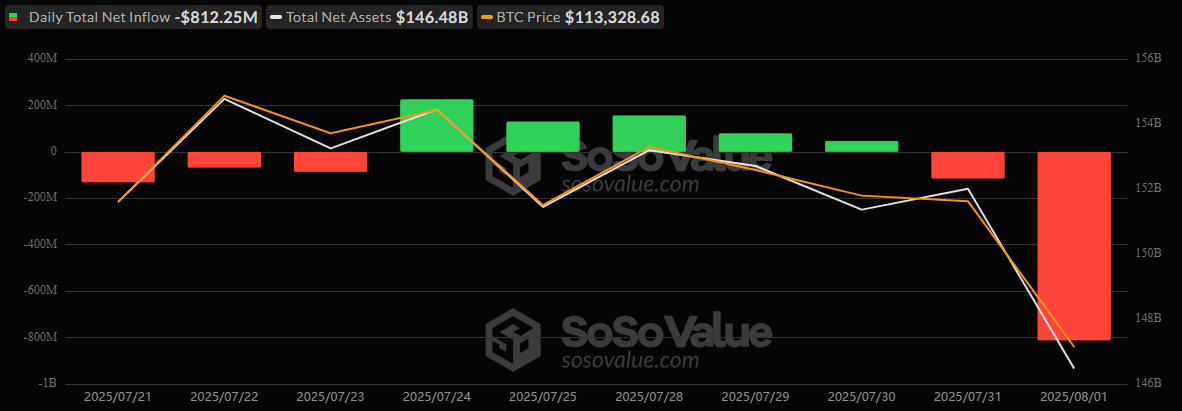

Ah, the grand theater of human folly! Bitcoin exchange-traded funds (ETFs), those modern-day chariots of financial ambition, have stumbled into a pit of despair, losing $812 million in a single day—their second-largest outflow ever. Meanwhile, ether ETFs, those younger siblings forever chasing Bitcoin’s shadow, saw their 20-day winning streak evaporate like morning dew under the sun, shedding $152 million. Truly, the gods of finance must be laughing at us mortals today. 🍿

The first day of August arrived not with the gentle whisper of hope but with the thunderous roar of capitulation. Both Bitcoin and ether ETFs were cast into the fiery abyss of red ink, undoing weeks of steady gains. Bitcoin ETFs bled an astonishing $811.25 million, marking the largest outflow since February and the second-largest in history. A sudden shift in investor sentiment? Or perhaps the realization that even digital gold cannot escape the whims of mortal greed? Who can say? 🤷♂️

The carnage was universal. Fidelity’s FBTC led the retreat with $331.42 million fleeing its coffers, followed closely by Ark 21shares’ ARKB, which hemorrhaged $327.93 million. Grayscale’s GBTC lost $66.79 million, Bitwise’s BITB shed $38.27 million, and Grayscale’s Bitcoin Mini Trust dropped $33.60 million. Even Blackrock’s IBIT, usually the unshakable titan of inflows, could not resist the tide, bleeding $2.58 million. Total trading volume soared to $6.14 billion, while net assets plummeted to $146.48 billion. Such is the fragility of human confidence. 💔

And what of Ether, that eternal optimist among cryptocurrencies? Its ETFs, too, were not spared from this financial tempest. After 20 glorious days of green, the streak ended abruptly with a $152.26 million outflow. Grayscale’s Ether Mini Trust bore the brunt, losing $47.68 million, while Bitwise’s ETHW shed $40.30 million and Grayscale’s ETHE parted ways with $37.20 million. Smaller players like Invesco’s QETH, Fidelity’s FETH, and Vaneck’s ETHV also faced multi-million-dollar exits. Only Blackrock’s ETHA managed to remain neutral, as if mocking its peers. Ether ETF trading reached $2.26 billion, with net assets retreating to $20.11 billion. How fickle are the hearts of men! 😅

This sudden reversal, after weeks of bullish momentum, begs the question: Is this merely a healthy correction—a necessary pause before the next ascent—or is it the first crack in the dam of institutional confidence? For now, one truth stands clear: Friday, August 1st, 2025, will be remembered as one of the most tumultuous days for crypto ETFs, a day when fortune’s wheel turned sharply against the hopeful. And so, dear reader, let us laugh at our collective misfortune, for what else can we do? 😂🚀

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- XRP’s Little Dip: Oh, the Drama! 🎭

2025-08-02 18:33