Oh, how the mighty have fallen! What once seemed like the inevitable flood of traditional finance (TradFi) dollars pouring into U.S. spot Bitcoin ETFs has come to a screeching halt. The crypto market, once an arena for unrelenting growth, now finds itself a little… wobbly. Call it fragility, call it exhaustion, but the reality is that the golden days are behind us. 😬

The autumn of 2024, that fateful season when spot Bitcoin ETFs were first introduced, was meant to be a new dawn-a regulated, user-friendly gateway for institutional capital to swagger into crypto like they owned the place. And for a moment, they did. With the SEC giving the green light, Bitcoin’s (BTC) price soared like a hawk on a thermal updraft, touching new heights in late 2024, and again in mid-2025. Yes, that sweet TradFi cash was behind the rocket fuel, lifting everything it touched. 🚀💸

Sentiment Shift: The Wall of Silence

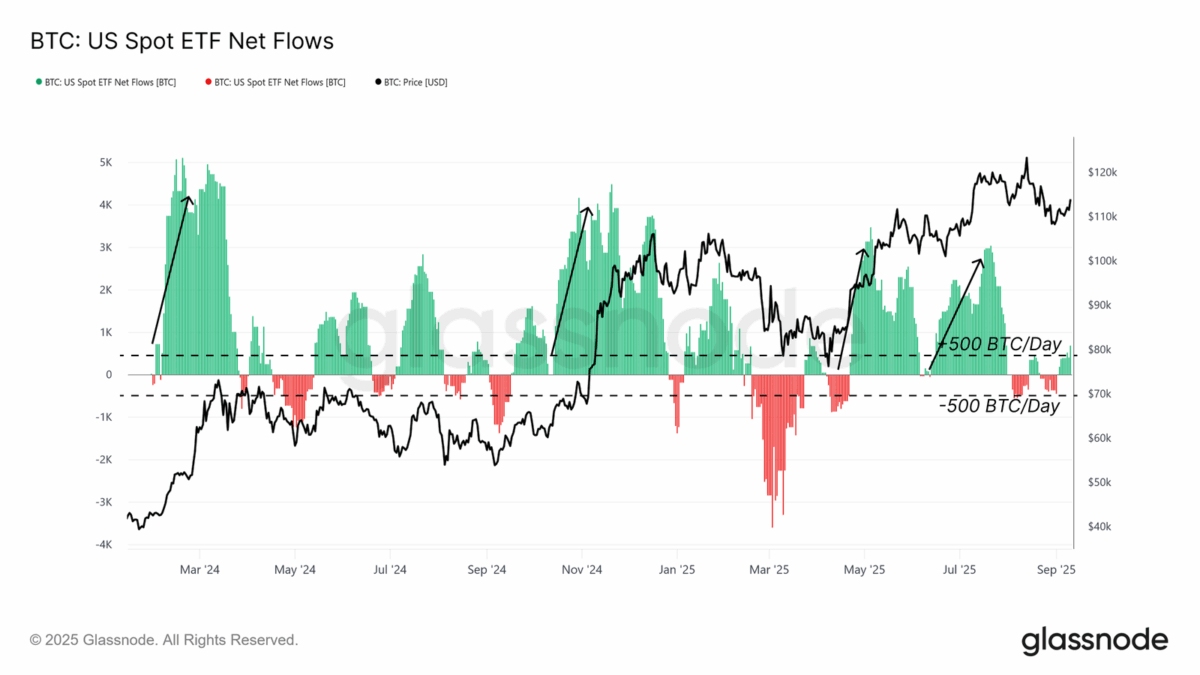

But oh, what a difference a few months make. In stark contrast to the frenetic inflows that turned the crypto world into a glittering disco ball of high returns, we now find daily netflows limping along at a tepid ±500 BTC. That’s a far cry from the roaring waves of investment we saw in the heady days of early 2025. The investors? They’re out. The party? It’s winding down. 🎉

And the numbers back up the story. Glassnode, the crypto analytics platform that likes to remind you when your dreams are built on sand, shows the sad reversal. From once luring billions of dollars daily like a Vegas casino, the 14-day moving averages for netflows have flatlined. They’re now chilling around break-even, just hanging there, like an awkward guest who stayed a bit too long at a party. 😒

The netflows are barely clinging to the positive side of things, and a steep drop from the euphoric buying pressure of earlier in 2025 suggests that this first wave of institutional love for crypto might have hit its expiration date. 🕐

Profit-Taking & Market Meltdown: A Recipe for Disaster

As if the economic turmoil wasn’t enough, the old game of profit-taking is also throwing a wrench into things. Picture this: early institutions swooping in when Bitcoin was flirting with $50,000, now watching it skyrocket to a lofty $123,000 in mid-August. Do they hang onto their bags, or cash out for a tidy profit? Spoiler: They’re cashing out. And that’s leaving the market in a bit of a tailspin. 💸

The selling pressure from these profit-taking sharks, combined with the waning interest from new investors, has left Bitcoin teetering on the edge of fragility. Will the market find its balance, or are we about to witness the latest crypto bubble deflate in slow motion? Only time will tell… ⏳

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- XRP: A Most Lamentable Fall! 📉

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- Kanye West’s YZY Token: A Wild Ride of 6800% Surge and Market Mayhem! 🎢💰

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Altcoins Collapse: Trump’s Tariff Threats Cause Cosmic Chaos

- Dostoevsky Discovers Google: Crypto Wallets Face Absurd Bureaucratic Fate 😱

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

2025-09-12 16:48