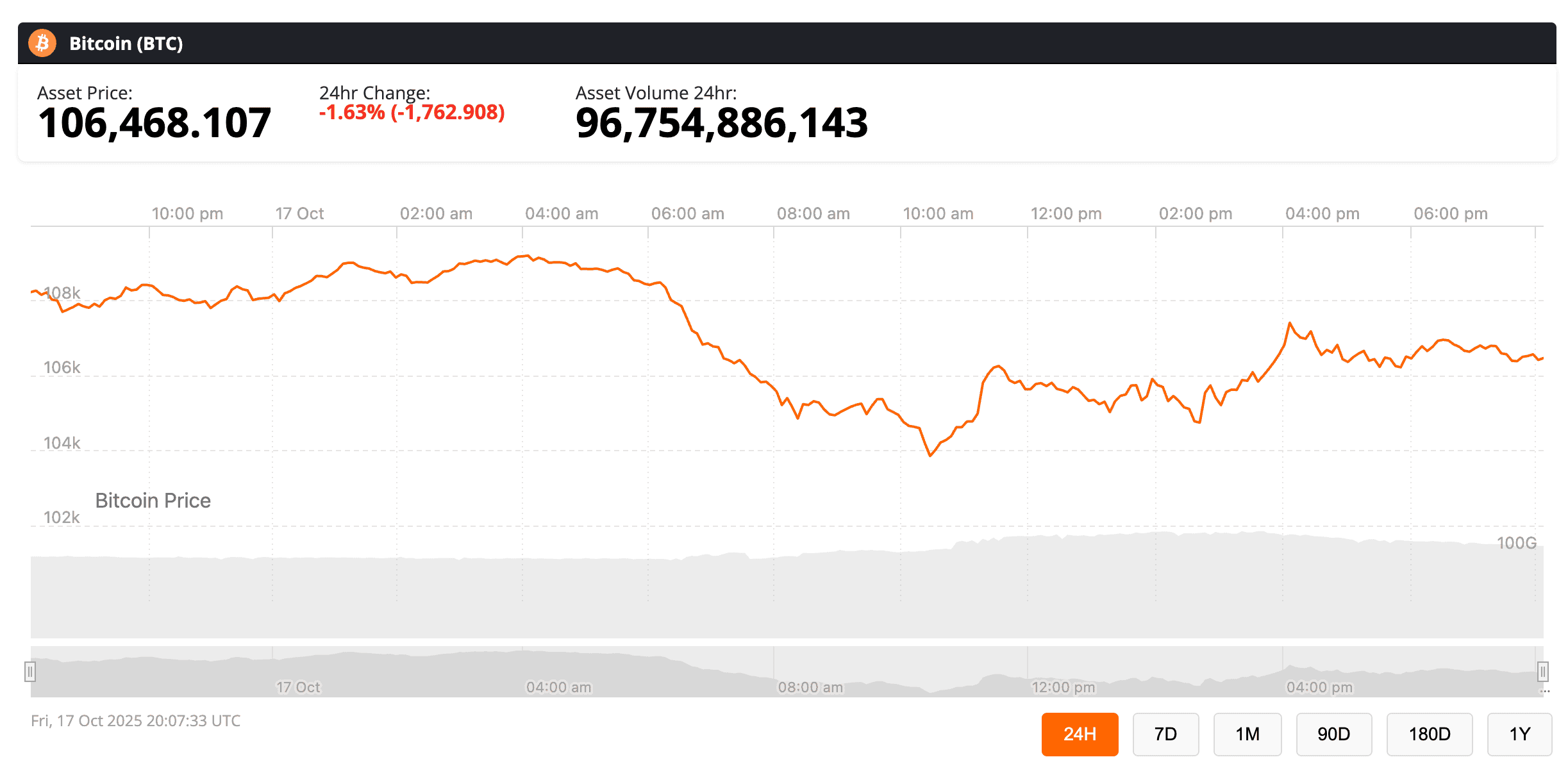

After a melodramatic dive of more than 5% in just two days, Bitcoin found its footing near $106K on Friday morning, mirroring the mood swings of the traditional finance world. U.S. regional bank stocks, once the center of all market angst, staged a charming little comeback after banks like Truist Financial, Regions Financial, and Fifth Third Bancorp posted results that were surprisingly less disastrous than the doomsayers had predicted.

The juicy tidbit: these banks reported lower provisions for credit losses than analysts expected – in layman’s terms, the cracks in the financial system aren’t as cavernous as the naysayers had us believe. This gave the S&P Regional Banks Index a boost, clawing back part of Thursday’s 6.3% nosedive. It was the kind of selloff that reminded some of the March 2023 mini-crisis, when fears about loan fraud at Zions Bancorp and Western Alliance sent everyone into a frenzy.

By Friday, Zions had bounced back by over 6%, Truist was up 2%, and Western Alliance inched forward by 1.6%. Traders, it seems, had a change of heart: maybe the sky wasn’t falling after all. Even European giants like Barclays, Deutsche Bank, and Japan’s Mizuho and Sumitomo Mitsui found their footing after getting pummeled earlier in the week.

Analysts, in their soothing corporate-speak, assured us that regional banks are “well reserved for potential losses” and that capital buffers are stronger than last year – which, translated, means: “everyone chill, you overreacted.”

Trump’s Trade Cooldown Boosts Sentiment

And then, out of nowhere, a breath of fresh air came from the political realm. President Donald Trump, in a twist nobody saw coming, announced that his infamous tariffs on Chinese goods “will not persist” and confirmed plans for a summit with Xi Jinping within two weeks. Beijing, of course, responded with diplomatic sweetness, and just like that, risk appetite made a quick return. U.S. stock futures surged 1.2%, as traders dared to hope that the world’s two largest economies might finally opt for conversation over confrontation.

S&P 500 futures erasing losses as Trump claims high tariffs on China won’t stick. Futures are now +75 points from their overnight low, source: X

Bitcoin’s Balancing Act

But hold your horses – crypto traders are not popping champagne just yet. Despite the improved risk sentiment, Bitcoin (BTC) remains stubbornly glued to the $105,000 mark, as if it’s caught in a game of tug-of-war between macro optimism and lingering market jitters.

So, is this the end of Bitcoin’s bull run or merely a pit stop? The evidence is a bit of a mixed bag. On the one hand, regional banks – those same institutions that almost triggered a financial meltdown last year – are showing resilience, suggesting that the financial system isn’t quite on the verge of implosion. On the other hand, Bitcoin’s inability to rally alongside the easing credit fears signals that traders are still holding their breath.

If the Trump-Xi talks manage to calm global trade tensions and U.S. banks keep their cool, Bitcoin might just break free and resume its ascent. But if this brief sense of relief fades away – or another financial curveball comes flying our way – the $100K line could get tested again.

Regardless, Bitcoin is now firmly entangled with legacy finance. The world’s most famous anti-bank asset is, ironically, moving in lockstep with bank stocks. Ah, the poetic contradictions of modern markets. They sure know how to keep us guessing. 🙄💸

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD HKD PREDICTION

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- XRP’s 2026 Forecast Collapses-Banks Wave Goodbye to Crypto Dreams!

- North Korean Hackers Using Deepfakes and Fake Interviews to Steal Crypto – Beware!

2025-10-18 00:32