What one ought never to admit in public (but here’s what happened):

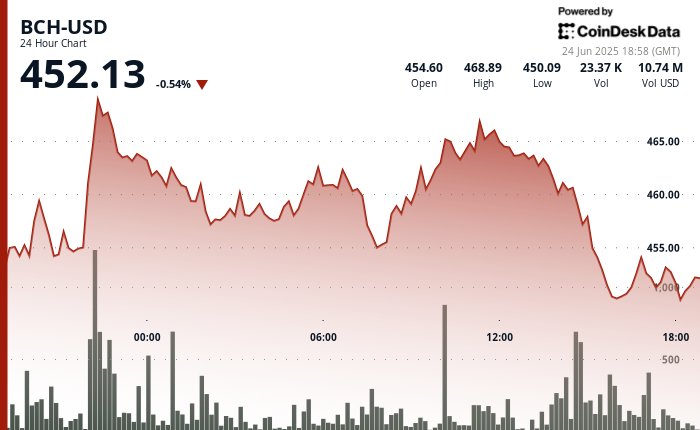

- BCH, in an admirable show of stubbornness, dashed itself thrice against the $467 barricade — and, like a suitor rejected at every ball, slouched away in disappointment, high volume notwithstanding.

- Desperate buyers loitered artfully near the $450 mark, whispering encouragements and forming what optimists would call a “support zone.”

- The final hour proved Shakespearean: volatility took center stage, and BCH pirouetted into a V-pattern recovery, complete with dramatic volume swells. 🕺

Bitcoin Cash (or as I like to call it, the Wildean tragic hero of crypto) was last seen clinging to $452.13, looking decidedly forlorn with a meagre 0.54% stumble over 24 hours. The grand debut at $467 ended prematurely—thrice, no less! Never has resistance looked so attractive, or so unattainable. The $467 threshold has the allure of a velvet-rope club that simply won’t let BCH past, regardless of how dapper its volume spike appears.

On the night of June 23rd, BCH made a valiant, if not melodramatic, leap to $467. A 3% surge—bravo!—before being shown the door. Twice more our protagonist attempted entry; twice more it met the consternation of “Not tonight, darling.” Lower highs trailed forlornly behind that initial spike, composing a bearish sonnet in descending trendlines (perhaps set to minor key).

But hark! From the hallowed halls of finance, word arrived: Federal Reserve’s Jerome Powell declared the banks need no permission slip to choose their digital dancers. The gatekeepers have grown bored with their clipboards, ushering in an age where institutional crypto affairs may flourish—or flounder with greater efficiency.

A Modest Proposal: Technical Musings

- BCH performed a 24-hour flânerie through a $19.76 range (4.4%), from $449.61 to $469.63. Even Oscar’s cigarette holder couldn’t travel such a distance unsinged.

- At 22:00, June 23, BCH pirouetted up nearly 3% with 79,485 units in tow, only for the cold splash of $467 rejection to await.

- Two encore performances at $467 followed—each rejected more coldly than the last.

- Supporters, those magnificent fools, clustered thickly between 15:00 and 16:00 at $450, as if quantity could outwit gravitas.

- With every failed ascent, lower highs composed a trendline more melancholy than a rain-soaked poet at sunset.

- Destiny loves theatrics: a micro-V, a brief recovery from $449.94 to $451.31, had the flair of a curtain call (albeit in the minor leagues).

- Volume surged with the anxious energy of a matron at auction—first upon falling, then rebounding, each more desperate than the last.

- So here BCH sits, propped up at $450, applauded for simply having survived the spectacle. One cannot decide if this is resilience or merely stubbornness. 🎭

Read More

- CRO PREDICTION. CRO cryptocurrency

- Why Is Everyone Obsessing Over These Cryptos? 🤔

- Brent Oil Forecast

- USD JPY PREDICTION

- USD MXN PREDICTION

- AVAX Poised for a Jump: Why the Next $80 Might Just Be a Matter of Time

- EUR THB PREDICTION

- Economist Reveals His Biggest Bitcoin Mistake – You Won’t Believe What It Is

- USD HKD PREDICTION

- Silver Rate Forecast

2025-06-24 23:19