Ah, Bitcoin, the ever-elusive creature, which, much like a dramatic character in a Regency romance, flits between the extremes of delight and despair. Over the course of the last hour, it has flirted with a price between $112,996 and $113,210, while the market capitalization daintily rests at a modest $2.24 trillion. With a lively trading volume of $37.65 billion, Bitcoin has been caught in a particularly tight range of $110,985 to $113,329. Truly, the volatility is enough to make even the most composed traders reach for a cup of tea!

Bitcoin

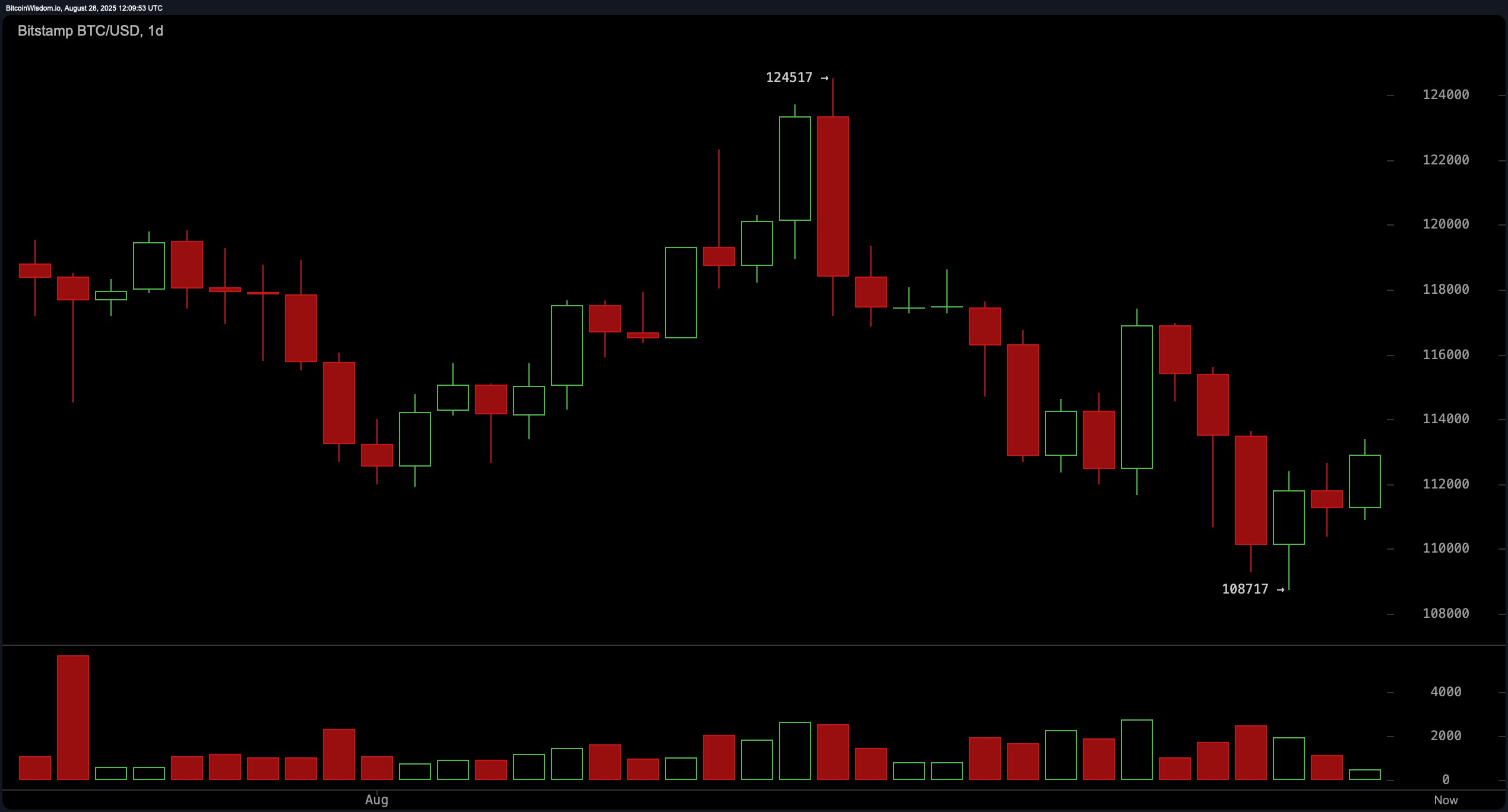

Bitcoin’s daily chart reveals a market in a state of consolidation, much like a ball in full swing where the guests are trying to find a partner for the next waltz. Following a downward break from a descending triangle pattern, we see a rather intriguing arrangement of lower highs at $124,517 and a low at $108,717. At present, the price sits comfortably near $113,000, but there is a hint of a possible rebound on the horizon, with increased volume at recent lows-suggesting an accumulation of intrigue. Support sits prettily at $108,500, while resistance raises its haughty head at $117,500 and $124,500. Should the price break above $117,500, it could signal an inviting, upward journey, but beware! A breach below $108,000 might spoil the dance altogether.

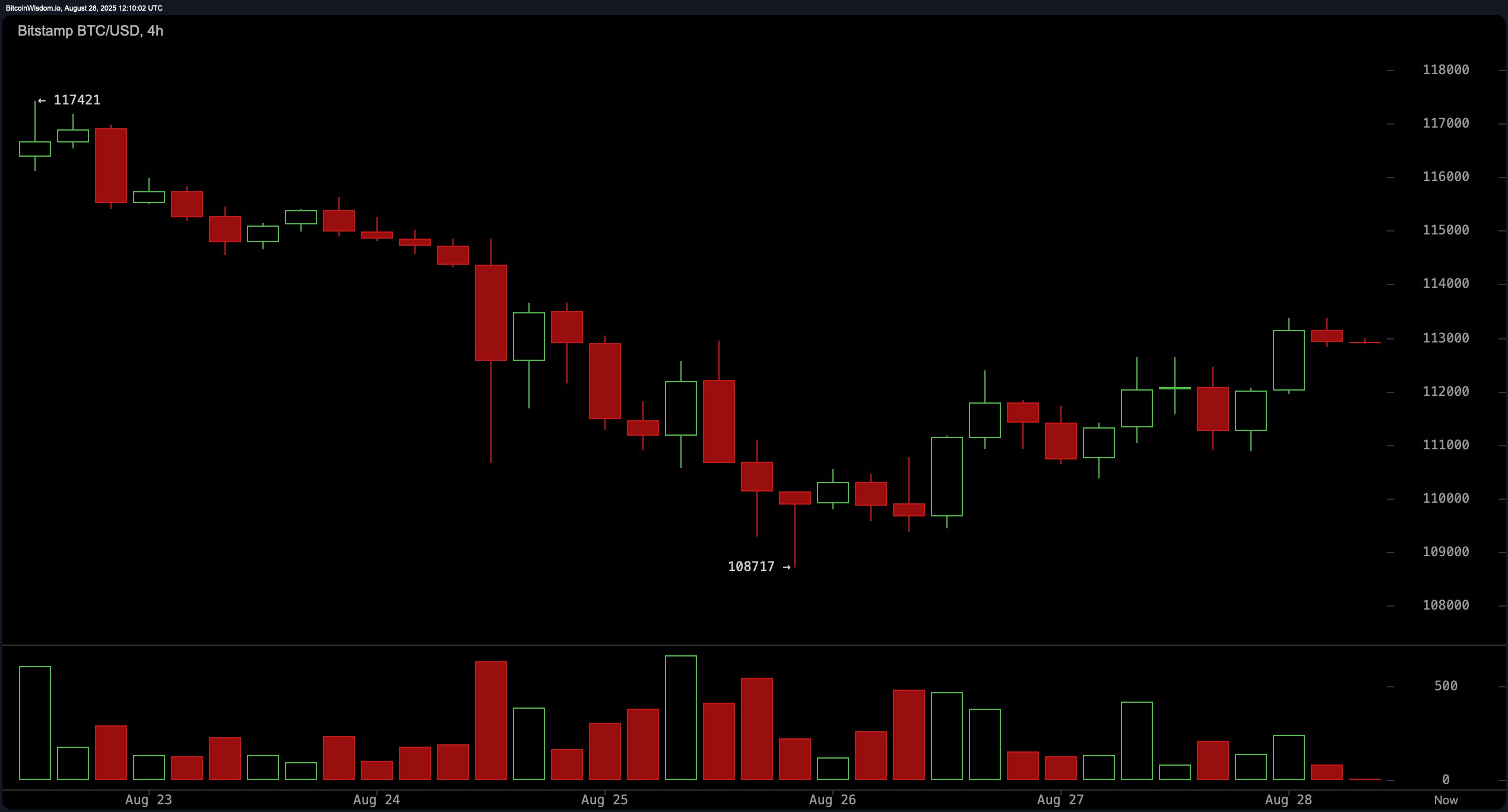

The 4-hour bitcoin chart paints a picture of a market in the throes of a trend reversal-gone from bearish to bullish, like a shift in the plot of a novel that keeps the reader guessing. After a drop to $108,700, the price has steadily climbed, marked by higher highs and higher lows, along with increased green volume bars-signaling a positive change in momentum. Bitcoin is presently trading between $113,000 and $113,500, a crucial resistance zone where the price might either rise further or fall into despair. Should it rise above, expect a swift, upward move. Should it falter, prepare for the downward spiral to return to the $110,000 region, where traders will be forced into a more cautious waltz.

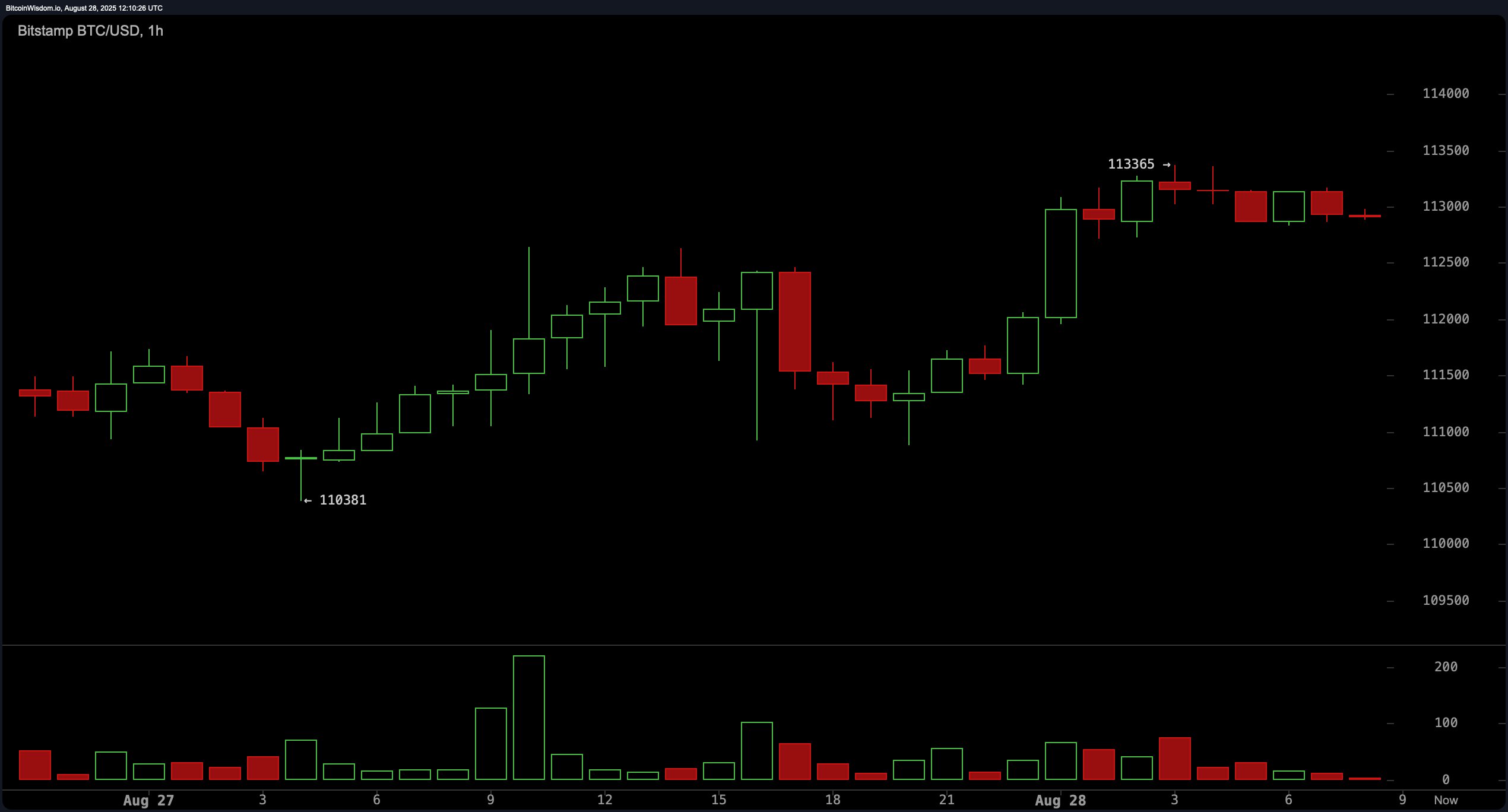

On the 1-hour chart, bitcoin seems to be in an intraday uptrend, making a valiant progress from $110,381 to a recent high of $113,365. It now finds itself trapped in a flag-like pattern-an impending storm or a momentous breakout? Declining volume during this consolidation suggests a market holding its breath, waiting for the right moment. Should the price surpass $113,500, prepare for a delightful rally toward $114,000-$114,500. However, should it drop below $111,500, traders may need to stop-loss their way out of a sticky situation.

Oscillators across multiple indicators are suggesting a rather non-committal mood from the market-neutral, but not without its moments of indecision. The relative strength index (RSI) rests at a comfortable 46, the Stochastic oscillator at 25, and the commodity channel index (CCI) at -84, all suggesting a market unwilling to pick sides. As for the average directional index (ADX), it languishes at 17, hinting at a weak trend. Meanwhile, the momentum oscillator offers a faint bullish signal at -3,349, while the moving average convergence divergence (MACD) whispers of a bearish turn with its reading of -1,183. Truly, the market is in a state of great uncertainty, much like a romance yet to be resolved.

Moving averages present a divided landscape, much like two warring families. The short-term averages, such as the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, and 30 periods, all seem to signal bearishness, with a host of sell signals. However, the longer-term EMAs and SMAs-those at the 100 and 200 intervals-still speak of strength, offering support to the lower levels. The EMA (100) at $110,905 and SMA (100) at $111,726 suggest the price is well supported, while the EMA (200) at $103,939 and SMA (200) at $101,094 indicate that, despite the recent tumult, the longer-term bullish trend remains steadfast.

Bull Verdict:

If bitcoin decisively breaks above the $113,500 resistance level with strong volume, expect bullish momentum to surge toward $117,500 and $124,500. Higher lows, a recovering 4-hour trend, and support from longer-term moving averages all seem to indicate that the upward march may well continue. It is, of course, a dance, and the right steps could lead to a grand crescendo!

Bear Verdict:

Should bitcoin fail to overcome the $113,500 resistance and instead drop below the $111,500-$110,000 support band, then the bearish pressure could resume its dominance. With multiple short-term moving average sell signals and the absence of strong oscillator signals, the risk of a drop to $108,000 remains ever so present. A stormy end to the dance, indeed!

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD HKD PREDICTION

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- Shocking Crypto Caper: Nano Labs Goes Wild with $50M BNB Bonanza! 🚀💰

- Dogecoin’s $1.25 Dream: 170% Surge or Just a Meme? 💸🐶

- Crypto’s Big Bet on FOMC: Will It Pay Off? 🚀💥

- Pump.fun Smashes $1B Daily Revenue – Meme Coins Take Over, Hyperliquid Cries

2025-08-28 16:34