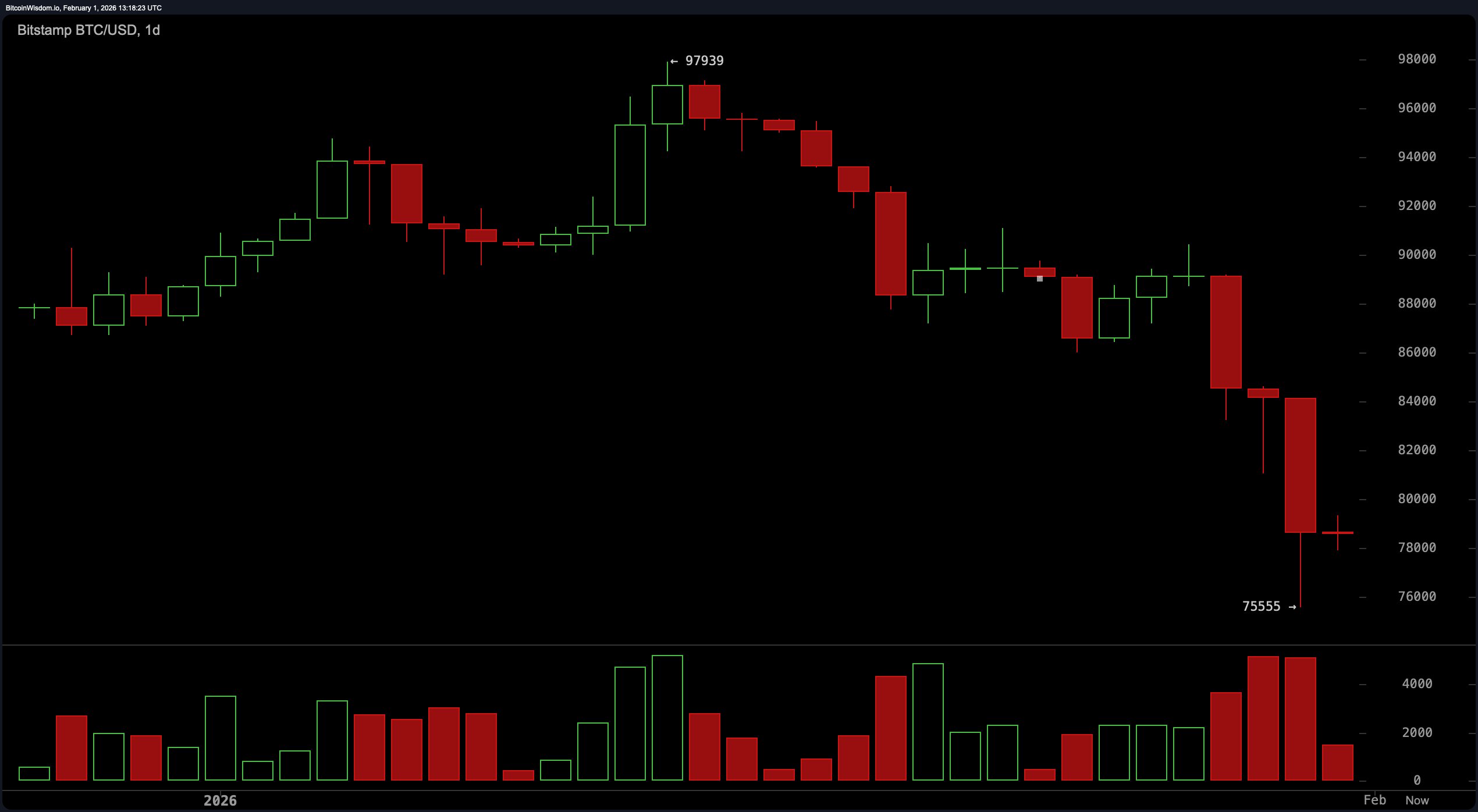

The daily chart, a canvas of despair, reveals a tableau of shattered dreams and broken levels. After a precipitous plunge through the $88,000-$90,000 range, our protagonist, Bitcoin, executes a dramatic nosedive into the $75,500 abyss. This is no genteel decline, but a liquidation-driven farce, confirmed by a spike in trading volume. The result? A long, mournful wick southward and a hesitant stabilization on what one might charitably call a “demand zone.” Traders, those eternal optimists, cling to the hope of a daily close above $86,000, though anything less is but a mirage in the desert of despair.