Bitcoin transaction fees have taken a nosedive-so low, in fact, you’d think the network had stumbled back into the Stone Age, or perhaps just got tired of all the hustle and bustle.

According to some fancy graphs from Glassnode, the 14-day moving average of daily fees now hovers at 3.5 BTC-yeah, that’s a number from 2011 when everyone was still trying to figure out if Bitcoin was a fancy joke or the future of money. Spoiler: It’s still both, depending on your mood.

Why’s Bitcoin’s Fee Bubble Deflating Faster than a Party Balloon?

Turns out, not many folks want to pay hefty fees for a network that’s more about hiding your savings in digital socks than flashing flashy transactions. Demand for blockspace has evaporated faster than cheap beer at a college party, and Bitcoin’s purpose has shifted-no longer the payment superstar, but the digital gold hoarders’ best friend.

On-chain data’s got the receipts. Big money firms like Strategy are stuffing their wallets with Bitcoin, turning it into a digital piggy bank rather than a payment platform for pizza or lattes.

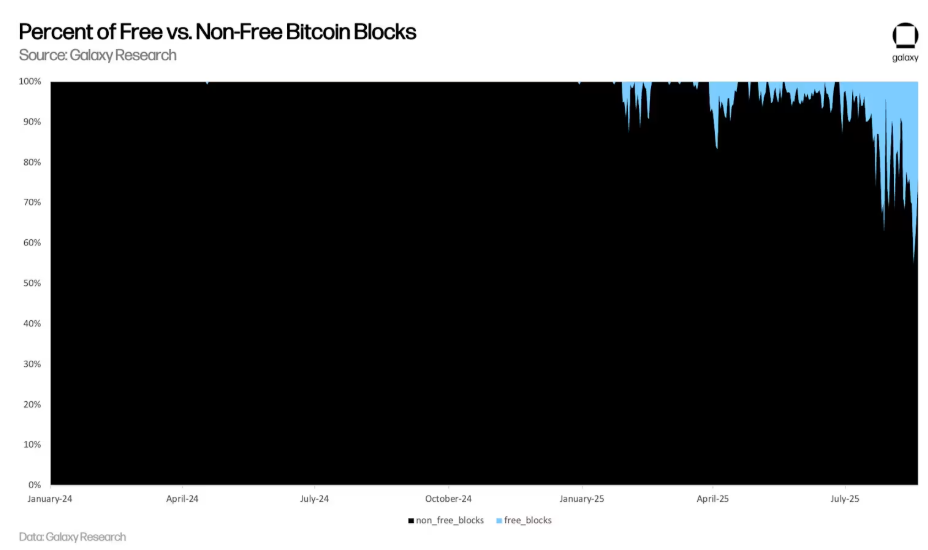

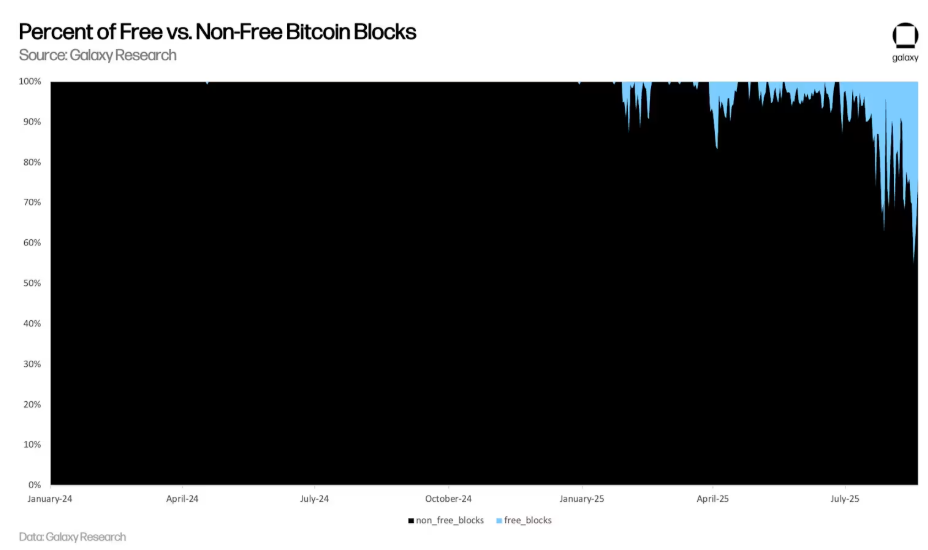

And speaking of waiting rooms, Galaxy Digital notes that the mempool-think of it as Bitcoin’s version of a line at the DMV-is emptier than the fridge at Friday lunch. Blocks are only half full or worse, acting like they’re on a diet. Some blocks are so light they might as well be ghosts-no fees needed, no rush, no fuss.

“These blocks fail to reach the maximum weight limit (4,000,000 weight units) despite room to include more transactions. The mempool is basically empty most times, and when it’s not, it’s full of transactions that don’t want to pay extra for quick processing,” Galaxy said with a shrug.

It gets better-or worse, depending on whether you’re a miner. After the 2024 halving cut rewards to a measly 3.125 BTC, the miners had hoped transaction fees would fill in the financial gaps. Nope. Instead, the market’s decided to take it easy, making life harder for the little guys trying to stay afloat. The long-term survival of Bitcoin’s security? Asking for a friend.

And it’s not just technical mumbo jumbo that’s driving the change. The whole market structure has shifted gears. Big shot institutional players and ETFs are swooping in, reducing the need for the average Joe to log transactions directly on the blockchain. Meanwhile, retail traders chasing meme coin glory are jumping ship to cheaper, speedier chains like Solana-because who wants to wait when you can throw your money into the wind faster than a hurricane?

“If more BTC volume moves into ETFs, custodians, and speedy alt-L1s, Bitcoin might just turn into a glorified settlement layer-like a fancy restaurant with no food,” Galaxy warned, sounding like a concerned chef.

Amid all this, Bitcoin’s popularity keeps climbing-big institutions and governments are now hopping aboard the hype train, and the price’s been climbing, too, topping a shiny new all-time high of over $124,000. Some folks are even whispering about reaching the million-dollar mark someday, which sounds about as plausible as pigs flying-minus the bacon.

Read More

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- XRP Stands at $2.96-Is it the Final Battle or Just a Whimper? 🚨

- Grayscale’s Crypto ETF: 42% Growth or Just Another Digital Mirage?

- Gold Hits New Heights While Bitcoin Seems to Be Taking a Nap – You Won’t Believe This!

- TRON’s Stablecoin Chaos: Whales Wobble, Binance Falls! 🐉💸

- Three Coins Chekhov Would Yawn at-Yet Might Still Make You Rich 😴💸

2025-08-24 21:27