Right. So Bitcoin has apparently decided to become Asia’s new financial frenemy. The high-stakes, awkward dinner party where no one knows the rules, but everyone’s bluffing. Legislators are on the dancefloor now, not the nerds in the corner. Their every move decides if this is a glittering future or a truly expensive trip to the toilet. 💩

And who’s leading the conga line? Hong Kong. Bless. They’re stapling digital assets into their market infrastructure like a desperate crafter. ETFs for the normies, a Stablecoins Bill for the… stable? They’re basically trying to turn crypto’s chaotic “vibes” into actual, boring, functional plumbing. Good luck with that.

Hong Kong Writes the Rulebook (Because Someone Has To)

What the Hell Happened? – In a flurry of activity that suggests someone finally had a large coffee, HKEX listed some ETFs. Asia’s first! *Confetti cannon that misfires* Then Australia copied them. Because of course. Korea decided the main issue was users not being protected from themselves (fair) and demanded 80% of assets be kept in a metaphorical freezer. Indonesia’s OJK just grabbed the mic and said, “I’m in charge now.” *Shrugs*

The Messy, Human Reality – Over in China, the rules for what to do with all the bitcoin they’ve seized are… whatever the local government feels like on the day. A total shambles. Meanwhile, Japan’s government was asked if bitcoin could be, like, a national treasure? They basically laughed and wrote “LOL no” in the official record. My hero. And a legend in Taiwan proposed spending 0.1% of the GDP on a national bitcoin fund. My kinda reckless.

The Ripple Effect (No, Not That Crypto) – So now Aussie pension funds can throw your retirement money at this. Hong Kong’s move created a whole cottage industry of people who get paid to watch digital money. Korea says “stay safe,” Hong Kong says “come on in!,” and Indonesia just glares from the corner. It’s a beautiful, chaotic mess.

The Latest Goss – The US, in a shock move, did not immediately confiscate all the bitcoin. Groundbreaking. China’s now peeking at stablecoins to make the yuan look cool. And Hong Kong? They passed their bill and are now officially open for stablecoin business. Applications are probably being filed on the back of napkins as we speak.

The Great Government Crypto Yard Sale 🛒

Let’s be clear: governments aren’t buying this stuff. They’re taking it from naughty people. China’s PlusToken case was basically a national lottery win. The US held onto their spoils, Germany just sold it all like a sensible person. This means we have to live with the constant threat of a government suddenly dumping a mountain of crypto and crashing the party. How fun!

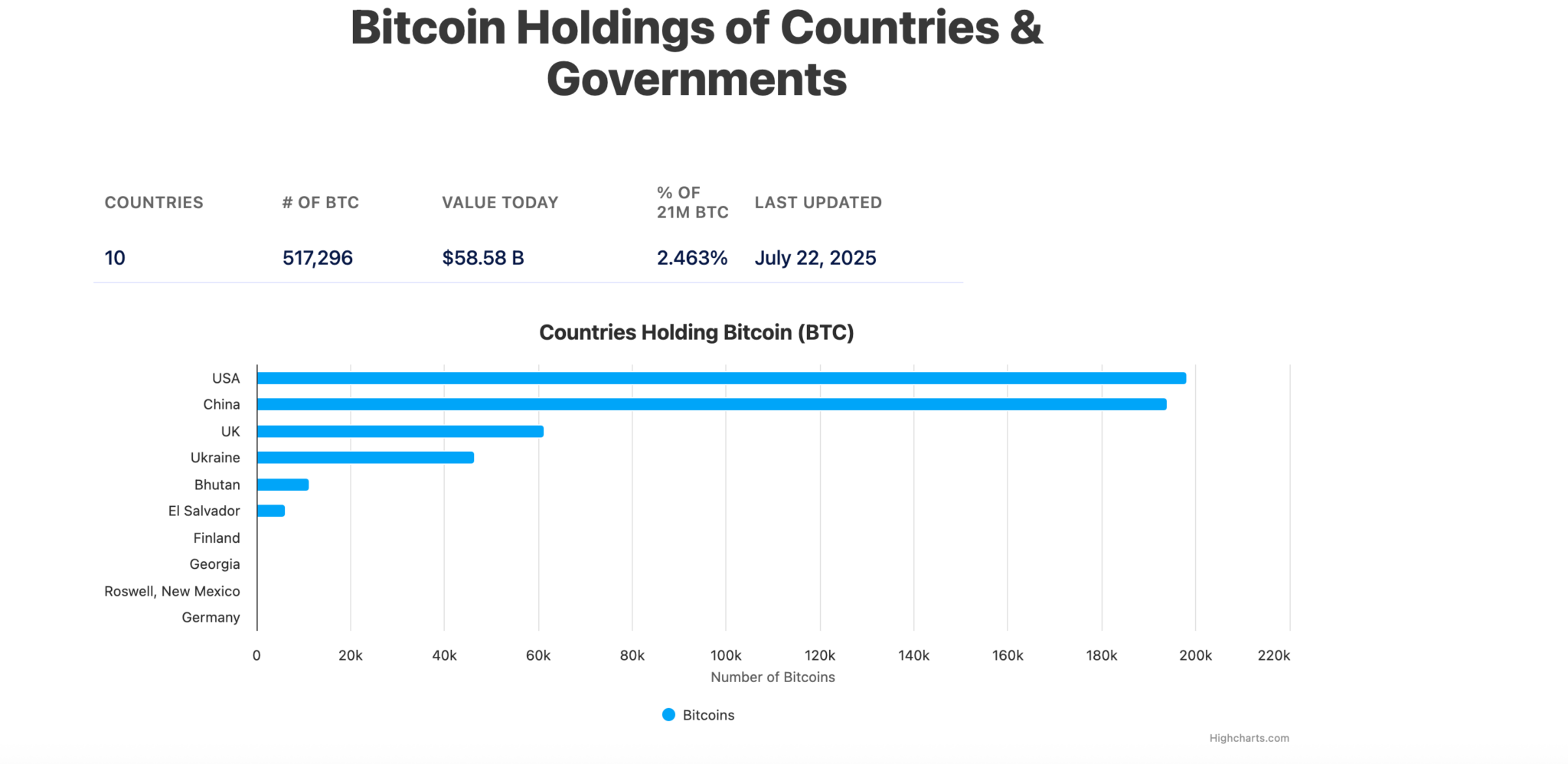

Apparently, governments now own 2.3% of all Bitcoin. Which is both a lot and also… completely unplanned. It’s the financial equivalent of finding a weird mushroom in your garden and not knowing if it’s a delicacy or will kill you.

A Blast from the Past – Gold ETFs made things boring and respectable. Crypto ETFs are trying to do the same but keep getting tripped up by pesky things like “laws” and “how do we keep this safe?”. Also, the IMF still thinks it’s all a bit naff and won’t let it sit at the big kids’ table.

Everything That Could Go Wrong 🌈 – Governments causing chaos with unplanned sales. Stablecoins collapsing because, surprise, they weren’t stable. Over-regulation sending everyone to digital nomad islands. And the US thinking about putting crypto in your retirement fund is the most terrifying rom-com plotline ever.

Politicians Discover Bitcoin (God Help Us All)

Politicians have entered the chat. They’re now asking the big questions, like “can we, you know, just… have some?” Taiwan said yes, Japan said absolutely not, and Brazil’s Chamber of Deputies had a hearing about putting a whopping 5% of their reserves into it. Texas, being Texas, just went ahead and did its own thing. Because politics is now driving this. A truly chilling thought.

The Numbers That (Kinda) Matter

- 2.3%: The portion of bitcoin owned by your friendly neighborhood government. 😬

- 195,000: Bitcoin seized in China’s PlusToken case (aka The Motherlode).

- 80%: How much of your crypto Korea insists must be kept on ice. ❄️

- April 30, 2024: Hong Kong’s “hold my beer” ETF moment.

- May 21, 2025: Hong Kong makes stablecoins… a thing you need a license for.

Expert Opinion (Because We Have To)

“The introduction of Spot VA ETFs in Hong Kong is the latest exciting addition to HKEX’s diverse and vibrant ETP ecosystem, providing investors with access to a new asset class.” – HKEX (Translation: “Please give us money.”)

“The Government welcomed the passage of the Stablecoins Bill… to establish a licensing regime for fiat-referenced stablecoins issuers in Hong Kong.” – HKMA (Translation: “We made a form! Fill it out!”)

“The Act… requires virtual asset service providers to safely manage and store their customers’ deposits and virtual assets.” – FSC Korea (Translation: “For the love of god, don’t lose it.”)

So here we are. China’s sitting on a pile of seized crypto, scratching its head. Hong Kong’s opening a bureaucratic lemonade stand. And the US might just accidentally blow up your grandma’s 401(k). Asia’s got to decide: get on the ride, or watch from behind the safety barricades. 🎢 Place your bets. Or don’t. Probably don’t.

Read More

- Gold Rate Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Silver Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Dostoevsky Discovers Google: Crypto Wallets Face Absurd Bureaucratic Fate 😱

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

2025-08-22 06:03