Alas, dear reader, what a sorrowful conclusion to the trading week! Both the Bitcoin and Ether exchange-traded funds (ETFs) endured a dreadful series of losses, bidding farewell to $367 million and $232 million, respectively. Thus, the week ended not with a bang, but with a mere whimper, leaving crypto-linked funds in a rather dismal state of affairs.

Bitcoin and Ether ETFs Endure Disastrous Redemptions to End the Week

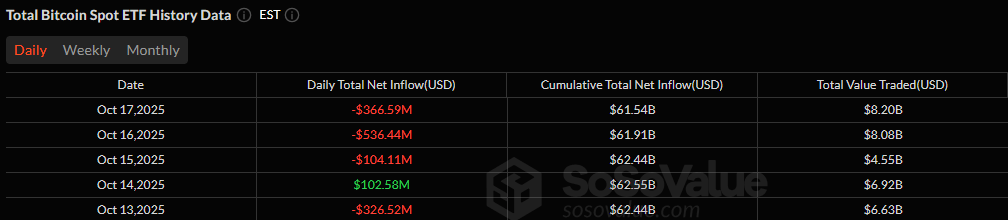

As the final hours of the week drew near, more misfortune befell crypto ETFs. After two days of unrelenting selling, both Bitcoin and Ether ETFs closed on Friday, October 17, with deep crimson marks on their balance sheets. This marked not only a third consecutive day of outflows but also one of the most tumultuous weeks since the balmy days of early summer.

Alas, investors, in their infinite wisdom, continued to scale back their Bitcoin ETF holdings, resulting in a loss of $366.59 million. The outflows were concentrated in four primary funds, with BlackRock’s IBIT leading the charge, expelling a staggering $268.81 million. Fidelity’s FBTC followed in sorrowful second place, shedding $67.37 million, while Grayscale’s GBTC saw $25.04 million take their leave. Valkyrie’s BRRR completed the exodus with a modest $5.57 million. While the trading volume was not negligible at $8.20 billion, the net assets plummeted to a mere $143.93 billion, painting a rather bleak picture of investor sentiment.

The Ether ETFs, not to be left out of the woe, also mirrored the sell-off, with a total loss of $232.28 million, spread across six funds. BlackRock’s ETHA bore the heaviest burden, losing $146.06 million, while Fidelity’s FETH and Grayscale’s ETHE parted ways with $30.61 million and $26.13 million, respectively. Further losses came from Bitwise’s ETHW (-$20.59 million), Grayscale’s Ether Mini Trust (-$4.69 million), and Vaneck’s ETHV (-$4.21 million). Despite an ample trading volume of $2.49 billion, net assets fell to a meagre $25.98 billion. After several weeks of dominance by inflows, the tides have unmistakably turned, leaving investors with bated breath as they await a possible turnaround next week.

FAQ

- What befell Bitcoin and Ether ETFs this week?

Both Bitcoin and Ether ETFs suffered grievous outflows, losing $367 million and $232 million, respectively, bringing a tumultuous week to a close. - Which Bitcoin ETF experienced the greatest redemption?

The illustrious BlackRock’s IBIT led the sell-off with $268.81 million in withdrawals, with Fidelity’s FBTC and Grayscale’s GBTC trailing in its wake. - What happened with the Ether ETFs?

The Ether ETFs mirrored the Bitcoin plight, with BlackRock’s ETHA suffering the most with a loss of $146.06 million. - What is the outlook for the market after such heavy losses?

With total ETF assets plummeting to $143.93 billion for BTC and $25.98 billion for ETH, all eyes are now on the coming week, as investors hope for the clouds to part and deliver a brighter future.

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Cardano’s Rollercoaster Ride: From $1 to $1.54 (And Possibly Back Again)

- Solana’s $200 Gambit: Will This Blockchain Darling Finally Deliver? 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

2025-10-18 22:56