Markets

What to know:

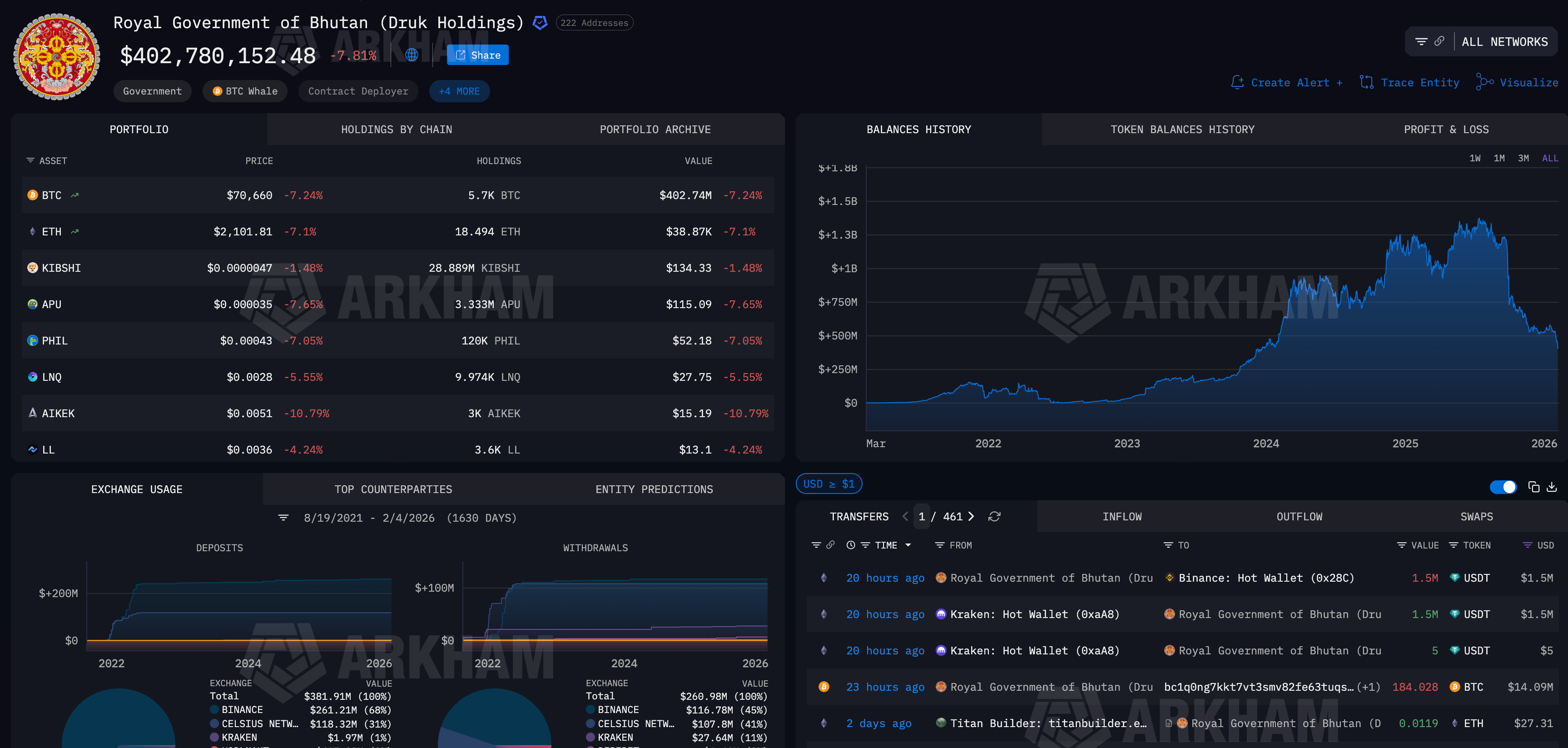

- In a rather theatrical twist, the Bhutanese government took its bitcoin wallets out of their three-month slumber, moving a staggering 184 BTC-worth about $14 million-while the crypto world threw a tantrum.

- The transfers, resembling a game of hide-and-seek, sent coins to fresh addresses and familiar faces like QCP Capital and a Binance hot wallet. This suggests they’re not merely playing with their cold storage but indulging in the drama of trading, liquidity management, or perhaps a cheeky sale.

- Although these moves do not scream “sell-off,” they certainly highlight Bhutan and its fellow big players using bitcoin as an agile tool on their balance sheet during these turbulent market times.

Ah, the Royal Government of Bhutan has decided to shake things up, moving bitcoin after months of wallet hibernation. As the price of bitcoin dipped below $71,000, funds began their journey to trading firms, exchanges, and mysterious new addresses, much like a royal decree amidst chaos.

Onchain data, that all-seeing oracle tracked by Arkham, reveals that Bhutan-linked wallets transferred more than 184 BTC just within the last 24 hours-a delightful little heist worth roughly $14 million.

Some bitcoin made its way to new addresses, while others waltzed over to known partners including QCP Capital and a Binance hot wallet, according to Arkham’s keen observations. These addresses are generally reserved for the high-stakes world of trading, liquidity management, or perhaps a dash for potential sales. CoinDesk even tried to summon a comment from QCP Capital via Telegram, as if that would unveil the secrets of the universe.

This flurry of activity marks Bhutan’s first notable wallet movement in three moons, coinciding perfectly with crypto’s dramatic rollercoaster. Bitcoin tumbled more than 7% in 24 hours, while silver decided to join the party with a plummet of 17%, all amid fears that our AI overlords are throwing traditional software business models into disarray.

Over the past two years, Bhutan has emerged as an unlikely player on the bitcoin stage, quietly amassing a stash through state-sponsored mining powered by the kingdom’s abundant hydropower. Unlike the corporate titans who parade their accumulation strategies, Bhutan’s bitcoin stockpile has remained largely incognito, making any change in wallet behavior a spectacle for traders to behold.

Now, while the latest transfers don’t confirm outright selling-despite being distributed across various destinations-they do raise eyebrows. Could it be mere reshuffling or a clever play for collateral management rather than an immediate liquidation? Only time will tell.

Nonetheless, sending bitcoin to exchanges and trading firms during this chaotic downturn is quite the contrast to the country’s otherwise lengthy periods of inactivity. Perhaps they’ve finally decided to join the fray!

This activity echoes a larger theme emerging in this market selloff: major holders are rethinking their approach to bitcoin, viewing it less as a static reserve and more as a dynamic balance-sheet tool during these turbulent times. Corporate treasuries, miners, and now sovereign entities are adjusting their positions as liquidity tightens and price swings escalate-a comedic ballet of financial maneuvering.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- XRP’s Little Dip: Oh, the Drama! 🎭

- THORChain Founder Loses $1.35M After Deepfake Zoom And Telegram Scam

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

2026-02-05 09:44