Ah, the Federal Reserve has once again played its game of economic puppetry, tugging at the strings of the crypto market with the finesse of a ballroom dancer but the subtlety of a sledgehammer. A trifecta of interest rate cuts, totaling a dazzling 0.75%, have stirred the pot, yet how very predictable-like predicting that the sun will rise or that your uncle will drunkenly sing at the next family gathering. 🎭

Fed’s Dance of Delight and Disappointment

Jeff Ko, the oracle of CoinEx, whispers that most of us had already anticipated this ballet, with the dot plot subtly hinting at a hawkish encore. A modest $40 billion in Treasury magic trickery was employed-not exactly the grand stimulus opera but enough to make traders clutch their pearls. Meanwhile, markets reacted with the enthusiasm of a cat faced with a cucumber-mildly startled and mildly optimistic-lifting stocks and giving Bitcoin a momentary gasp of hope. 🐱🥒

Rumors, Reality, and the Whims of Santiment

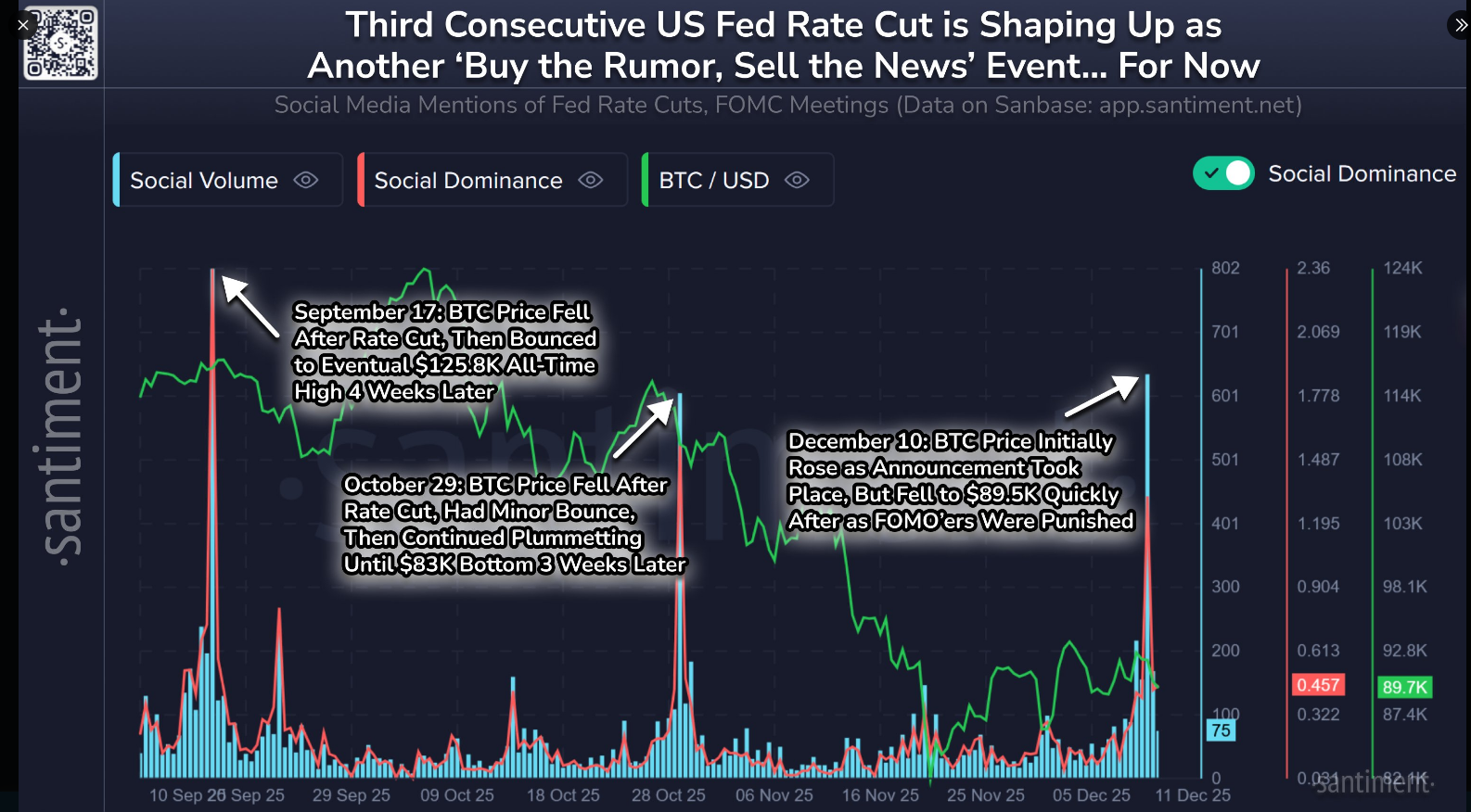

Our dear on-chain prophets at Santiment bless us with their wisdom: these rate cuts are like summer sales-short-lived and often followed by frantic shopping sprees of sell-offs. That classic “buy the rumor, sell the news” dance was performed with gusto, leaving traders dizzy. The market swaggered under $90,000 then boomed to $93,500, only to retreat to the comforting arms of $92,300-like a teenager on their first crush’s rollercoaster ride. 🎢

The Fed’s trio of cuts over three months-each ritual ending with a cozy 0.75% blush-are thought by some to be bullish for our beloved crypto. Yet, in practice, they have been more like icy showers-brief and unrefreshing. Santiment hints at small waves of fear, Uncertainty, and Doubt (FUD) and retail panic as signals that the storm is settling-and perhaps, a bounce is brewing, like a caffeinated squirrel plotting its next move.

1⃣ September 17, 2025: A gentle lowering of rates to 4.00-4.25%, because why not?

2⃣ October 29, 2025: The plot thickens-though our narrator forgets the next part, for it was a subplot.

Technical levels are as fickle as a diva. Bitcoin, that rebellious digit, whipsawed below $90,000 only to catapult back to $93,500-like a teenager testing boundaries. Resistance looms between $97,000 and $108,000, whispering promises of greatness if only the stars align. The MACD signal teases hope, as if the market’s inner voice is whispering “Maybe, just maybe…” as traders cling to charts and dreams alike.

Meanwhile, ETF activity is as lively as a snail in a marathon-mere $219 million since November’s end, leaving our investors in a state of cautious despair. The dollar, that once mighty titan, now sulks with a DXY at 98.36 and MACD showing bearish swagger. Stocks dance briefly above their old simple moving averages, offering a fleeting glimpse of hope-though the dance is somewhat uneven, like a lover’s quarrel, with losses hurting more than gains heal.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- USD COP PREDICTION

- Will Ripple’s Court Drama Empty SEC’s Wallet? XRP ETF Madness Incoming! 🚀🔥

- Whales Play Monopoly with 2 Million LINK: What Could Go Wrong? 🐋🎲

- South Korea’s 2026 Bitcoin ETF Plan: Genius or Absolute Chaos?

- TRX PREDICTION. TRX cryptocurrency

2025-12-12 20:48