Right. So, apparently some hackers decided to wake up from a very long nap and move $1.8 billion worth of stolen Bitcoin. Honestly, who needs sleep when you have illicit gains?

It all revolves around this Chinese mining pool, LuBian. You know, the one that got…lightly inconvenienced… back in 2020. Inconvenienced to the tune of 127,426 BTC. Which, let’s be real, is more than my lifetime supply of avocado toast. 🥑

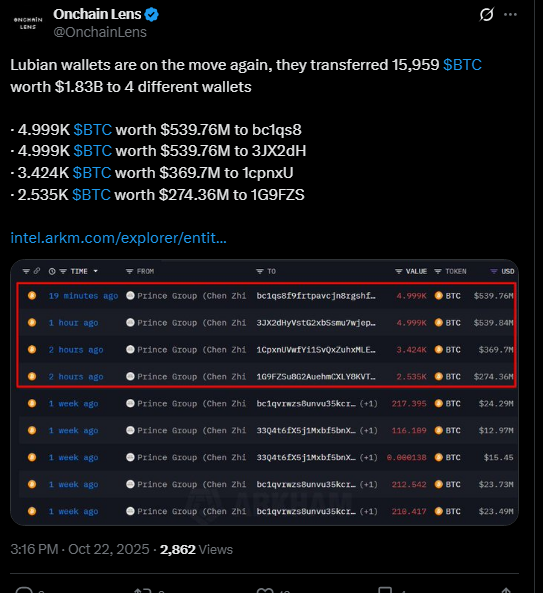

On-chain data (which sounds terribly technical, doesn’t it?) shows they’ve shifted about 15,959 BTC into four separate wallets. Like breaking up a huge pile of cash into smaller, less conspicuous piles. Subtle. Very subtle.

Source-X (whoever that is).

This is happening three years after the initial theft, when the Bitcoin actually meant less. Now, it’s worth almost $14.5 billion. Honestly, the audacity! It’s like finding a tenner in an old coat and discovering it’s now a winning lottery ticket. 🤯

Two of the transfers were a polite 4,999 BTC each (around $540 million each, no biggie). Then a slightly smaller 3,424 BTC and 2,535 BTC to complete the quartet of dodgy moves. Analysts are saying it’s “coordinated”. Coordinated? I suspect a nefarious mastermind. Or maybe just someone with a spreadsheet.

LuBian, bless their disappeared souls, used to control 6% of all Bitcoin mining. Then they vanished, probably due to a combination of regulators and general awkwardness.

Sudden Movement After Long Dormancy Raises Questions (and my Eyebrows)

And wouldn’t you know it, this all happened right after the US Department of Justice confiscated $14 billion in Bitcoin linked to the same hack. Coincidence? I think not. It’s either a desperate scramble to protect their ill-gotten gains or just a really, really bad time to take a holiday. 🤔

The question is, are they panicking? Or just rearranging the deck chairs on the Titanic of crypto crime? It all makes you wonder if they’re scared that someone might actually, you know, catch them.

The stolen Bitcoin briefly stirred in mid-2024, but nothing like this! It’s like a hibernating bear waking up and demanding a buffet. 🐻

Now blockchain observers – sounds very important – are going to be watching to see if the money gets thrown into mixers or exchanged. Apparently, it’s all about obscuring “transaction trails.” Honestly, it’s all a bit much.

Historic Theft Highlights Cryptocurrency Risks (Duh!)

This is officially one of the biggest crypto heists ever. It exposed just how vulnerable these mining pools can be. Key security? Not their strong suit, apparently. LuBian even asked for their Bitcoin back. Can you imagine the awkwardness? Like asking a burglar to politely return your heirloom. 🙄

It’s even bigger than the Mt. Gox disaster, which, admittedly, was quite a disaster. This just reinforces the fact that crypto security is…well, let’s just say it’s still a work in progress.

Honestly, it’s a stark reminder that keeping your digital assets safe requires more than just hoping for the best. Maybe install a better lock on your digital door.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- XRP: The Cryptocurrency That Dares to Dream (and Fail) 😅

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

- EUR ARS PREDICTION

- 📉 SUI’s Price Plummets Below $4: Is It Time to Panic or Party? 🎉

- Thailand’s Cryptic Cure for Tourist Blues 🌴💰

- Dogecoin’s Bull Run? Don’t Bet Against This Chart, Says Analyst 🐕💸

2025-10-23 08:17