📢 Folies de la Société et Cryptos : Le Nouveau Théâtre Numérique !

Voici quelques points essentiels :

Voici quelques points essentiels :

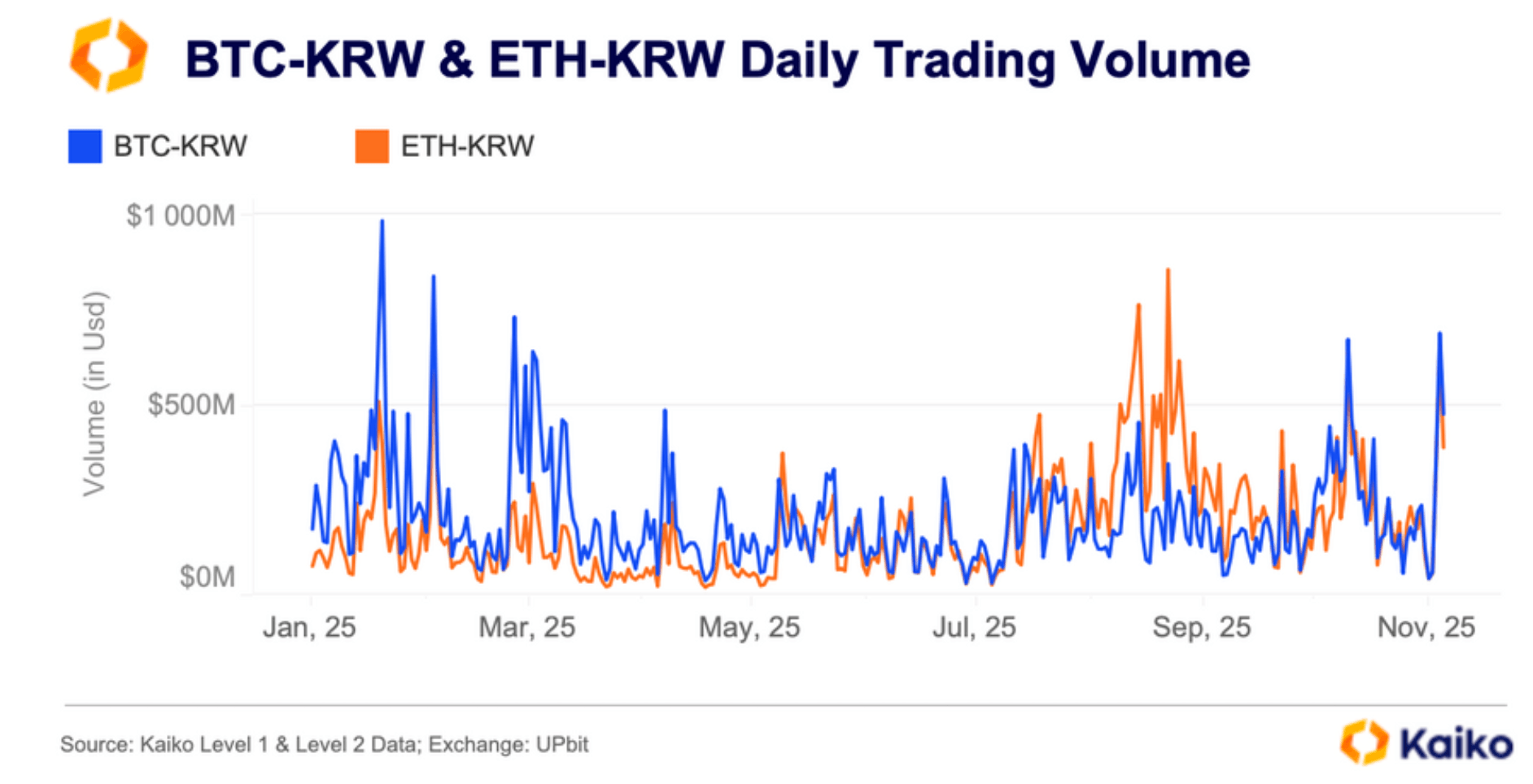

Kaiko Research, with all their fancy charts and graphs, decided to take a peek under the hood of Korean crypto liquidity. Spoiler: It’s not just about who’s shouting the loudest on the trading floor. Real liquidity, they say, is about pulling off a big trade without making the market throw a tantrum. Simple? No. But hey, nothing worth doing ever was. 😅

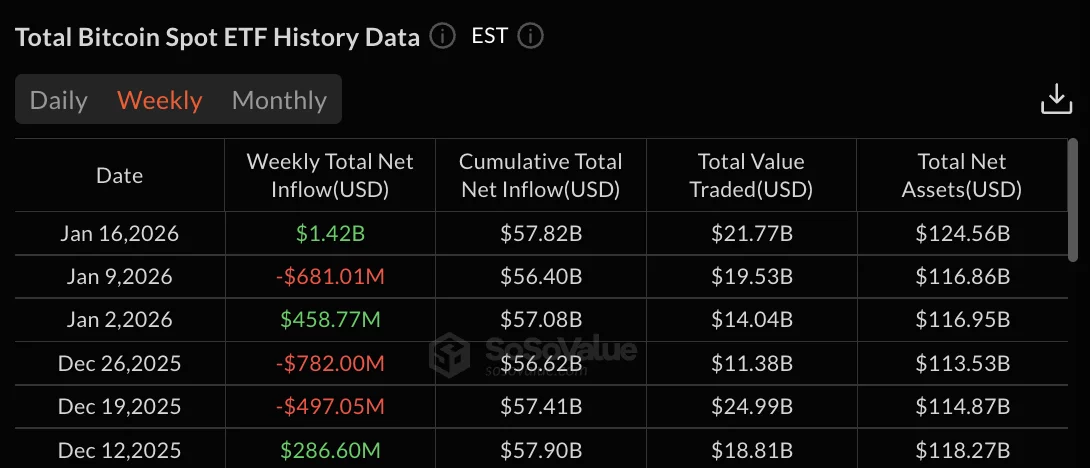

Ah, IBIT, the crown jewel of BlackRock, proudly led the pack with a princely sum of $1.035 billion in allocations. It dominated the scene like a czar surveying his empire, accounting for 73% of total weekly inflows across all Bitcoin ETF products. Truly, a masterstroke!

In the vast expanse of the digital realm, where lines of code weave the fabric of our modern existence, a voice of reason has emerged from the ether. Vitalik Buterin, the enigmatic co-founder of Ethereum, has sounded the alarm, warning that the very essence of his creation is under siege by the monster of complexity. 🦹♂️🔍

XRP decided to drop by 1.18% because, why not? It’s not like we had plans for that extra 1.18%. 🙄

’Tis reported, by diligent scribes at AMBCrypto, that Ripple has joined hands with LMAX, offering a stablecoin named RLUSD. A partnership, you say? Such maneuvers, they claim, are part of a grand, long-term scheme. Me thinks they’re trying to distract us with novelty! Will it move the price? Perhaps… eventually. Patience, dear friends, patience. 🙄

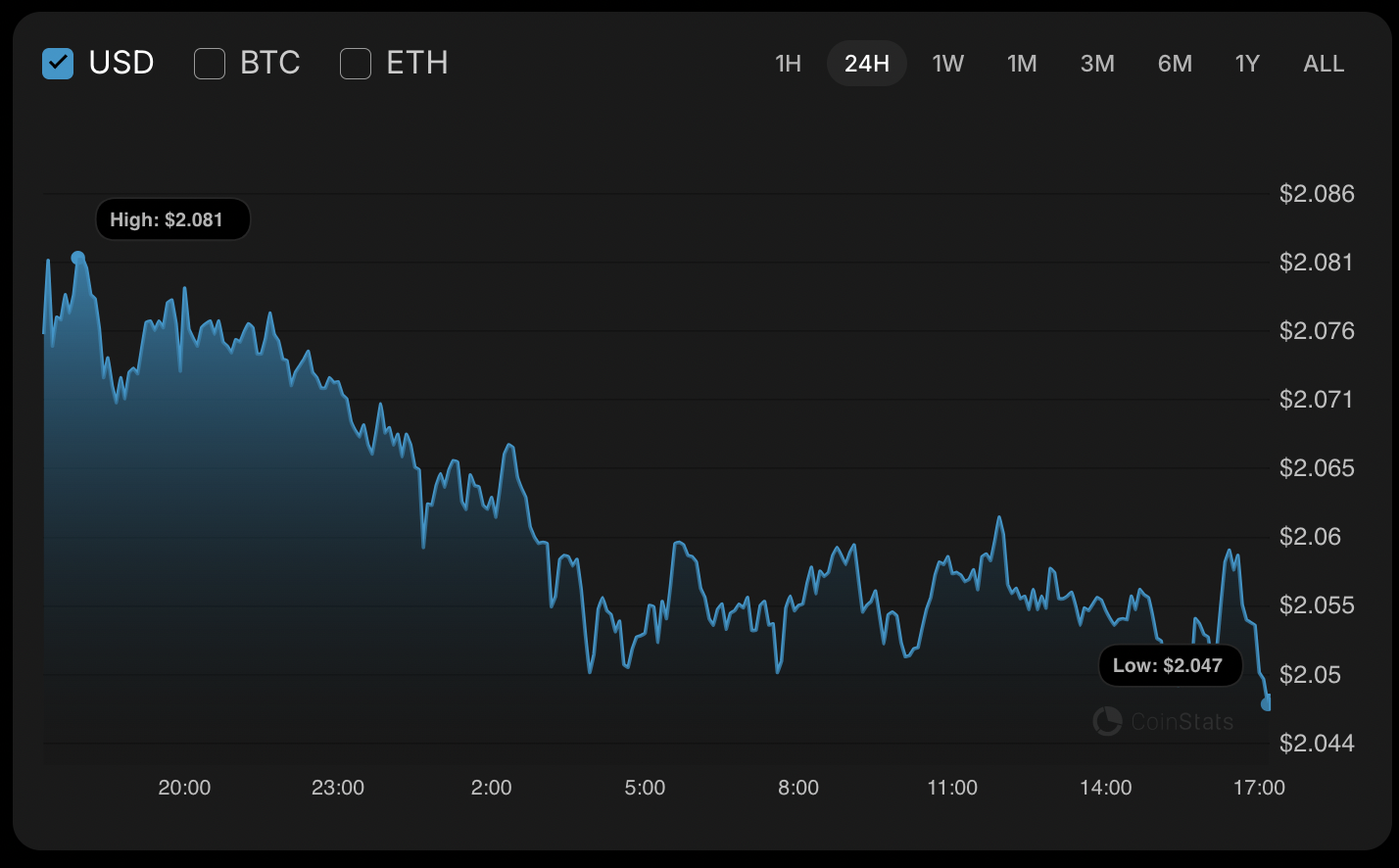

Yes, the beast is stirring. Ethereum now stands-nay, shuffles cautiously-at a technically critical juncture, where the 20- and 21-week exponential moving averages converge like two old generals whispering secrets of past wars. 🤫 This zone, whimsically dubbed the “bull market support band,” has historically marked the boundary where depression ends and dreams begin. The price, trembling like a serf facing his landlord, interacts with this sacred line.

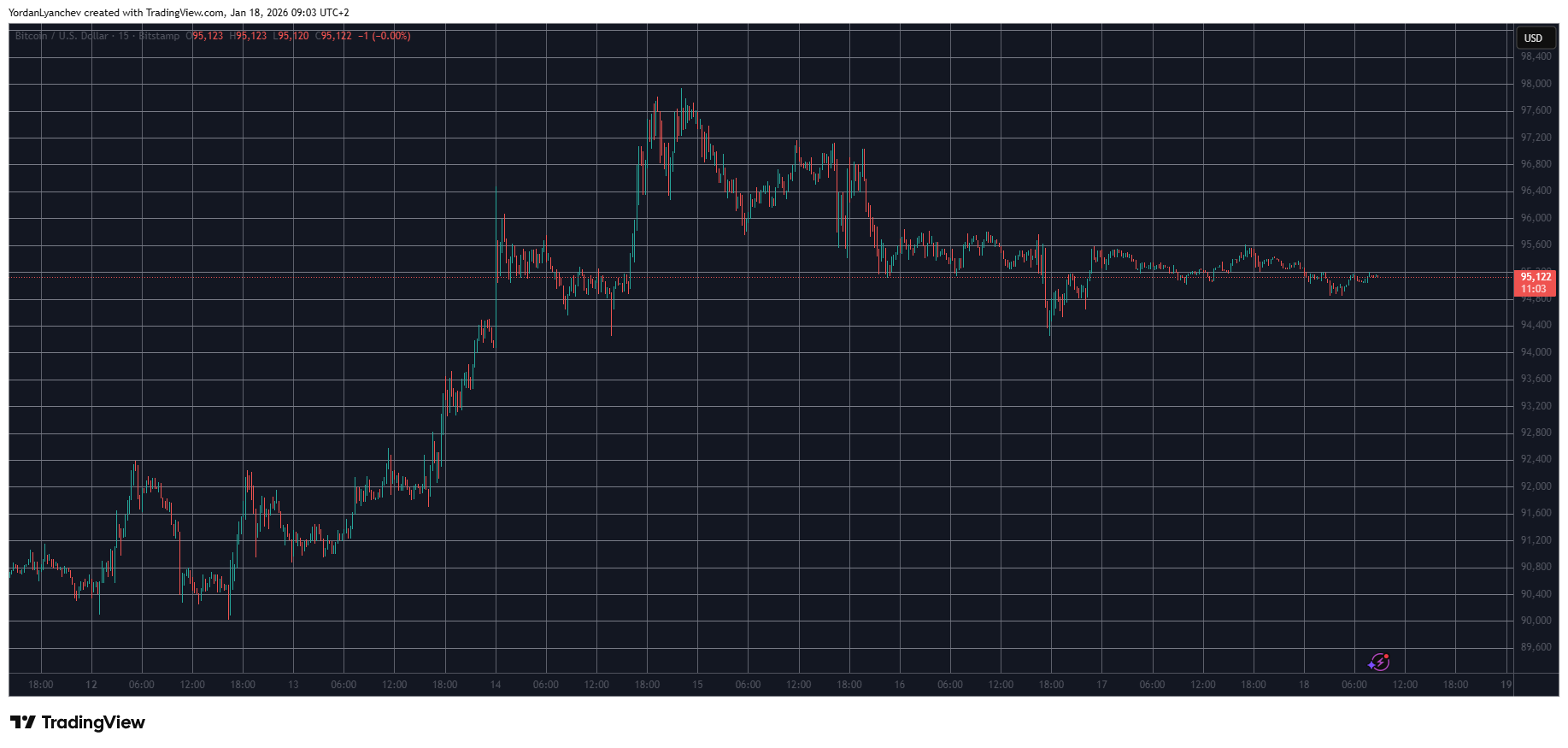

Funding rates, dear reader, are those tedious mechanisms by which perpetual futures markets maintain some semblance of order-though one might argue they serve chiefly to vex traders further. A positive funding rate suggests an excess of optimism (or folly, depending on whom one asks), wherein long traders must pay premiums to their short counterparts, lest the market descend into chaos. How very tedious.

The EU, that paragon of unity, responded with the urgency of a man discovering his socks are missing. Meanwhile, the Democrats, ever the diligent guardians of fiscal responsibility, rushed to thwart the President’s tariff proposals, their efforts as futile as trying to catch a shadow with a net. Yet, amidst this chaos, BTC stood tall-calm, unshaken, as if it had already foreseen the entire debacle and decided to ignore it. A saint in a world of sinners, or perhaps a cryptocurrency with a PhD in existential apathy.

It started 2026 all optimistic and shiny, gaining roughly $10 billion. Which, let’s be real, is a lot of shiny. But naturally – naturally – it’s already given back 85% of that in less than a week. It’s the classic “high-risk, high-reward” thing. Or, as I like to call it, “highly likely to leave you questioning your life choices.”