Crypto ETFs faced a midweek meltdown, with Bitcoin and Ether playing the role of overworked baristas at a coffee shop that’s closing early. 🚨☕ XRP recorded its first-ever day of net outflows, while Solana stood alone in positive territory, like the last kid at a party who still has a smile on their face. 😂

Crypto ETFs Retreat as 🐍Bitcoin, 🐲Ether and 🦴XRP Dump Over $620 Million

Risk appetite vanished faster than a cryptocurrency on a hot day, with selling pressure resurfacing like a bad ex. 🙃 Bitcoin led the pullback, Ether followed, and XRP experienced a notable turning point-probably because it finally realized it’s not the center of the universe. Only Solana managed to escape the downturn, posting a small but symbolic gain. 🌈

[bn_top-ad]

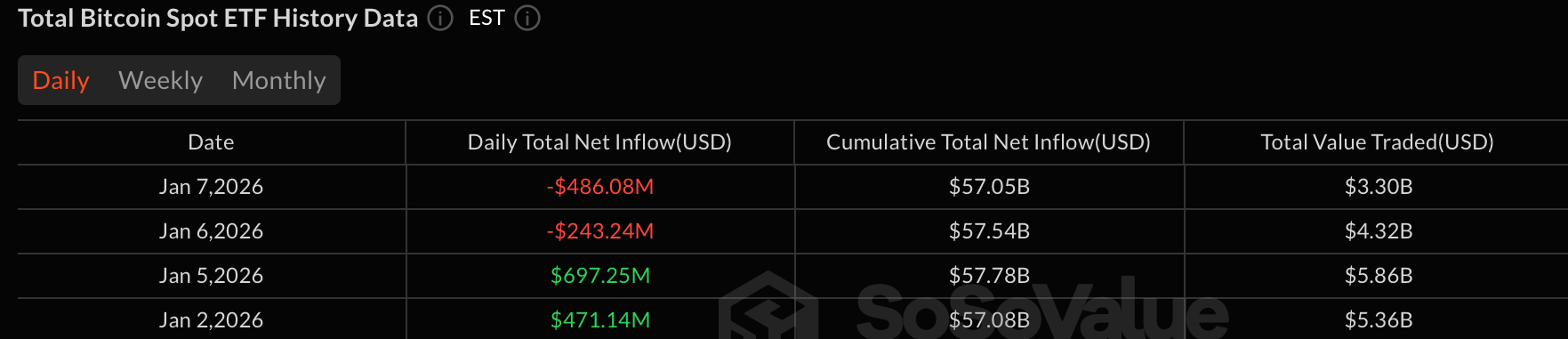

Bitcoin ETFs logged a $486.08 million net outflow, marking the heaviest single-day exit of 2026 so far. Fidelity’s FBTC absorbed the largest hit with $247.62 million in redemptions, while Blackrock’s IBIT followed with a $129.96 million outflow. Ark & 21Shares’ ARKB and Bitwise’s BITB added further pressure, shedding $42.27 million and $39.03 million, respectively. Smaller exits were seen from Grayscale’s GBTC ($15.63 million) and Vaneck’s HODL ($11.57 million). Trading volume reached $3.30 billion, as total net assets slid to $118.36 billion. 💸

Ether ETFs also reversed course, posting a $98.45 million net outflow after recent inflow momentum stalled. Grayscale’s ETHE led the retreat with a $52.05 million exit. Additional losses came from Fidelity’s FETH ($13.29 million), Grayscale’s Ether Mini Trust ($13.03 million), and Bitwise’s ETHW ($11.23 million). Blackrock’s ETHA and Vaneck’s ETHV contributed exits of $6.64 million and $4.59 million, respectively. Franklin’s EZET was the lone bright spot with a $2.38 million inflow, though it offered little relief. Total value traded stood at $1.30 billion, with net assets steady at $19.31 billion. 🧨

XRP ETFs marked a historic shift, recording their first-ever net outflow of $40.80 million. Early inflows into Bitwise’s 🦴XRP ($2.44 million), Canary’s XRPC ($2.32 million), and Grayscale’s GXRP ($1.69 million) were overwhelmed by a sharp $47.25 million exit from 21Shares’ TOXR. Trading volume reached $33.74 million, while net assets held at $1.53 billion. 🚫

Solana ETFs were the sole bright spot, closing the day with a $1.97 million inflow, entirely driven by Bitwise’s BSOL. Total value traded came in at $22.21 million, with net assets ending at $1.08 billion. 🌟

By the close, the day’s trading flow reflected a clear risk reset. Bitcoin and Ether absorbed heavy profit-taking, XRP stumbled for the first time since launch, and Solana quietly attracted incremental capital. 🤯

FAQ📉

- Why did Bitcoin ETFs see heavy outflows midweek?

Bitcoin ETFs lost $486 million as profit-taking triggered the largest daily exit of 2026. Because someone finally realized that Bitcoin isn’t a magic bean, and profit-taking is just a fancy way of saying “I’m scared of the market.” 😂 - What caused ether ETFs to turn negative again?

Ether ETFs shed $98 million as recent inflows stalled and selling resumed across major funds. Because Ether is the ex who keeps coming back, even though you’ve already moved on. 🙃 - Why did XRP ETFs post their first-ever outflow?

A large $47 million exit from one fund pushed XRP ETFs into their first net red day. Because even the most loyal followers can get tired of the same old story. 🚫 - Why did solana ETFs stay positive during the selloff?

Solana ETFs gained $2 million as investors selectively added exposure despite broader risk-off flows. Because Solana is the quiet kid who always gets the job done, even when no one’s looking. 🌈

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Pump.fun’s Record Volume: Is Solana’s Meme Coin Renaissance Here? 🚨

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- PENGU: The Cryptocurrency Drama Fit for a Molière Play 🎭💰

- Crypto Cash Floods Trump’s PAC: $21M and Counting! 🚀💸

- USD KZT PREDICTION

- Zcash: The $520 Fiasco 🎭💸 – Will ZEC Ever Break Free?

- Barclays Bets on Ubyx: A Token Tale of Tons of Cash! 💰🚀

2026-01-08 19:39