Bitcoin (BTC) is once again hovering in that uncomfortably familiar region, now at a dainty $108,000. That’s up a heart-stopping 0.33%—or, as some traders like to call it, “the change you find in your sofa”—over the last 24 hours. Picture it gracefully tiptoeing between $100,000 and $110,000, the financial markets’ equivalent of waiting at baggage claim, watching the same three suitcases go around for hours, wondering if yours will ever appear or if you’ll just move in and set up camp.

The Imminent Bitcoin Battle Fronts: $107,000 And $110,500

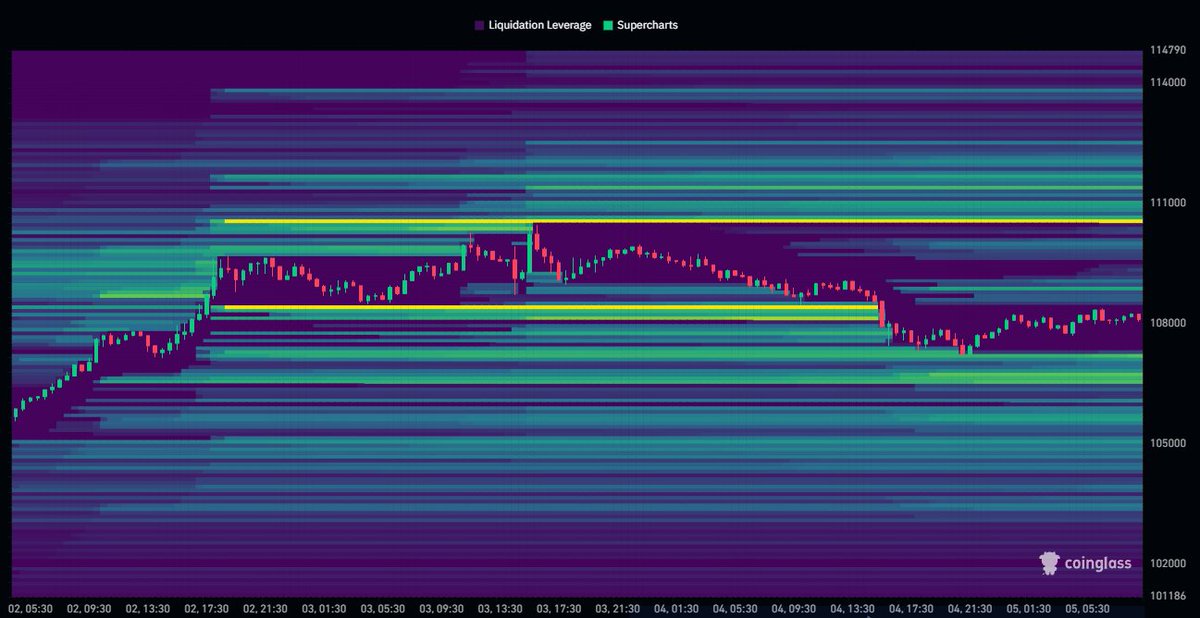

Legendary market sage Daan Crypto, star of X (formerly known as Twitter but not at all “formerly” in terms of drama), bequeathed to mere mortals an X post on July 5. Waxing apocalyptic, he unveiled the sacred glyphs of liquidity, sourced from the oracle Coinglass. There was much wailing and gnashing of teeth after a swath of leveraged positions was wiped out at $108,000—likely because traders thought “leverage” is just another word for “putting all your chips on red and hoping the roulette table likes you.”

Attention has now shifted—like kids after the ice-cream truck—to liquidity blobs at $107,000 (the sturdy “support” where traders clutch their positions as if gripping the last donut at an office meeting) and $110,500, the “resistance”, which is just a fancier way of saying “good luck getting past this without slipping on a banana peel.” If $107,000 gives out, expect a dramatic Swan Lake-style dive toward $100,000. If it holds, bounce incoming! Or so the legends say.

Above us looms $110,500, a number so intimidating that short-sellers are already practicing their “I told you so” faces. Should Bitcoin break through that—snap—there could be a “short squeeze” so tight you’ll hear bears smoking in the back alley, muttering about how they never liked cryptocurrency in the first place. If that squeeze happens, there’s little charted territory ahead. Anything could happen. Time to upgrade your charting software, or just start reading tea leaves.

The net result? Bitcoin remains stuck in the $107,000–$110,500 barrel roll, the financial market equivalent of an existential waiting room, powered by anxiety, caffeine, and endless memes. Something’s got to give. Or not. 🥲

Bitcoin Exchange Leverage Reaches New High

Meanwhile, CryptoQuant reports the estimated leverage ratio across exchanges at a “new yearly high” of 0.27—this means everyone is collectively borrowing more money than sense, all convinced they’ll be the next Satoshi Nakamoto and not the next “Well, at least I learned a valuable lesson.” This figure essentially signals an arms race of risk-taking; it’s as if playing hopscotch in a minefield is now in fashion again.

So what’s the body count? As of now, Bitcoin clings to $108,232, with a weekly performance of +0.70%—and 6.41% for the month. The market cap sits at $2.15 trillion, which is roughly the combined GDP of several moderately sized planets, and Bitcoin still reigns supreme with 64.6% market dominance. If Bitcoin could blush, it’d be beet red.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Crypto Chaos: Shiba Inu Flirts with Another Zero, Ethereum on the Brink, Bitcoin’s $100K Nightmare!

- Bitcoin’s Wild Ride: $79B Futures & Sky-High Options-Brace for Impact! 🚀💥

- Ripple’s RLUSD Invades Japan: Crypto’s New Empire Begins?

- Worldcoin’s Wobbly Waltz: Traders Tiptoe Between Hope and Hesitation 🕺💰

- EU’s Crypto Crackdown: Can Regulations Keep Up with the Wild West?

2025-07-06 15:48