Shiba Inu’s Sudden Ascent: A Most Thrilling Enigma 🐕

As the great market leader bitcoin tops $122,000 to set new lifetime highs, the broader crypto market is galvanized into action. And SHIB, dear reader, is no exception. 🚀

As the great market leader bitcoin tops $122,000 to set new lifetime highs, the broader crypto market is galvanized into action. And SHIB, dear reader, is no exception. 🚀

Click Holdings Limited, the Hong Kong-based juggler of human resources and senior care, has awakened from its slumber, ready to tango with the burgeoning ‘Silver Economy.’ Just when you thought the elderly folks were merely knitting and complaining, here comes cryptocurrency, rushing in like a whirlwind to modernize operations and nosh on youthful investments! Who knew care for senior citizens might now involve Swanson’s frozen dinners bought with bitcoin? 🍔💰

Speaking of numbers, the market cap of this digital darling now eclipses a formidable $2.43 trillion. Quite the feat, when one considers it has decisively ousted Amazon—whose once-mighty valuation rests at a mere $2.38 trillion. Yet, lest we forget, Apple still reigns supreme, lounging comfortably at $3.15 trillion. One must wonder if Tim Cook is sweating just a little. 🤔

According to Bitwise CEO, Hunter Horsley, Ethereum is “building the infrastructure for the next version of the internet,” which sounds like a line from a sci-fi movie, but hey, who can argue with the guy? He’s saying that ETH might just go beyond $10,000. That’s a bold statement, but then again, crypto is all about bold, right? 🚀

In the early hours of July 14, Metaplanet made its latest move public, proclaiming on X (formerly Twitter—don’t ask why) that it had added another 797 BTC to its ever-expanding collection. At this rate, they’ll have 30,000 BTC by the end of 2025. A lofty target, don’t you think? What better way to secure the future than by filling the coffers with digital tokens of ephemeral value? But surely, it’s not just about numbers. No, no. It’s a show of unwavering belief in Bitcoin. A belief that borders on madness, perhaps, but who am I to judge? We all find solace in something.

The latest XRP rally has captured market attention, with the token climbing around 6% in 24 hours to reach $2.96, breaking above the important $2.84 resistance level. This breakout was confirmed by a sharp spike in trading volume, which surged to 176 million XRP around 3:00 AM UTC—more than double the typical hourly average, according to CoinDesk data. Institutional investors appear to be a driving force behind the move, adding substantial liquidity to the market.

This marks the Czech National Bank’s grand debut into the cryptosphere. According to a dusty old Form 13F they filed with the U.S. Securities and Exchange Commission—a form as thrilling as watching paint dry—the bank snapped up those shares on July 14, back when they were merely valued at a pedestrian $18.13 million. It’s like buying a vintage wine for the price of grape juice and then discovering it ages into a rare vintage overnight! 🍷✨

But as Bitcoin stabilizes post-ATH, market attention is rapidly pivoting to altcoins, several of which are showing signs of preparing for their breakout moves toward historic highs. Here’s a breakdown of the top contenders.

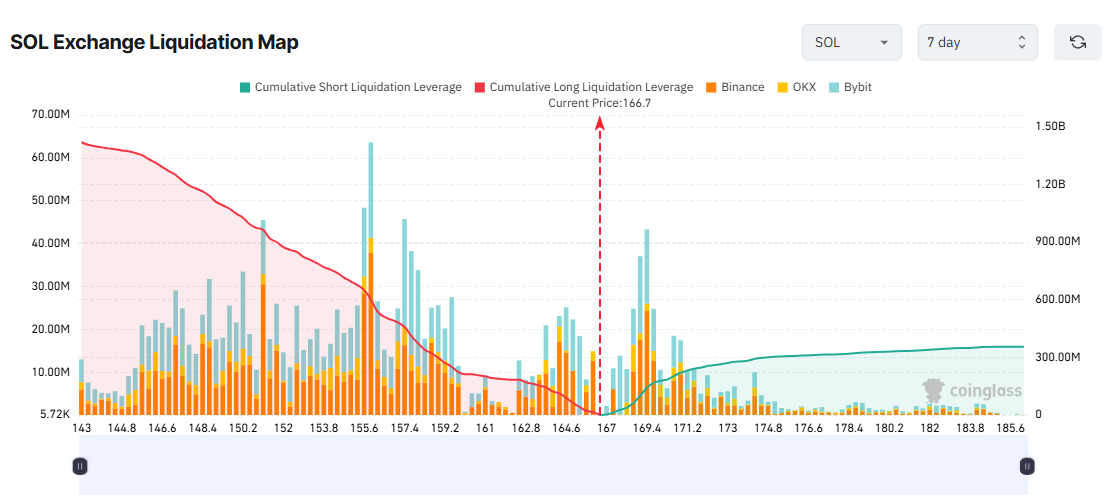

Yet, amidst the jubilation, July also bore witness to record-setting liquidation losses, with Open Interest (OI) volumes reaching historic highs. While Bitcoin and Ethereum basked in the glory of their gains, several altcoins now stand on the precipice of significant liquidation risks, as price volatility increases. 🌊