Ethereum’s Wild Ride: Will It Soar or Plummet Next? 🌊🚀

Ethereum (ETH) is one of the biggest gainers today, rising by 6.15% like a boss. 😎

Ethereum (ETH) is one of the biggest gainers today, rising by 6.15% like a boss. 😎

In a dazzling revelation on the vibrant social media platform X, Swissblock boldly proclaims that Bitcoin still has upside potential! How shocking! Key metrics, like stubborn house guests, show no signs of overstaying their welcome at the top.

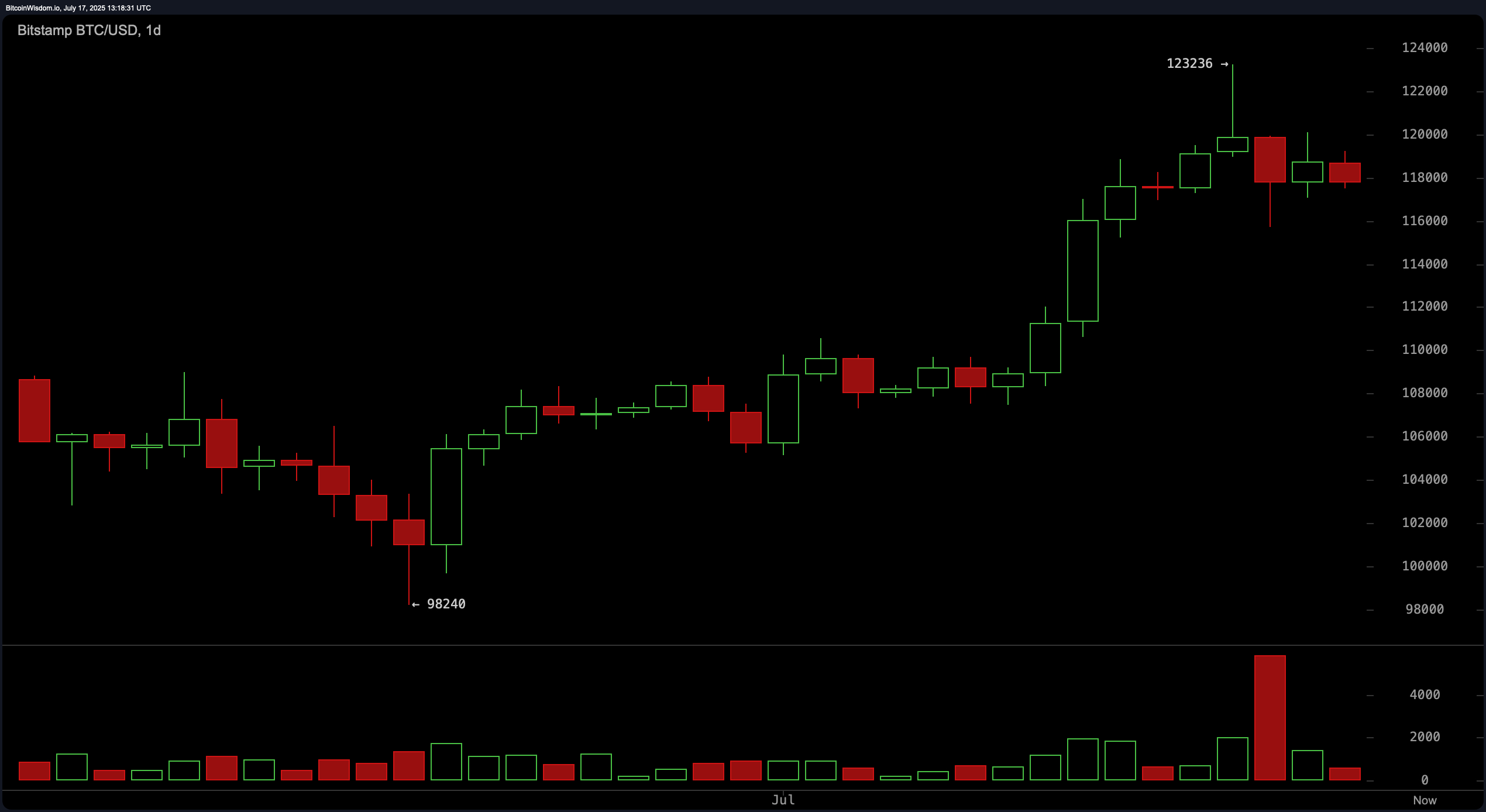

On the daily chart, bitcoin has reversed from a recent low near $98,240 to establish a pronounced bullish trend, achieving a peak of $123,236 before facing notable selling pressure. The latest candlestick formations exhibit smaller bodies and a marked reduction in trading volume, suggesting the rally has transitioned into a period of consolidation or short-term cooling off. For risk-managed long positions, traders may consider entries on a pullback toward the previous breakout zone between $110,000 and $114,000, especially if new bullish reversal patterns develop. Resistance remains strong near $123,000, where heavy selling has previously occurred, making it a potential profit-taking zone.

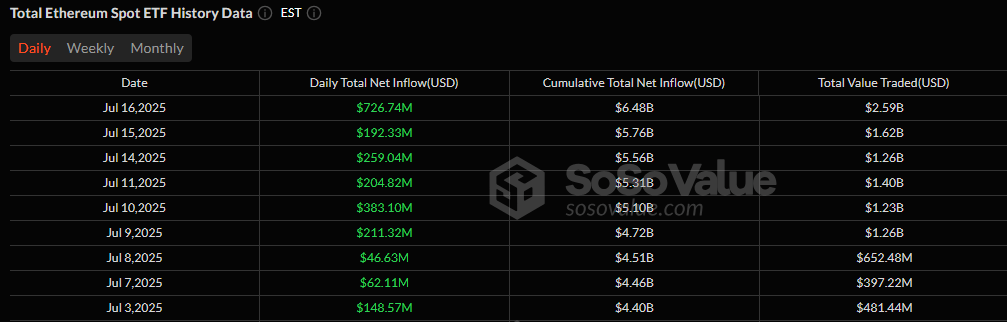

Ah, the world of ETFs—a place where numbers make hearts race and wallets sigh in relief. On this particular day, Ether ETFs didn’t just break records, they obliterated them, with an astonishing $726.74 million flowing in as if there was a sudden shortage of Ethereum in the world. Blackrock’s ETHA took the lion’s share, hauling in $499.25 million like it was just picking up loose change. But let’s not forget the other players in this game of financial musical chairs.

According to the wise sages at DefiLlama, the total value locked (TVL) in Bitcoin-based (BTC) DeFi protocols has soared from a mere $304.66 million on Jan. 1, 2024, to a staggering $6.5 billion by Dec. 31, 2024. As of this writing, the TVL stands at a princely $7.05 billion. A 22-fold increase, indeed! 🚀

HBAR, with a flair for the dramatic, leaped to a high of $0.2500, its highest level since March 7, a staggering 100% increase from its lowest point in June. This meteoric rise was, of course, fueled by the ongoing crypto bull run, a phenomenon that seems to have as many twists and turns as a Russian novel.

Here’s the dish on why a jaunt to $0.000164 isn’t just wishful thinking.

Previously, the former Prime Minister Thaksin Shinawatra had proposed a crypto payments sandbox limited to Phuket to drive tourism. But this new plan expands the vision nationwide while shifting from mere discussions to a structured, regulator-backed framework. 🎉

This avalanche of institutional interest has pushed the total ETH holdings across spot ETFs to over 5 million coins—more than 4% of Ethereum’s circulating supply. In a striking contrast, ETFs bought around 107 times more ETH on Wednesday than was issued by the network, per data from Ultra Sound Money.

Virtuals Protocol (VIRTUAL) has, in the past 24 hours, managed to climb a staggering 12%, settling at $1.88 — its highest daily close since the halcyon days of late June. The trading volume, ever the faithful companion, has surged by 67%, a clear sign that the market is either incredibly optimistic or just plain gullible. This surge has confirmed a breakout from the consolidation range that had VIRTUAL trapped between $1.50 and $1.80 for much of July. 📈